Application for Deduction for Employment of Certain 2022

What is the Application For Deduction For Employment Of Certain

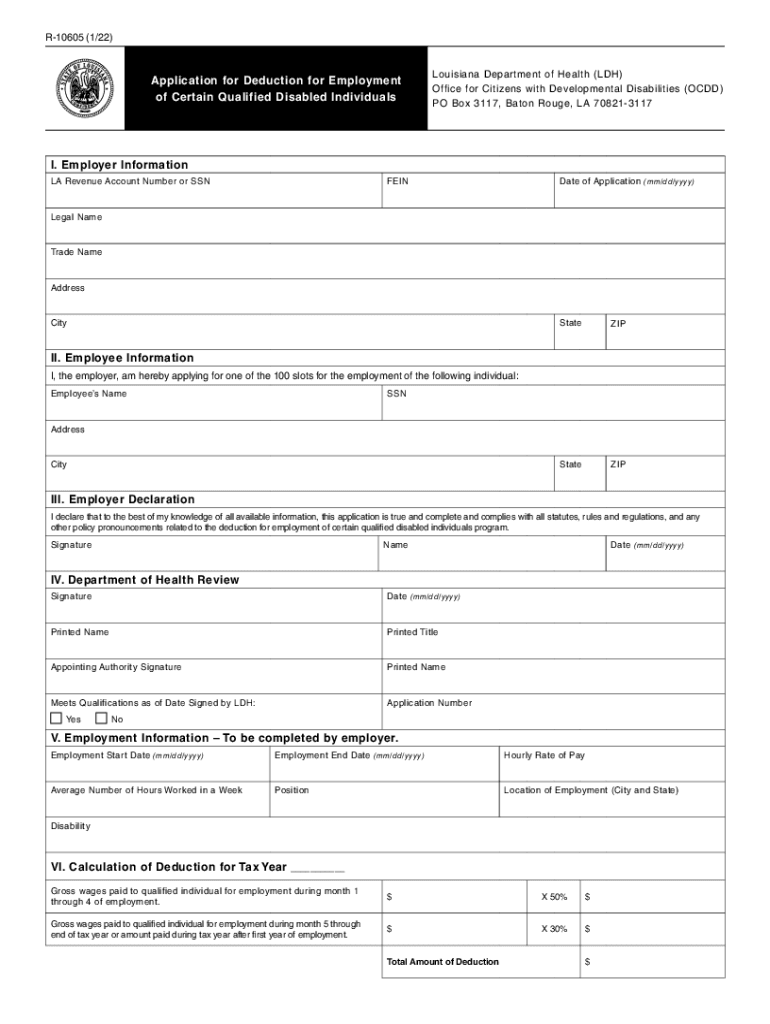

The Application For Deduction For Employment Of Certain is a specific form used by employers and employees to claim deductions related to certain expenses incurred during employment. This form is essential for ensuring that both parties comply with tax regulations and can effectively document the eligibility for deductions. Understanding the purpose and requirements of this application is crucial for accurate tax reporting and compliance.

How to use the Application For Deduction For Employment Of Certain

Using the Application For Deduction For Employment Of Certain involves several key steps. First, gather all necessary information, including personal details, employment information, and specific expenses related to your job. Next, accurately fill out the form, ensuring that all sections are completed to avoid any delays in processing. Once the form is filled out, it can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS or your employer.

Steps to complete the Application For Deduction For Employment Of Certain

Completing the Application For Deduction For Employment Of Certain requires careful attention to detail. Follow these steps:

- Collect necessary documents, such as receipts and proof of employment.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your employer, including their name and address.

- List the specific expenses you are claiming deductions for, ensuring they meet IRS guidelines.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for deductions using the Application For Deduction For Employment Of Certain, certain eligibility criteria must be met. Generally, the expenses claimed must be necessary and ordinary for your job. This includes costs that are directly related to your employment and not reimbursed by your employer. Additionally, you must be able to provide documentation to support your claims, such as receipts or invoices.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Application For Deduction For Employment Of Certain. It is important to familiarize yourself with these guidelines to ensure compliance. The IRS outlines what constitutes deductible expenses, the documentation required, and the process for submitting the application. Adhering to these guidelines helps prevent issues with tax filings and potential audits.

Form Submission Methods

The Application For Deduction For Employment Of Certain can be submitted through various methods. Options typically include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices or tax assistance centers.

Choosing the appropriate submission method can streamline the process and ensure timely processing of your application.

Quick guide on how to complete application for deduction for employment of certain

Complete Application For Deduction For Employment Of Certain effortlessly on any gadget

Web-based document management has gained traction among enterprises and individuals alike. It serves as a flawless eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents promptly without holdups. Manage Application For Deduction For Employment Of Certain on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest method to modify and eSign Application For Deduction For Employment Of Certain without any strain

- Find Application For Deduction For Employment Of Certain and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, be it via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Application For Deduction For Employment Of Certain and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for deduction for employment of certain

Create this form in 5 minutes!

People also ask

-

What is the Application For Deduction For Employment Of Certain?

The Application For Deduction For Employment Of Certain is a form that allows businesses to claim deductions for specific employee-related expenses. This can signNowly lower taxable income, resulting in potential tax savings. Understanding how to accurately complete this application is essential for maximizing benefits.

-

How does airSlate SignNow help with the Application For Deduction For Employment Of Certain?

airSlate SignNow streamlines the process of sending and eSigning the Application For Deduction For Employment Of Certain. Users can securely share documents, collect electronic signatures, and ensure that all necessary information is submitted accurately and efficiently. This simplifies compliance and saves time for businesses.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business needs, including monthly and annual subscriptions. Each plan includes access to features that assist users with the Application For Deduction For Employment Of Certain. Features such as unlimited templates and document storage may vary based on the selected plan.

-

Can I integrate airSlate SignNow with other software for the Application For Deduction For Employment Of Certain?

Yes, airSlate SignNow seamlessly integrates with various software platforms, making it easier to manage the Application For Deduction For Employment Of Certain within your existing workflows. Key integrations include CRM systems, cloud storage, and accounting software, enhancing overall efficiency in document handling.

-

What benefits does eSigning the Application For Deduction For Employment Of Certain provide?

eSigning the Application For Deduction For Employment Of Certain through airSlate SignNow offers multiple benefits, such as reducing turnaround time and ensuring document security. Electronic signatures are legally binding and can signNowly expedite approval processes. This helps businesses get their claims processed faster and more reliably.

-

Is the Application For Deduction For Employment Of Certain safe with airSlate SignNow?

Absolutely! airSlate SignNow is designed with top-notch security protocols to protect sensitive information found in the Application For Deduction For Employment Of Certain. It employs encryption, secure servers, and access controls to ensure that your data remains confidential and secure from unauthorized access.

-

What features does airSlate SignNow offer that are valuable for the Application For Deduction For Employment Of Certain?

airSlate SignNow provides essential features like customizable templates, document tracking, and automated reminders tailored for the Application For Deduction For Employment Of Certain. These tools simplify the document management process, ensuring you stay organized and compliant throughout your submission journey.

Get more for Application For Deduction For Employment Of Certain

- Virginia deed trust form

- Special warranty deed template form

- Virginia deed form 497428043

- Quitclaim deed three individuals to an individual virginia form

- Va affidavit form

- Quitclaim deed by two individuals to llc virginia form

- Warranty deed from two individuals to llc virginia form

- Affidavit of payment prior to sale corporation or llc virginia form

Find out other Application For Deduction For Employment Of Certain

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document