How to Claim Disabled Adults as Dependents on Income Tax 2021

What is the How To Claim Disabled Adults As Dependents On Income Tax

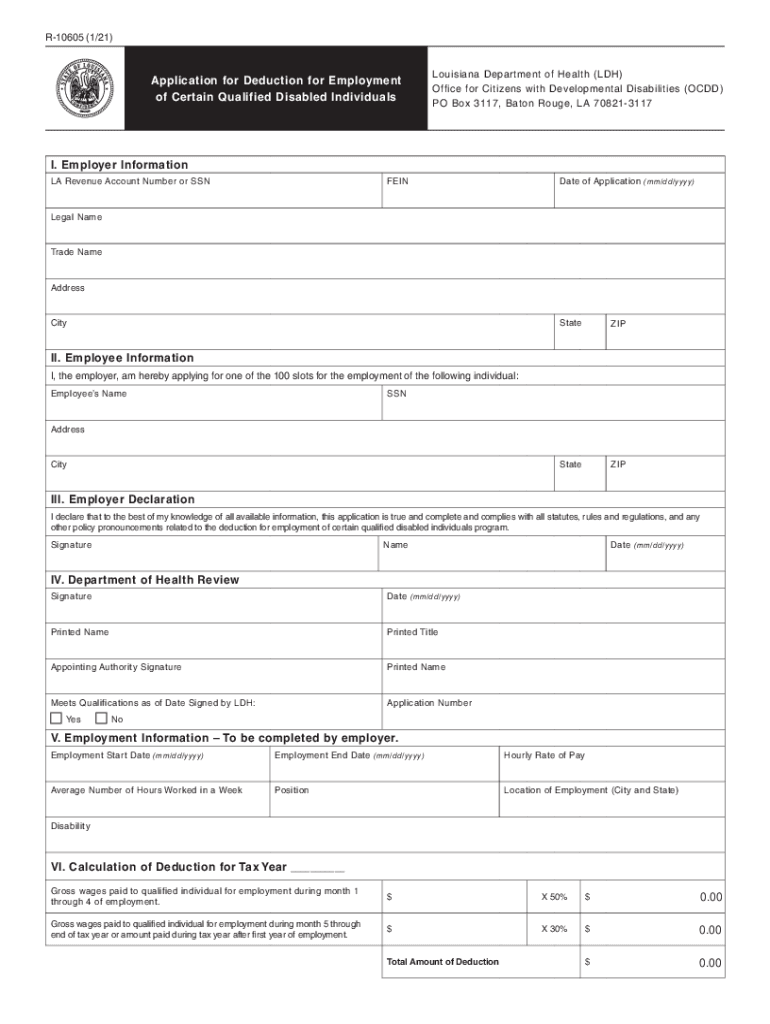

The process of claiming disabled adults as dependents on income tax allows taxpayers to potentially reduce their taxable income. This provision is designed to support individuals who provide care for disabled adults, ensuring they can receive tax benefits. To qualify, the disabled adult must meet specific criteria set by the IRS, including income limits and the nature of the disability. Understanding these requirements is essential for successful claims.

Eligibility Criteria

To claim a disabled adult as a dependent, certain eligibility criteria must be met. The disabled adult must be either a qualifying relative or a qualifying child. Key conditions include:

- The individual must have a permanent and total disability.

- The taxpayer must provide more than half of the disabled adult's financial support during the tax year.

- The disabled adult must reside with the taxpayer for more than half the year, unless they are in a care facility.

- The disabled adult's gross income must be below a certain threshold, which is adjusted annually.

Steps to complete the How To Claim Disabled Adults As Dependents On Income Tax

Completing the process involves several key steps to ensure compliance with IRS regulations. Here’s a general outline of the steps:

- Determine if the disabled adult meets the eligibility criteria.

- Gather necessary documentation, including proof of disability and financial support.

- Complete the appropriate tax forms, such as the Form 1040.

- Include the dependent’s information in the designated section of the tax return.

- File the tax return electronically or by mail, ensuring all required documents are attached.

Required Documents

To successfully claim a disabled adult as a dependent, certain documents are necessary for verification. These may include:

- Proof of the disabled adult's disability, such as medical records or a letter from a healthcare provider.

- Financial records demonstrating that the taxpayer provides more than half of the dependent's support.

- Tax returns from previous years, if applicable, to establish income levels.

IRS Guidelines

Understanding the IRS guidelines is crucial for claiming a disabled adult as a dependent. The IRS outlines specific rules regarding eligibility, documentation, and filing procedures. Taxpayers should refer to IRS Publication 501 for detailed information on qualifying relatives and children, as well as the necessary criteria for claiming dependents. Staying informed about any changes in tax laws can also impact the claiming process.

Legal use of the How To Claim Disabled Adults As Dependents On Income Tax

Legally claiming a disabled adult as a dependent requires adherence to IRS regulations. Taxpayers must ensure that all claims are accurate and substantiated by proper documentation. Misrepresentation or failure to meet the eligibility criteria can result in penalties or audits. It is advisable to maintain thorough records and consult with a tax professional if there are uncertainties regarding the legal aspects of the claim.

Quick guide on how to complete how to claim disabled adults as dependents on income tax

Effortlessly Prepare How To Claim Disabled Adults As Dependents On Income Tax on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage How To Claim Disabled Adults As Dependents On Income Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Method to Modify and eSign How To Claim Disabled Adults As Dependents On Income Tax with Ease

- Find How To Claim Disabled Adults As Dependents On Income Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your document, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign How To Claim Disabled Adults As Dependents On Income Tax and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to claim disabled adults as dependents on income tax

Create this form in 5 minutes!

People also ask

-

What is the process of How To Claim Disabled Adults As Dependents On Income Tax?

To claim disabled adults as dependents on your income tax, ensure that the individual meets the IRS criteria for a qualifying relative. This includes providing more than half of their support and ensuring their gross income falls below a certain threshold. Proper documentation of expenses and support is essential during tax preparation.

-

How can airSlate SignNow assist in managing tax documents for claiming dependents?

airSlate SignNow helps streamline document management, making it easier to collect and store necessary tax documentation to claim dependents. With features like eSigning and secure storage, businesses can efficiently handle IRS forms and support materials for those claiming disabled adults as dependents. This ensures that your docs are ready when tax season arrives.

-

Are there any additional features in airSlate SignNow that can help with tax compliance?

Yes, airSlate SignNow offers features like customizable templates and automated workflows that are invaluable for maintaining tax compliance. By using these features, businesses can easily track submissions and ensure all required signatures and documentation are completed for claims like How To Claim Disabled Adults As Dependents On Income Tax.

-

What types of integrations does airSlate SignNow offer that can aid in tax preparation?

airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the efficiency of your tax preparation process. This means you can directly upload your signed documents and forms necessary for How To Claim Disabled Adults As Dependents On Income Tax into your preferred tools. These integrations help save time and reduce manual data entry errors.

-

Is there a pricing plan specifically suitable for small businesses looking to manage tax documents?

Absolutely! airSlate SignNow offers flexible pricing plans tailored for small businesses. These plans are designed to be cost-effective while providing all the necessary features to manage tax documentation, including the important task of How To Claim Disabled Adults As Dependents On Income Tax.

-

How secure are the documents stored in airSlate SignNow for tax purposes?

Documents stored in airSlate SignNow are secured with advanced encryption and multiple layers of protection, ensuring that sensitive tax information remains confidential. This level of security is crucial for users dealing with private information, such as those needing to understand How To Claim Disabled Adults As Dependents On Income Tax.

-

Can airSlate SignNow help prepare for an audit concerning dependency claims?

Yes, airSlate SignNow can assist in preparing for an audit related to dependency claims. By organizing all necessary documents in one secure place, users can efficiently access and present information required during an audit process, including how to validate claims about How To Claim Disabled Adults As Dependents On Income Tax.

Get more for How To Claim Disabled Adults As Dependents On Income Tax

Find out other How To Claim Disabled Adults As Dependents On Income Tax

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free