MILLER BREWING COMPANY V DEPARTMENT of ALCOHOLIC BEVERAGE 2021

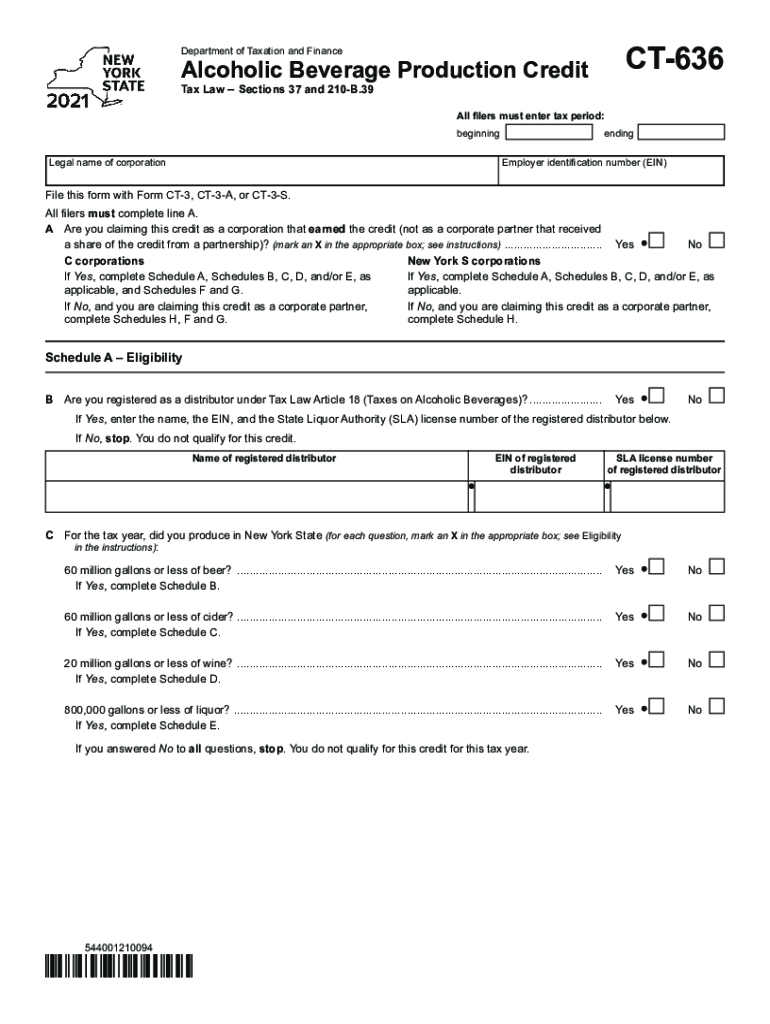

What is the CT-636 Form?

The CT-636 form, also known as the New York State Tax Corporation form, is used for claiming the New York production credit. This credit is available to eligible businesses that engage in qualified production activities within New York State. The form allows taxpayers to report their eligible production expenses and claim the corresponding tax credits, which can significantly reduce their overall tax liability. Understanding the specifics of the CT-636 form is essential for businesses looking to maximize their tax benefits while complying with state regulations.

Eligibility Criteria for the CT-636 Form

To qualify for the CT-636 form, businesses must meet certain eligibility criteria. Generally, the applicant must be a corporation that conducts production activities in New York State. This includes businesses involved in film, television, and other media production. Additionally, the production must meet specific spending thresholds on qualified expenses to be eligible for the credit. It is crucial for applicants to review the detailed criteria outlined in the form instructions to ensure compliance and eligibility.

Steps to Complete the CT-636 Form

Completing the CT-636 form requires careful attention to detail. Here are the steps involved:

- Gather all necessary documentation, including proof of production expenses and any relevant financial records.

- Fill out the CT-636 form accurately, ensuring that all required fields are completed.

- Calculate the total eligible expenses and the corresponding tax credit based on the guidelines provided.

- Review the completed form for accuracy and completeness before submission.

- Submit the form along with any required attachments to the appropriate New York State tax authority.

Form Submission Methods

The CT-636 form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form online through the New York State Department of Taxation and Finance website, which offers a streamlined electronic filing process. Alternatively, businesses may opt to mail the completed form and any supporting documents to the designated address provided in the form instructions. In-person submissions may also be possible at certain tax offices, depending on local regulations.

Filing Deadlines for the CT-636 Form

It is essential to be aware of the filing deadlines associated with the CT-636 form to avoid penalties. Typically, the form must be filed by the due date of the corporation's tax return. This deadline may vary depending on the corporation's fiscal year and any extensions that have been granted. Taxpayers should consult the New York State Department of Taxation and Finance for specific dates relevant to their situation.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the CT-636 form can result in significant penalties. These may include fines for late filing, disallowance of the claimed credits, and potential interest on unpaid taxes. It is crucial for businesses to adhere to all guidelines and deadlines to ensure compliance and avoid unnecessary financial repercussions.

Quick guide on how to complete miller brewing company v department of alcoholic beverage

Effortlessly Prepare MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly option to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly and without delays. Manage MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

Steps to Modify and Electronically Sign MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE with Ease

- Locate MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and electronically sign MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct miller brewing company v department of alcoholic beverage

Create this form in 5 minutes!

How to create an eSignature for the miller brewing company v department of alcoholic beverage

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask

-

What is 'you ct 636' in the context of airSlate SignNow?

The term 'you ct 636' refers to a specific feature within the airSlate SignNow platform that simplifies the eSigning process. This feature enables users to easily create, send, and manage documents electronically, ensuring secure and efficient transactions.

-

How does airSlate SignNow pricing work for the 'you ct 636' feature?

Pricing for the 'you ct 636' feature varies depending on your business needs and the number of users. airSlate SignNow offers various subscription plans that provide access to advanced functionalities, including 'you ct 636', ensuring good value for businesses of all sizes.

-

What are the primary benefits of using 'you ct 636' with airSlate SignNow?

Using 'you ct 636' with airSlate SignNow allows businesses to streamline their document workflows. It enhances efficiency by reducing paperwork and waiting times, while also providing a secure environment for signing contracts and agreements electronically.

-

Can 'you ct 636' integrate with other software applications?

Yes, 'you ct 636' seamlessly integrates with various CRM systems and productivity tools. This integration capability allows users to enhance their existing workflows by incorporating electronic signatures directly within their preferred applications.

-

Is it easy to use the 'you ct 636' feature within airSlate SignNow?

Absolutely! The 'you ct 636' feature offers a user-friendly interface that makes it easy for anyone to send and sign documents. With just a few clicks, users can initiate the eSigning process without needing extensive training or technical knowledge.

-

What types of documents can I use with the 'you ct 636' feature?

The 'you ct 636' feature supports a wide range of document types, including contracts, agreements, and forms. This versatility makes it suitable for various industries, ensuring that you can manage all your eSigning needs in one platform.

-

Are there mobile options available for 'you ct 636'?

Yes, airSlate SignNow with 'you ct 636' offers mobile compatibility, enabling users to send and sign documents on the go. This feature enhances accessibility and ensures that you can conduct business anytime and anywhere.

Get more for MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE

Find out other MILLER BREWING COMPANY V DEPARTMENT OF ALCOHOLIC BEVERAGE

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter