Form CT 636 Alcoholic Beverage Production Credit Tax Year 2020

Understanding the CT 636 Alcoholic Beverage Production Credit

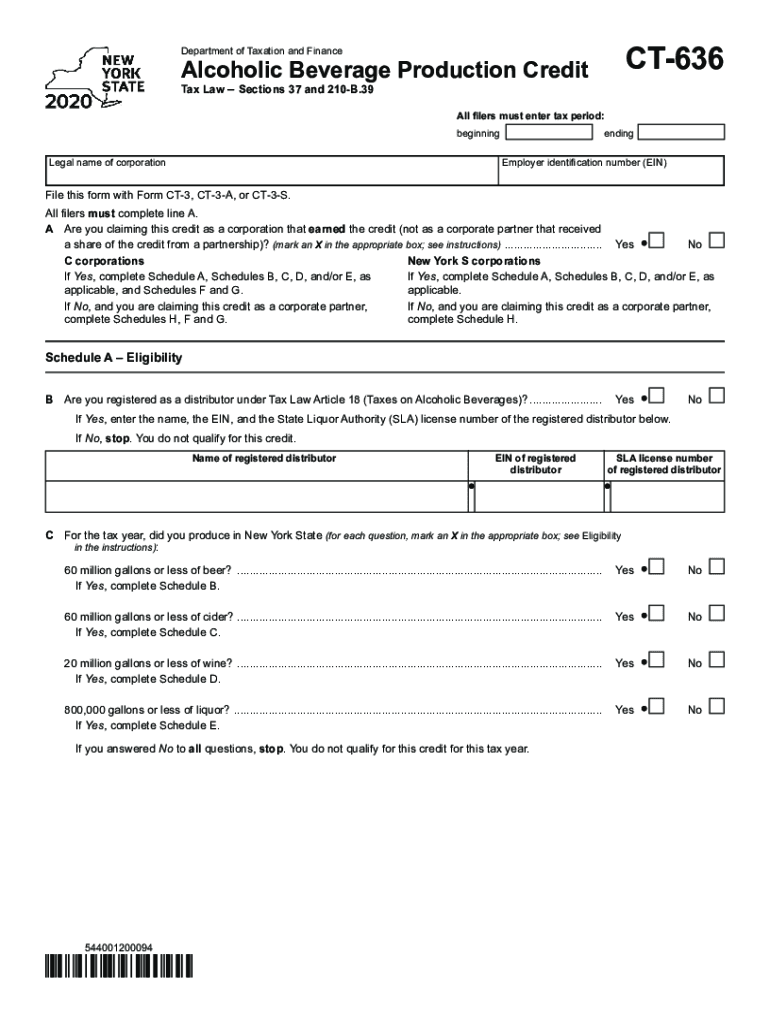

The CT 636 form is specifically designed for claiming the Alcoholic Beverage Production Credit in New York. This credit is available to producers of alcoholic beverages who meet certain criteria. It allows eligible businesses to receive a tax credit based on their production levels. Understanding the details of this form is crucial for businesses in the alcoholic beverage industry, as it can significantly impact their tax obligations and financial planning.

Steps to Complete the CT 636 Form

Filling out the CT 636 form requires careful attention to detail to ensure compliance and accuracy. Here are the general steps to follow:

- Gather necessary documentation, including production records and financial statements.

- Complete all sections of the form, providing accurate information about production volumes and business operations.

- Calculate the credit amount based on the specific guidelines provided for the tax year.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for the CT 636 Form

To qualify for the Alcoholic Beverage Production Credit, businesses must meet specific eligibility requirements. These typically include:

- Being a registered producer of alcoholic beverages in New York.

- Meeting minimum production thresholds as defined by state regulations.

- Maintaining proper records of production and sales.

It is essential to review the latest guidelines to ensure compliance with all eligibility criteria before submitting the CT 636 form.

Legal Use of the CT 636 Form

The CT 636 form is legally binding when completed accurately and submitted in accordance with state regulations. To ensure its legal standing, businesses should:

- Use a reliable electronic signing platform to sign the form digitally.

- Retain copies of all submitted documents for record-keeping and potential audits.

- Stay informed about changes in tax laws that may affect the form's requirements.

Filing Deadlines for the CT 636 Form

Timely submission of the CT 636 form is crucial to avoid penalties and ensure eligibility for the tax credit. Key deadlines typically include:

- The due date for filing the form, which aligns with the business's tax return deadline.

- Any extensions that may apply, which should be requested in advance.

Businesses should mark these important dates on their calendars to ensure compliance.

Obtaining the CT 636 Form

The CT 636 form can be obtained through the New York State Department of Taxation and Finance. It is available in both digital and paper formats. Businesses should ensure they are using the most current version of the form to avoid any issues with their submission.

Quick guide on how to complete form ct 636 alcoholic beverage production credit tax year 2020

Prepare Form CT 636 Alcoholic Beverage Production Credit Tax Year effortlessly on any device

Online document handling has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form CT 636 Alcoholic Beverage Production Credit Tax Year on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form CT 636 Alcoholic Beverage Production Credit Tax Year with ease

- Find Form CT 636 Alcoholic Beverage Production Credit Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, be it via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form CT 636 Alcoholic Beverage Production Credit Tax Year and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 636 alcoholic beverage production credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 636 alcoholic beverage production credit tax year 2020

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is ct 636 in the context of airSlate SignNow?

The ct 636 refers to a specific document type that can be electronically signed using airSlate SignNow. This powerful tool simplifies the signature process, allowing users to send and eSign documents securely and efficiently.

-

How much does airSlate SignNow cost for processing ct 636 documents?

airSlate SignNow offers competitive pricing plans for businesses looking to manage ct 636 documents. Our plans are tailored to meet diverse needs, ensuring that you get a cost-effective solution for all your document signing requirements.

-

What features does airSlate SignNow provide for ct 636 document signing?

When dealing with ct 636 documents, airSlate SignNow provides features like customizable signing flows, template creation, and real-time tracking. These features ensure that your document management and signing experience is both streamlined and efficient.

-

How can airSlate SignNow benefit my business with ct 636 documents?

By using airSlate SignNow for ct 636 documents, your business can enhance workflow efficiency, reduce processing time, and minimize paper usage. These benefits translate into cost savings and improved productivity for your team.

-

Can I integrate airSlate SignNow with other software for managing ct 636 documents?

Yes, airSlate SignNow seamlessly integrates with various software platforms to help manage ct 636 documents. This integration capability allows you to connect with CRM systems, cloud storage solutions, and more, enabling a cohesive workflow.

-

Is it easy to send ct 636 documents for signing through airSlate SignNow?

Absolutely! airSlate SignNow simplifies the process of sending ct 636 documents for signature. With an intuitive interface, you can quickly upload files, specify signers, and send documents out for eSignature in just a few clicks.

-

What security measures are in place for ct 636 documents signed via airSlate SignNow?

airSlate SignNow prioritizes the security of your ct 636 documents. We employ advanced encryption methods and adhere to industry standards to ensure that all documents are protected during transmission and storage.

Get more for Form CT 636 Alcoholic Beverage Production Credit Tax Year

Find out other Form CT 636 Alcoholic Beverage Production Credit Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors