INSTRUCTIONS for PIT 1 NEW MEXICO PERSONAL in Form

Understanding PIT 1 Instructions for New Mexico Personal Income Tax

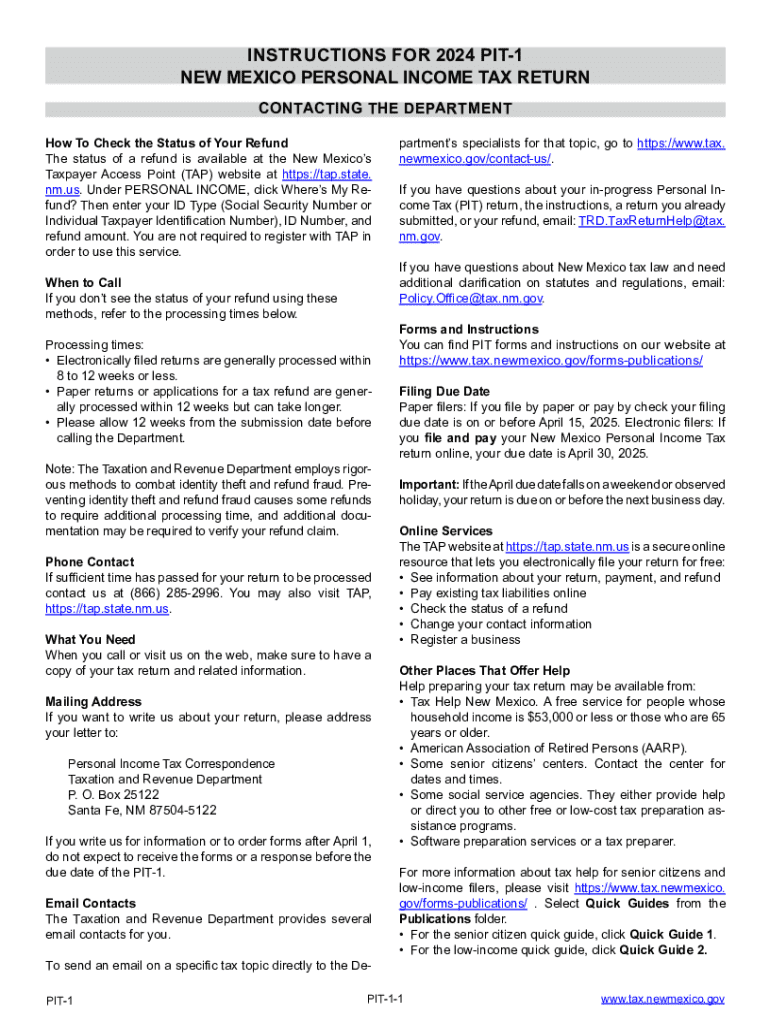

The PIT 1 form is essential for individuals filing their personal income tax in New Mexico. This form is used to report income, claim deductions, and calculate tax liabilities for residents. It is important to understand the specific requirements and guidelines associated with this form to ensure accurate filing and compliance with state tax laws.

Steps to Complete the PIT 1 Form

Completing the PIT 1 form involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and any records of deductions.

- Fill Out Personal Information: Provide your name, address, Social Security number, and filing status at the top of the form.

- Report Income: Enter your total income from all sources, including wages, interest, and dividends.

- Claim Deductions: Identify and claim any eligible deductions that apply to your situation, such as medical expenses or charitable contributions.

- Calculate Tax: Use the provided tax tables to determine your tax liability based on your taxable income.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it before submission.

Required Documents for PIT 1 Filing

To successfully file the PIT 1 form, you will need the following documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Proof of residency, if applicable

Having these documents ready will streamline the completion process and help ensure that all information is accurate.

Filing Deadlines for PIT 1

It is crucial to be aware of the filing deadlines for the PIT 1 form to avoid penalties. The standard deadline for filing is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check for any updates or changes to the tax calendar that may affect your filing schedule.

Legal Use of PIT 1 Instructions

The PIT 1 instructions provide legal guidelines for individuals filing their personal income tax in New Mexico. Adhering to these instructions is essential to ensure compliance with state tax laws. Failure to follow the guidelines may result in penalties or delays in processing your tax return. Understanding the legal implications of your filing can help you avoid complications.

Examples of Using PIT 1 Instructions

Using the PIT 1 instructions can clarify various scenarios, such as:

- Filing as a single individual with no dependents

- Claiming deductions for education expenses

- Reporting income from freelance work

These examples illustrate how the instructions can guide taxpayers through different situations, ensuring that all applicable rules are followed.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for pit 1 new mexico personal in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the pit 1 instructions for using airSlate SignNow?

The pit 1 instructions for airSlate SignNow guide users through the initial setup and document creation process. These instructions ensure that you can easily navigate the platform and utilize its features effectively. Following these steps will help you streamline your document management and eSigning tasks.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses of all sizes. The pit 1 instructions provide detailed information on the different pricing tiers and what features are included in each. This transparency helps you select the best option for your needs.

-

What features are included in airSlate SignNow?

airSlate SignNow offers a variety of features designed to enhance your document workflow, including eSigning, document templates, and real-time collaboration. The pit 1 instructions highlight these features and explain how to utilize them effectively. This ensures you can maximize the benefits of the platform.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce costs associated with traditional document signing methods. The pit 1 instructions emphasize the efficiency and ease of use that come with the platform, allowing you to focus on your core business activities while improving document turnaround times.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing its functionality and allowing for seamless workflows. The pit 1 instructions provide guidance on how to set up these integrations, ensuring you can connect your favorite tools and streamline your processes.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents. The pit 1 instructions detail the security measures in place, such as encryption and authentication, to protect your data throughout the signing process.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides various support options, including a comprehensive knowledge base, live chat, and email support. The pit 1 instructions also guide you on how to access these resources, ensuring you have the help you need whenever you encounter challenges.

Get more for INSTRUCTIONS FOR PIT 1 NEW MEXICO PERSONAL IN

- Arrears discharge form

- Pre authorized debit plan p rancho management services form

- Official form 106j

- Dws osd 354 utah department of health health utah form

- St 389 2016 form

- Celebrate recovery inventory worksheet form

- Md rule 9 203 a mdcourts form

- Free tenancy agreement templates to download rentfair form

Find out other INSTRUCTIONS FOR PIT 1 NEW MEXICO PERSONAL IN

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy