Subcontractor Information Form

Understanding the Subcontractor Information Form

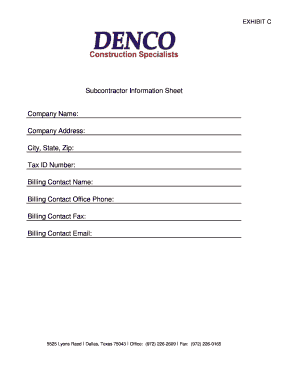

The subcontractor information form is a crucial document used by businesses to collect essential details from subcontractors. This form typically includes information such as the subcontractor's name, address, contact details, and tax identification number. It serves to verify the subcontractor's credentials and ensure compliance with tax regulations. By gathering this information, businesses can maintain accurate records and streamline the payment process, ensuring that all parties are informed and compliant with legal requirements.

Steps to Complete the Subcontractor Information Form

Filling out the subcontractor information form involves several straightforward steps. First, the subcontractor should provide their full legal name and business name, if applicable. Next, they must include their contact information, such as phone number and email address. It is also essential to enter the tax identification number accurately, as this is used for tax reporting purposes. Finally, subcontractors should review the form for any errors before submission to ensure all information is correct and up-to-date.

Key Elements of the Subcontractor Information Form

Several key elements are essential for the subcontractor information form. These include:

- Legal Name: The full name of the subcontractor or business entity.

- Contact Information: Phone number and email address for communication.

- Tax Identification Number: A unique identifier for tax purposes.

- Business Address: The physical address where the subcontractor operates.

- Type of Services Offered: A brief description of the services the subcontractor provides.

Including these elements ensures that the form is complete and meets the necessary legal requirements.

How to Use the Subcontractor Information Form

The subcontractor information form is used primarily for record-keeping and compliance purposes. Businesses should provide this form to subcontractors at the beginning of any contract or project. Once completed, the form should be securely stored in the business's records. This allows for easy access during audits or when verifying subcontractor details for tax reporting. Additionally, having this information on file helps streamline communication and payment processes.

Legal Use of the Subcontractor Information Form

Legally, the subcontractor information form serves to protect both the business and the subcontractor. It ensures that the subcontractor is properly classified for tax purposes, which is critical for compliance with IRS regulations. By collecting and maintaining this information, businesses can avoid potential penalties associated with misclassification or failure to report payments accurately. It is advisable to consult with a legal professional to ensure the form complies with all applicable laws and regulations.

Form Submission Methods

Submitting the subcontractor information form can be done through various methods. The most common methods include:

- Online Submission: Many businesses now offer digital forms that can be filled out and submitted electronically.

- Mail: The completed form can be printed and sent via postal service to the appropriate office.

- In-Person Submission: Subcontractors may also choose to deliver the form directly to the business office.

Choosing the appropriate submission method can depend on the preferences of both the subcontractor and the business involved.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the subcontractor information form 74926247

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a subcontractor information sheet?

A subcontractor information sheet is a document that collects essential details about subcontractors, including their qualifications, experience, and contact information. This sheet helps businesses streamline the onboarding process and ensures compliance with regulations. Using airSlate SignNow, you can easily create and manage subcontractor information sheets digitally.

-

How can airSlate SignNow help with subcontractor information sheets?

airSlate SignNow provides a user-friendly platform to create, send, and eSign subcontractor information sheets efficiently. With its customizable templates, you can tailor the sheets to meet your specific needs. This not only saves time but also enhances the accuracy of the information collected.

-

Is there a cost associated with using airSlate SignNow for subcontractor information sheets?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of features like unlimited eSigning and document management. You can choose a plan that best fits your requirements for managing subcontractor information sheets.

-

What features does airSlate SignNow offer for subcontractor information sheets?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for subcontractor information sheets. Additionally, it allows for easy collaboration and sharing among team members. These features ensure that you can manage your subcontractor information efficiently.

-

Can I integrate airSlate SignNow with other tools for subcontractor information sheets?

Absolutely! airSlate SignNow offers integrations with various third-party applications, enhancing your workflow for subcontractor information sheets. Whether you use project management tools or CRM systems, you can seamlessly connect them to streamline your processes.

-

What are the benefits of using airSlate SignNow for subcontractor information sheets?

Using airSlate SignNow for subcontractor information sheets provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The digital format allows for quick updates and easy access to information. This ultimately leads to better management of subcontractor relationships.

-

How secure is the information on subcontractor information sheets with airSlate SignNow?

Security is a top priority for airSlate SignNow. All subcontractor information sheets are protected with advanced encryption and secure access controls. This ensures that sensitive information remains confidential and is only accessible to authorized personnel.

Get more for Subcontractor Information Form

Find out other Subcontractor Information Form

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online