Travel and Accommodation Claims 2024-2026

What is the Travel And Accommodation Claims

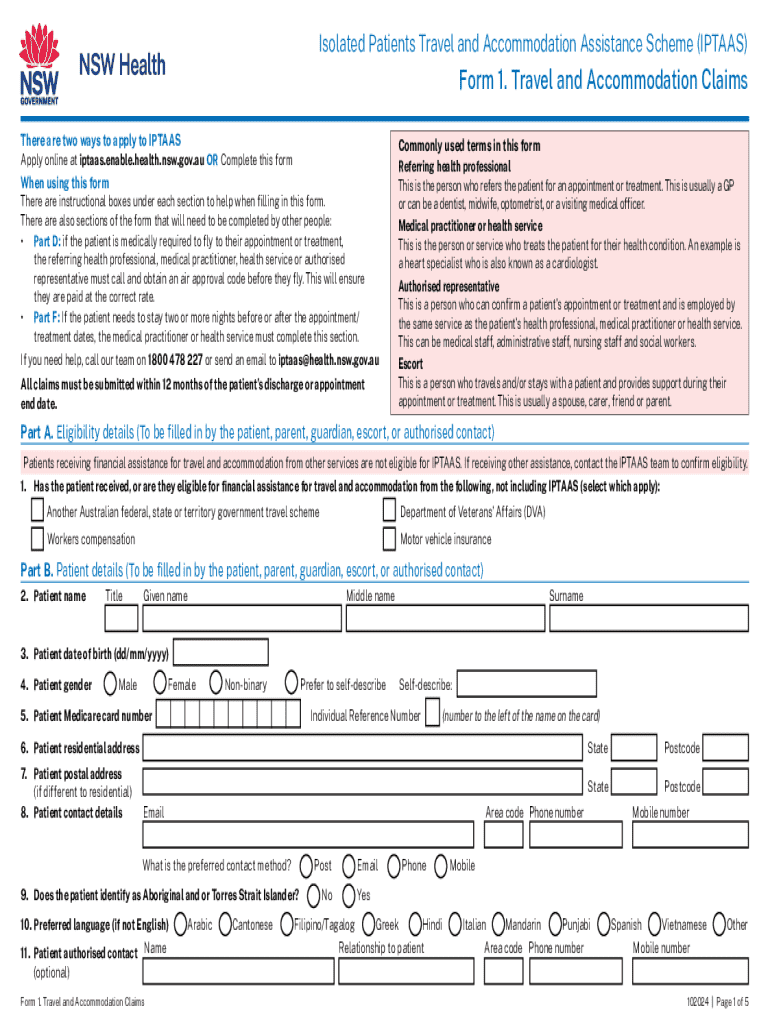

The Travel And Accommodation Claims form is a document used by individuals or businesses to request reimbursement for travel-related expenses incurred during business activities. This form typically covers costs such as transportation, lodging, meals, and other associated expenditures. Understanding this form is essential for ensuring that all eligible expenses are accurately reported and reimbursed according to company policies or IRS guidelines.

How to use the Travel And Accommodation Claims

Using the Travel And Accommodation Claims form involves several key steps. First, gather all relevant receipts and documentation that support your claim. Next, fill out the form by detailing each expense, including the date, amount, and purpose of the travel. Ensure that you categorize expenses correctly, as this will facilitate the approval process. After completing the form, submit it to the appropriate department or individual for review and reimbursement.

Steps to complete the Travel And Accommodation Claims

Completing the Travel And Accommodation Claims form requires careful attention to detail. Follow these steps:

- Collect all necessary receipts and documentation for your expenses.

- Fill out your personal and travel details at the top of the form.

- List each expense, specifying the date, amount, and purpose.

- Attach copies of receipts to support your claims.

- Review the form for accuracy before submission.

- Submit the completed form to the designated approver.

Required Documents

To successfully file a Travel And Accommodation Claims form, certain documents are essential. These typically include:

- Receipts for all travel-related expenses.

- A detailed itinerary of the trip.

- Any relevant travel authorization or approval from your employer.

- Proof of payment for accommodations, such as hotel invoices.

Eligibility Criteria

To be eligible for reimbursement through the Travel And Accommodation Claims form, the expenses must be incurred during business-related travel. The individual must be an employee or authorized representative of the company, and the travel must align with the company's travel policy. Additionally, expenses must be reasonable and necessary for the completion of business tasks.

IRS Guidelines

The IRS provides specific guidelines regarding travel and accommodation expenses. According to IRS regulations, expenses must be ordinary and necessary for business purposes. This includes costs for transportation, lodging, meals, and incidentals. It is crucial to maintain accurate records and receipts, as the IRS may require documentation to substantiate claims during audits.

Create this form in 5 minutes or less

Find and fill out the correct travel and accommodation claims

Create this form in 5 minutes!

How to create an eSignature for the travel and accommodation claims

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Travel And Accommodation Claims?

Travel And Accommodation Claims refer to the reimbursement requests made by employees for expenses incurred during business travel. These claims typically include costs for transportation, lodging, meals, and other related expenses. Understanding how to effectively manage these claims can streamline the reimbursement process and ensure employees are compensated promptly.

-

How does airSlate SignNow simplify Travel And Accommodation Claims?

airSlate SignNow simplifies Travel And Accommodation Claims by providing an intuitive platform for creating, sending, and signing documents electronically. This reduces paperwork and speeds up the approval process, allowing employees to submit their claims quickly and receive reimbursements faster. The user-friendly interface ensures that both employees and managers can navigate the system with ease.

-

What features does airSlate SignNow offer for managing Travel And Accommodation Claims?

airSlate SignNow offers features such as customizable templates for Travel And Accommodation Claims, automated workflows, and real-time tracking of document status. These features help organizations maintain compliance and ensure that all claims are processed efficiently. Additionally, the platform supports electronic signatures, making it easy for approvers to authorize claims on the go.

-

Is airSlate SignNow cost-effective for handling Travel And Accommodation Claims?

Yes, airSlate SignNow is a cost-effective solution for managing Travel And Accommodation Claims. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing powerful features. The reduction in paper usage and administrative time also contributes to overall cost savings for organizations.

-

Can airSlate SignNow integrate with other tools for Travel And Accommodation Claims?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing the management of Travel And Accommodation Claims. Whether you use accounting software, HR platforms, or project management tools, these integrations help streamline workflows and ensure that all relevant data is synchronized across systems.

-

What are the benefits of using airSlate SignNow for Travel And Accommodation Claims?

Using airSlate SignNow for Travel And Accommodation Claims offers numerous benefits, including increased efficiency, reduced processing time, and improved accuracy. The platform minimizes the risk of errors associated with manual entry and provides a clear audit trail for all claims. Additionally, employees appreciate the convenience of submitting claims electronically, leading to higher satisfaction rates.

-

How secure is airSlate SignNow for handling sensitive Travel And Accommodation Claims?

airSlate SignNow prioritizes security, ensuring that all Travel And Accommodation Claims are handled with the utmost care. The platform employs advanced encryption protocols and complies with industry standards to protect sensitive information. Users can trust that their data is secure while using airSlate SignNow for their claims management.

Get more for Travel And Accommodation Claims

- Return to school note template form

- Water and sewer submetering addendum form

- Rera allotment letter format

- Fraud or identity theft incident report form

- Affidavit form 6c township of union public schools twpunionschools

- Installation form 27406923

- All crpf bn control room number form

- 10 withholdingannualreconciliationaw 3 city of akron form

Find out other Travel And Accommodation Claims

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template