Tax Corporation 2023

What is the Tax Corporation

The Tax Corporation is a legal entity created to conduct business while providing certain tax advantages. It is recognized by the state and federal governments and is subject to specific regulations. Corporations can be taxed separately from their owners, which may lead to lower overall tax rates depending on the structure and income. Understanding the nature of a Tax Corporation is essential for businesses aiming to maximize their tax efficiency.

Steps to complete the Tax Corporation

Completing the Tax Corporation involves several critical steps:

- Choose a unique name for the corporation that complies with state regulations.

- File Articles of Incorporation with the appropriate state agency, including necessary fees.

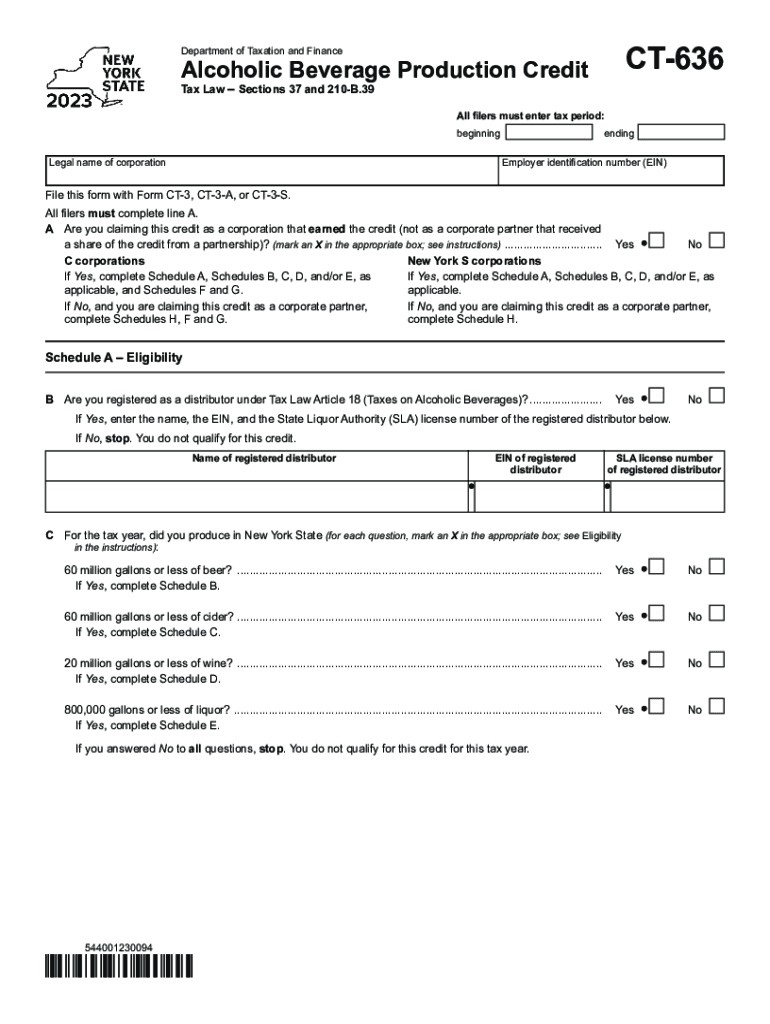

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Draft corporate bylaws that outline the management structure and operational procedures.

- Hold an initial board of directors meeting to adopt the bylaws and appoint officers.

- Register for state and local taxes as required.

IRS Guidelines

The IRS provides extensive guidelines for Tax Corporations, detailing how they should report income, deductions, and credits. Corporations must file their tax returns annually using Form 1120. It is crucial for corporations to maintain accurate financial records and adhere to IRS regulations to avoid penalties. The IRS also outlines rules regarding estimated tax payments and deadlines, which are vital for compliance.

Filing Deadlines / Important Dates

Corporations must be aware of key filing deadlines to remain compliant with tax regulations. The standard deadline for filing Form 1120 is the fifteenth day of the fourth month following the end of the corporation's tax year. If the corporation operates on a calendar year basis, this typically falls on April 15. Additionally, corporations may need to make estimated tax payments throughout the year, with specific due dates that should be noted to avoid penalties.

Required Documents

To successfully file taxes as a Tax Corporation, several documents are necessary, including:

- Form 1120: U.S. Corporation Income Tax Return.

- Financial statements, including balance sheets and income statements.

- Records of any deductions or credits claimed.

- Documentation for any estimated tax payments made during the year.

Penalties for Non-Compliance

Failure to comply with tax regulations can result in significant penalties for Tax Corporations. These may include fines for late filings, interest on unpaid taxes, and potential legal action. It is essential for corporations to stay informed about their tax obligations and ensure timely submissions to avoid these consequences.

Quick guide on how to complete tax corporation

Prepare Tax Corporation effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Tax Corporation on any device with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign Tax Corporation effortlessly

- Find Tax Corporation and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Tax Corporation and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax corporation

Create this form in 5 minutes!

How to create an eSignature for the tax corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 636 2018?

airSlate SignNow is an eSignature platform designed to help businesses streamline their document signing processes. The term '636 2018' refers to a specific compliance standard that our solution meets, ensuring that your eSignatures are legally binding and secure, which is essential for businesses in 2018 and beyond.

-

How does pricing for airSlate SignNow compare to other eSignature solutions focusing on 636 2018?

airSlate SignNow offers competitive pricing plans tailored to fit various business sizes while addressing the requirements of '636 2018' compliance. We provide transparent pricing with no hidden fees, ensuring you receive a budget-friendly solution that meets your eSigning needs effectively.

-

What key features does airSlate SignNow provide for the 636 2018 compliance?

airSlate SignNow includes features such as secure document storage, customizable signing workflows, and comprehensive audit trails to support '636 2018' compliance. These features help organizations maintain legal integrity and streamline their operations while ensuring all documents are managed securely.

-

How can airSlate SignNow benefit my business in the context of 636 2018?

By using airSlate SignNow, businesses can enhance their document workflows, reduce turnaround time, and maintain compliance with '636 2018' requirements. Our solution not only simplifies the eSigning process but also improves productivity by allowing teams to focus on core business objectives.

-

Can airSlate SignNow integrate with other software to support 636 2018 documentation?

Yes, airSlate SignNow offers integrations with popular software like Salesforce, Google Workspace, and Microsoft Teams, enabling seamless collaboration while ensuring 636 2018 compliance. These integrations allow you to manage your documents efficiently without disrupting your existing workflows.

-

Is it easy to get started with airSlate SignNow for 636 2018 compliance?

Absolutely! airSlate SignNow provides a user-friendly interface that makes it easy to start using our platform for '636 2018' compliant eSignatures. Our setup process is straightforward, and we offer supportive resources to guide you through the initial stages of implementation.

-

What security features does airSlate SignNow offer for 636 2018 compliance?

airSlate SignNow takes security seriously by utilizing advanced encryption, secure cloud storage, and multi-factor authentication to protect your documents. These features not only ensure compliance with '636 2018' but also safeguard sensitive information from unauthorized access.

Get more for Tax Corporation

- Motion to dissolve protective order maine form

- Morse fall scale 5024873 form

- Nih 829 form

- Application for registration of plant workplace standards tasmania form

- 1245 16th street santa monica form

- Statutory declaration by landlord signature validation form

- Luacabagsf02p o box 110020300 nyahururu ken form

- Accessibility statement floridas supreme court form

Find out other Tax Corporation

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe