Form ST 809719New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filersst809 2019

What is the Form ST 809719 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers ST-809

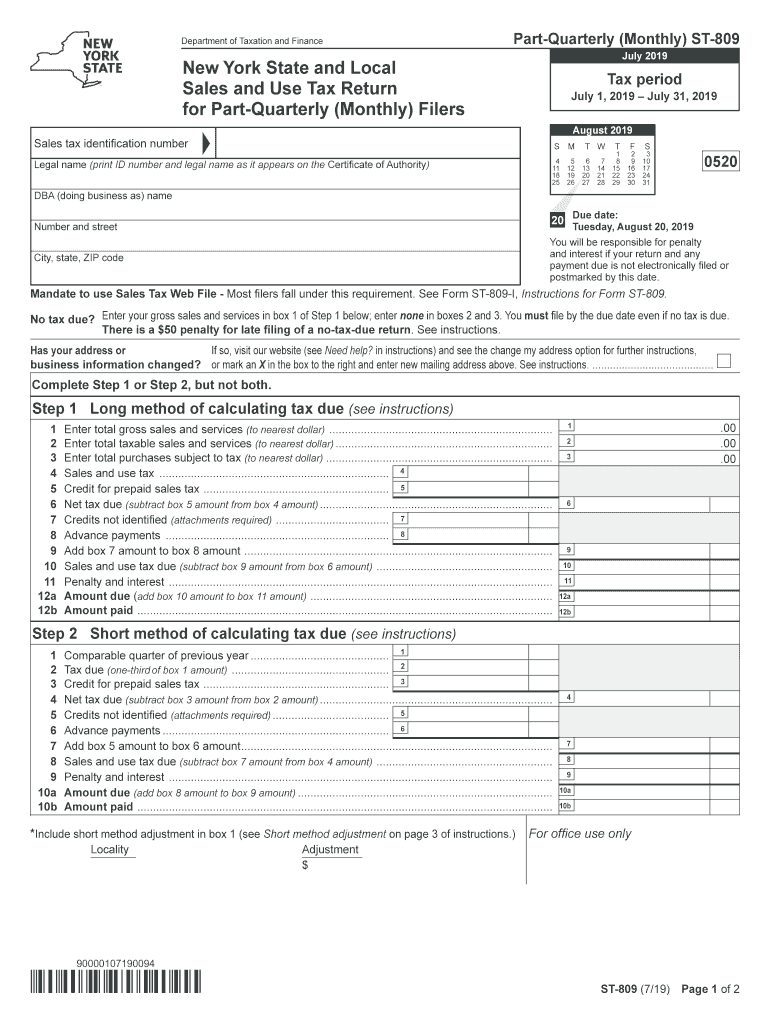

The Form ST 809719 is a tax return used by businesses in New York State to report and pay sales and use taxes. This form is specifically designed for entities that file on a quarterly or monthly basis. It captures essential information regarding taxable sales, purchases, and the total tax due. Understanding this form is crucial for compliance with New York State tax regulations, ensuring that businesses accurately report their tax obligations.

Steps to Complete the Form ST 809719 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers ST-809

Completing the Form ST 809719 involves several key steps:

- Gather necessary financial records, including sales receipts and purchase invoices.

- Calculate total taxable sales and purchases for the reporting period.

- Determine the appropriate tax rate based on the location of sales.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate it.

How to Obtain the Form ST 809719 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers ST-809

The Form ST 809719 can be obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and fill it out. Additionally, businesses can request physical copies through local tax offices or by contacting the Department of Taxation directly.

Legal Use of the Form ST 809719 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers ST-809

The legal use of the Form ST 809719 is governed by New York State tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Electronic submissions are permissible, provided they comply with the state's e-filing regulations. It is important for businesses to retain copies of submitted forms and any supporting documentation for their records.

Key Elements of the Form ST 809719 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers ST-809

Key elements of the Form ST 809719 include:

- Identification information for the business, such as name and address.

- Reporting period for the sales and use tax.

- Details on total sales, taxable sales, and exempt sales.

- Calculation of the total tax due based on applicable rates.

- Signature line for the authorized representative of the business.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 809719 vary based on the reporting frequency. Monthly filers must submit their returns by the 20th of the following month, while quarterly filers have a deadline of the last day of the month following the end of the quarter. It is essential for businesses to be aware of these deadlines to avoid penalties and interest on late payments.

Quick guide on how to complete form st 809719new york state and local sales and use tax return for part quarterly monthly filersst809

Effortlessly Create Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 without hassle

- Locate Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 and click Get Form to initiate.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using specialized tools provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of misplaced documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Adjust and electronically sign Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 809719new york state and local sales and use tax return for part quarterly monthly filersst809

Create this form in 5 minutes!

How to create an eSignature for the form st 809719new york state and local sales and use tax return for part quarterly monthly filersst809

How to create an eSignature for the Form St 809719new York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 online

How to create an eSignature for the Form St 809719new York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 in Google Chrome

How to generate an electronic signature for signing the Form St 809719new York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 in Gmail

How to create an eSignature for the Form St 809719new York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 straight from your smartphone

How to create an eSignature for the Form St 809719new York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 on iOS devices

How to create an electronic signature for the Form St 809719new York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 on Android devices

People also ask

-

What is Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809?

Form ST 809719 is the official tax return used by New York State businesses to report and pay sales and use tax. This form is crucial for quarterly and monthly filers to stay compliant with state tax regulations. Understanding how to accurately complete this form can save time and prevent potential penalties.

-

How can airSlate SignNow assist with completing Form ST 809719?

With airSlate SignNow, users can easily create, send, and eSign Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 online. Our platform simplifies document management, reducing the likelihood of errors while streamlining the filing process. This ensures that your tax returns are submitted quickly and accurately.

-

What features does airSlate SignNow offer for tax forms like Form ST 809719?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, specifically designed for forms like Form ST 809719. These features make it easy to fill out, sign, and store tax documents securely. Additionally, users can manage their tax filings efficiently, with reminders for due dates.

-

Is airSlate SignNow cost-effective for individuals and businesses filing Form ST 809719?

Yes, airSlate SignNow provides a cost-effective solution for both individuals and businesses needing to file Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809. By streamlining the process of document management and eSigning, users can save time and reduce expenses associated with traditional filing methods, ultimately leading to greater efficiency.

-

Can airSlate SignNow integrate with accounting software for Form ST 809719?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing users to import data directly into Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809. This integration reduces data entry errors and speeds up the overall process of preparing tax returns, enabling smoother filing and better financial tracking.

-

What benefits does eSigning provide for Form ST 809719?

eSigning with airSlate SignNow for Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809 enhances the overall filing experience. It ensures secure and verifiable signatures while eliminating the need for paper documents. This not only saves time but also contributes to a more environmentally-friendly process by reducing paper waste.

-

How secure is the information submitted through airSlate SignNow for Form ST 809719?

The security of your information is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols and secure data storage methods for files like Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809. This commitment to security ensures that your sensitive tax information remains confidential and protected from unauthorized access.

Get more for Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809

- 1 form 81g appendix of forms form 81g change gnb

- Grmc application form guam regional medical city

- Sample computer training registration form

- Student health form christian brothers university cbu

- Mountain mudd application form

- Frc application amp report form florida repeater council florida repeaters

- Sales contract for showpet puppies infinity border collies form

- Affidavit of insurance coverage aspen form

Find out other Form ST 809719New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filersst809

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document