Partnership, Joint Venture or Syndicate Form a 1 the Business ISC Isc

Understanding the Partnership, Joint Venture or Syndicate Form A-1

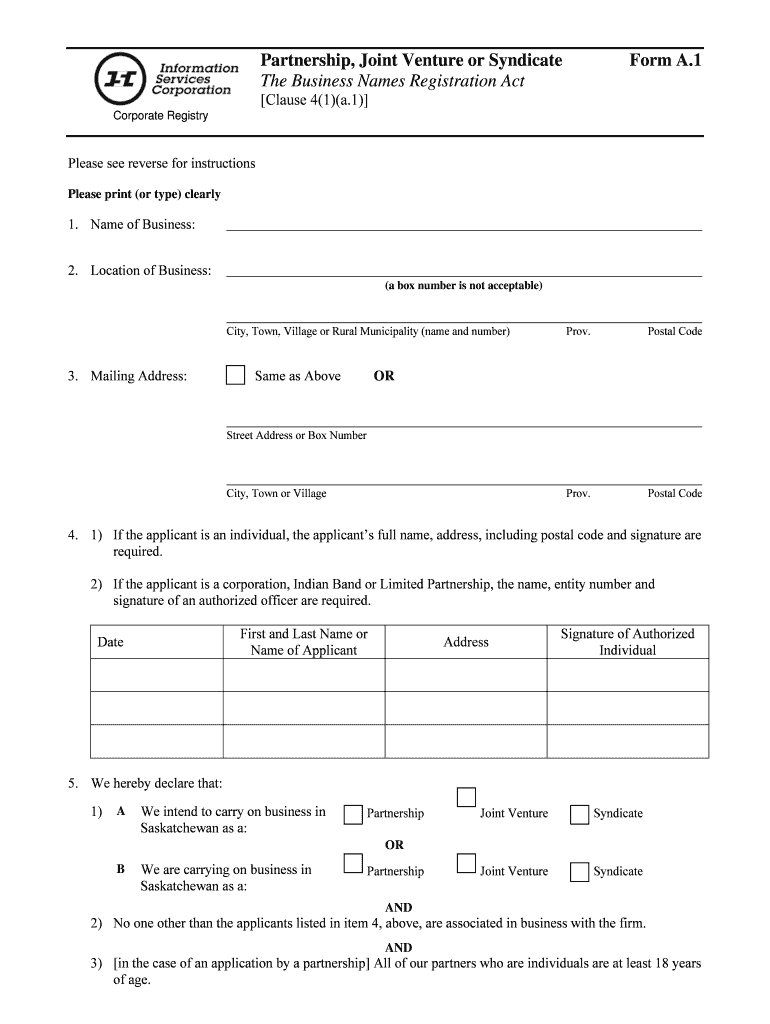

The Partnership, Joint Venture or Syndicate Form A-1, often referred to as the DA Form 4592, is a crucial document for businesses engaging in collaborative ventures. This form is used to outline the terms and conditions of partnerships, joint ventures, or syndicates, ensuring all parties involved have a clear understanding of their roles and responsibilities. It serves as a formal agreement that can help prevent disputes and misunderstandings in business operations.

Steps to Complete the Partnership, Joint Venture or Syndicate Form A-1

Completing the DA Form 4592 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the partners or entities involved, including names, addresses, and the nature of the partnership. Carefully fill out each section of the form, paying close attention to the details regarding the purpose of the partnership and the distribution of profits and losses. Once completed, review the form for any errors before submitting it to the appropriate authority.

Legal Use of the Partnership, Joint Venture or Syndicate Form A-1

The DA Form 4592 holds legal significance as it formalizes the agreement between parties. For the form to be recognized in a legal context, it must be completed accurately and signed by all involved parties. It is essential to ensure that the form adheres to relevant state and federal regulations, as these can vary. By following the legal guidelines, businesses can protect their interests and maintain compliance with applicable laws.

How to Obtain the Partnership, Joint Venture or Syndicate Form A-1

The DA Form 4592 can typically be obtained through official government websites or offices that handle business registrations. It may also be available at local business development centers or chambers of commerce. Ensure you are accessing the most current version of the form to avoid any issues during submission. If necessary, consult with legal professionals to ensure you have the correct documentation for your specific business needs.

Examples of Using the Partnership, Joint Venture or Syndicate Form A-1

Businesses often utilize the DA Form 4592 in various scenarios, such as forming a new partnership for a project, entering a joint venture to expand their market reach, or establishing a syndicate for investment purposes. For instance, two companies may collaborate on a product launch, using the form to outline their contributions and profit-sharing arrangements. These examples highlight the form’s versatility in facilitating business agreements.

Filing Deadlines and Important Dates for the Partnership, Joint Venture or Syndicate Form A-1

Filing deadlines for the DA Form 4592 can vary depending on the nature of the partnership and the state regulations. It is important to be aware of any specific deadlines to ensure compliance and avoid penalties. Keeping track of these dates is crucial for maintaining good standing with regulatory authorities. Businesses should also consider any relevant tax deadlines that may coincide with the submission of this form.

Quick guide on how to complete partnership joint venture or syndicate form a 1 the business isc isc

Complete Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to adjust and eSign Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc with ease

- Find Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc and select Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate Sign Now provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from a device of your choice. Modify and eSign Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need to fill out a customs form to mail a 1 oz letter? Would I put the customs form outside the envelope or inside?

No. There are specific envelopes that are used to identify mail under 16 oz and don’t require a P.S. form. These envelopes have a colored stripe along its borders which indicates to the shipper that it’s an international mail piece.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

Create this form in 5 minutes!

How to create an eSignature for the partnership joint venture or syndicate form a 1 the business isc isc

How to create an eSignature for your Partnership Joint Venture Or Syndicate Form A 1 The Business Isc Isc online

How to make an electronic signature for the Partnership Joint Venture Or Syndicate Form A 1 The Business Isc Isc in Google Chrome

How to make an electronic signature for signing the Partnership Joint Venture Or Syndicate Form A 1 The Business Isc Isc in Gmail

How to make an eSignature for the Partnership Joint Venture Or Syndicate Form A 1 The Business Isc Isc straight from your smart phone

How to create an eSignature for the Partnership Joint Venture Or Syndicate Form A 1 The Business Isc Isc on iOS devices

How to create an electronic signature for the Partnership Joint Venture Or Syndicate Form A 1 The Business Isc Isc on Android devices

People also ask

-

What is the da form 4592 and how does it work?

The da form 4592 is a crucial document used by businesses to initiate and approve various official processes. With airSlate SignNow, you can easily create, send, and eSign the da form 4592, streamlining the approval process. Our platform enables users to attach necessary files and store information securely.

-

How much does it cost to use airSlate SignNow for the da form 4592?

airSlate SignNow offers competitive pricing plans tailored to fit your needs for managing the da form 4592. Whether you’re a small business or a large enterprise, you can choose from various subscription tiers to find the best coverage for your document signing needs. Check our pricing page for current offers and promotions.

-

What features does airSlate SignNow offer for the da form 4592?

Our platform provides a range of features specifically designed to enhance your experience with the da form 4592. These include customizable templates, real-time tracking, and automated reminders. With these capabilities, you can ensure timely completion of your documents.

-

How can I integrate airSlate SignNow with other software for the da form 4592?

airSlate SignNow offers seamless integrations with popular business tools and software, making it easy to incorporate the da form 4592 into your existing workflow. You can connect with apps like Google Drive, Dropbox, and CRM systems, ensuring that your document management processes remain efficient and organized.

-

What are the benefits of using airSlate SignNow for eSigning the da form 4592?

Using airSlate SignNow for eSigning the da form 4592 streamlines the approval process, reducing turnaround time signNowly. Our platform is designed to be user-friendly, allowing you and your team to sign documents anytime, anywhere. Plus, it enhances document security with advanced encryption methods.

-

Can I customize the da form 4592 within airSlate SignNow?

Yes, you can easily customize the da form 4592 within airSlate SignNow to fit your specific requirements. This includes adding fields for signatures, dates, and other relevant information. The customization options ensure that the document meets your organization's standards and compliance needs.

-

Is there a mobile app to manage the da form 4592?

Absolutely! airSlate SignNow provides a mobile app that allows you to manage and eSign the da form 4592 on-the-go. This flexibility is perfect for busy professionals who need to manage documents quickly and efficiently, without being tied to their desks.

Get more for Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc

- Lic 9182 1115 criminal background clearance transfer cdss cdss ca form

- Da form 2166 8 fillable pdf da form 2166 8 fillable pdf miki 441

- Occupational drivers license order free texas legal forms texaslawhelp

- Dd form 2983 recruittrainee prohibited activities acknowledgment january 2015

- 32 team tourney bracket editable bracket form

- Online orders returns form arnotts arnotts

- 2017 chicago residential lease important message for form

- Ndis template form

Find out other Partnership, Joint Venture Or Syndicate Form A 1 The Business ISC Isc

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free