TN Business Now Have Option Not to File the Tangible Form

Understanding the TN Tangible Personal Property Form

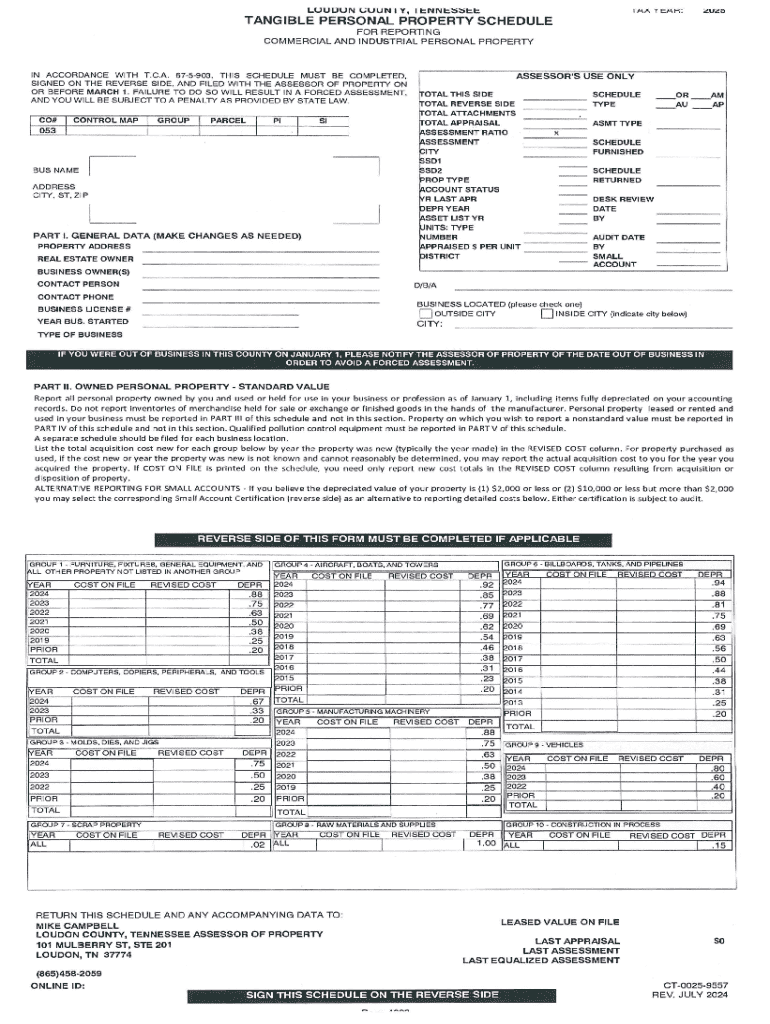

The TN tangible personal property form is essential for businesses in Tennessee to report their tangible personal property for tax purposes. This form helps ensure compliance with state tax regulations and provides a clear outline of the property owned by the business. Tangible personal property includes items such as machinery, equipment, and furniture that are not permanently affixed to real estate. Understanding the specifics of this form is crucial for accurate reporting and avoiding potential penalties.

Steps to Complete the TN Tangible Personal Property Form

Completing the TN tangible personal property form involves several key steps:

- Gather all relevant information about your tangible personal property, including descriptions, purchase dates, and values.

- Obtain the most recent version of the TN tangible personal property form from the appropriate state agency.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online, by mail, or in person.

Filing Deadlines and Important Dates

Filing deadlines for the TN tangible personal property form are crucial to avoid penalties. Generally, the form must be submitted by April 1 of each year. If April 1 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, as they can vary based on legislative updates or specific circumstances.

Required Documents for the TN Tangible Personal Property Form

To successfully complete the TN tangible personal property form, several documents may be required:

- Purchase invoices or receipts for all tangible personal property.

- Previous year’s tax returns, if applicable.

- Any supporting documentation that verifies the value and ownership of the property.

Having these documents ready will facilitate a smoother completion process and ensure accurate reporting.

Legal Use of the TN Tangible Personal Property Form

The TN tangible personal property form must be used in accordance with state laws and regulations. This form serves as a legal declaration of the property owned by a business and is subject to audits by the state tax authority. Accurate completion and timely submission are essential to maintain compliance and avoid legal repercussions, such as fines or additional taxes.

Penalties for Non-Compliance

Failure to file the TN tangible personal property form by the deadline can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is crucial to understand these consequences and ensure timely and accurate submissions to protect your business from financial liabilities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn business now have option not to file the tangible

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tn tangible personal property form?

The tn tangible personal property form is a document used in Tennessee to report personal property for tax purposes. This form helps individuals and businesses declare their tangible assets to ensure compliance with state regulations. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining the submission process.

-

How can airSlate SignNow help with the tn tangible personal property form?

airSlate SignNow provides a user-friendly platform to create, edit, and eSign the tn tangible personal property form. Our solution simplifies the process by allowing you to manage your documents digitally, reducing the need for paper and enhancing efficiency. With our tool, you can ensure that your form is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the tn tangible personal property form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring you get the best value while managing documents like the tn tangible personal property form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the tn tangible personal property form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the tn tangible personal property form. These features enhance the user experience by making it easy to fill out, sign, and store your documents securely. Additionally, you can collaborate with others in real-time.

-

Can I integrate airSlate SignNow with other software for the tn tangible personal property form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the tn tangible personal property form. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the tn tangible personal property form?

Using airSlate SignNow for the tn tangible personal property form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents quickly, ensuring you meet deadlines without hassle. Additionally, your data is protected with advanced security measures.

-

Is airSlate SignNow user-friendly for completing the tn tangible personal property form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the tn tangible personal property form. Our intuitive interface guides you through the process, ensuring that you can fill out and eSign your documents without any technical difficulties. You can get started quickly, even if you're not tech-savvy.

Get more for TN Business Now Have Option Not To File The Tangible

- Harvard pilgrim enrollment change form employer

- Pure romance order form 425408633

- Antrag auf zulassung universit t duisburg essen uni due form

- Employer representative authorization form acumen fiscal agent

- Raffle license application village of arlington heights form

- Tp 13014e form

- Lesson 1 student worksheet sports injury management form

- Withdrawal authorization form

Find out other TN Business Now Have Option Not To File The Tangible

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors