Instructions for Form CT 636 Alcoholic Beverage Production 2024-2026

What is the CT 636 Alcoholic Beverage Production Form?

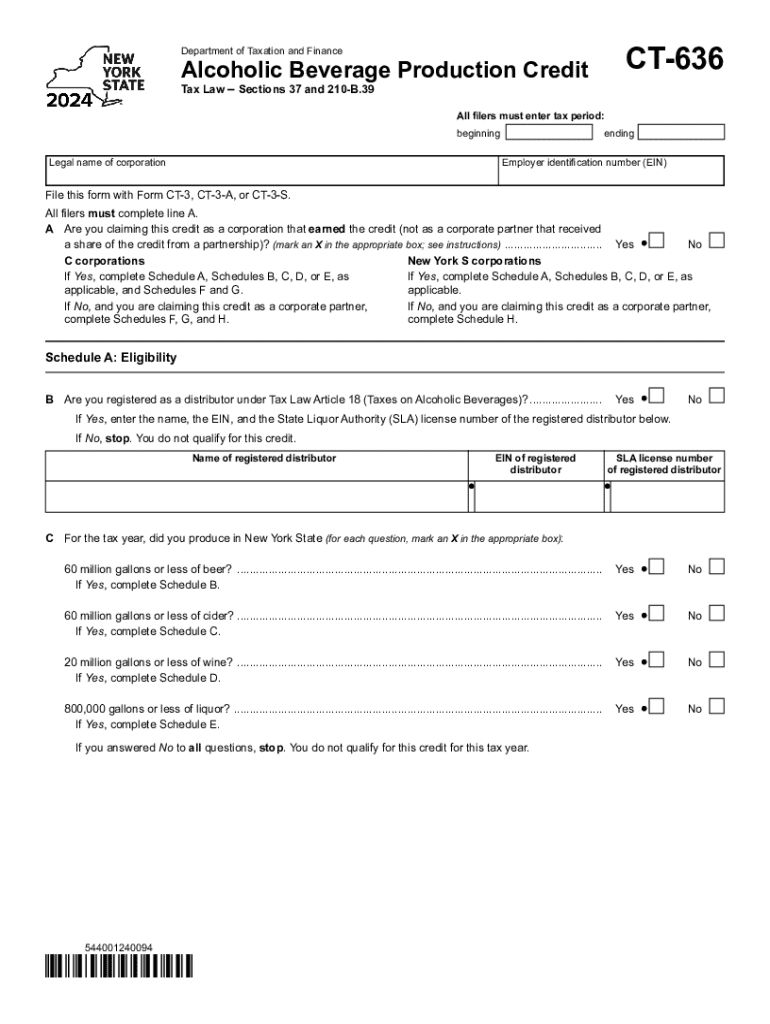

The CT 636 form is a tax document used in New York State specifically for alcoholic beverage producers. This form allows businesses to claim a production credit for the beer they manufacture, which can help reduce their overall tax liability. The CT 636 is essential for those in the wholesale and retail sectors of the alcoholic beverage industry, as it provides a means to report production activities and claim applicable credits.

Steps to Complete the CT 636 Form

Completing the CT 636 form involves several key steps:

- Gather necessary information, including your business details and production data.

- Fill out the form accurately, ensuring all sections are completed.

- Calculate the production credit based on the beer manufactured during the tax year.

- Review the form for accuracy and completeness before submission.

Each step is crucial to ensure compliance and to maximize potential tax credits.

Eligibility Criteria for the CT 636 Form

To be eligible for filing the CT 636, businesses must meet specific criteria:

- Be a registered producer of alcoholic beverages in New York State.

- Have a valid tax identification number.

- Manufacture beer for sale, which qualifies for the production credit.

Understanding these criteria helps businesses determine their eligibility and prepare the necessary documentation.

Filing Deadlines for the CT 636 Form

Filing deadlines for the CT 636 form are critical for compliance. Typically, businesses must submit the form by the due date of their tax return. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Missing the deadline may result in penalties or the loss of eligible credits.

Required Documents for CT 636 Submission

When submitting the CT 636 form, several documents are generally required:

- Proof of production, such as production reports or invoices.

- Tax identification documentation.

- Any additional forms or schedules that support the claims made on the CT 636.

Having these documents ready ensures a smoother filing process and helps avoid delays.

Form Submission Methods for CT 636

The CT 636 form can be submitted through various methods:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can streamline the filing process and ensure timely processing.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 636 alcoholic beverage production

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 636 alcoholic beverage production

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 636 in relation to airSlate SignNow?

The ct 636 refers to a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflow, ensuring that documents are signed quickly and efficiently. By utilizing ct 636, businesses can improve their overall productivity and reduce turnaround times.

-

How does airSlate SignNow's ct 636 feature benefit my business?

The ct 636 feature provides signNow benefits by simplifying the eSigning process and reducing the need for physical paperwork. This not only saves time but also cuts costs associated with printing and mailing documents. By adopting ct 636, businesses can enhance their operational efficiency and improve customer satisfaction.

-

What are the pricing options for airSlate SignNow with ct 636?

airSlate SignNow offers flexible pricing plans that include access to the ct 636 feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality. Each plan is designed to be cost-effective, ensuring that you get the best value for your investment in ct 636.

-

Can I integrate ct 636 with other software applications?

Yes, airSlate SignNow's ct 636 feature seamlessly integrates with a variety of software applications, enhancing your existing workflows. This integration capability allows you to connect with CRM systems, project management tools, and more. By leveraging ct 636, you can create a cohesive digital environment that boosts productivity.

-

Is ct 636 secure for handling sensitive documents?

Absolutely, the ct 636 feature in airSlate SignNow is designed with security in mind. It employs advanced encryption and compliance measures to protect sensitive information during the eSigning process. You can trust that your documents are safe and secure when using ct 636.

-

How user-friendly is the ct 636 feature for new users?

The ct 636 feature is designed to be intuitive and user-friendly, making it accessible for users of all skill levels. With a straightforward interface and easy navigation, new users can quickly learn how to send and eSign documents. This ease of use is a key advantage of choosing airSlate SignNow with ct 636.

-

What types of documents can I manage with ct 636?

With the ct 636 feature, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle all their eSigning needs in one place. Whether you need to send a simple document or a complex contract, ct 636 has you covered.

Get more for Instructions For Form CT 636 Alcoholic Beverage Production

- View your communitys preliminary flood hazard data fema gov form

- The vitalitylife discretionary trust for use with form

- Hear kcl form

- Trust form amp guide part 1 cavendish online

- Application form to be completed by unemployed youth sasseta

- Workforce training one state is using job data to help decide form

- State and local forms

- Gv 110 temporary gun violence restraining order form

Find out other Instructions For Form CT 636 Alcoholic Beverage Production

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation