SC 40 Edition of SC 40, Unified Tax Credit for the Elderly Form

What is the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly

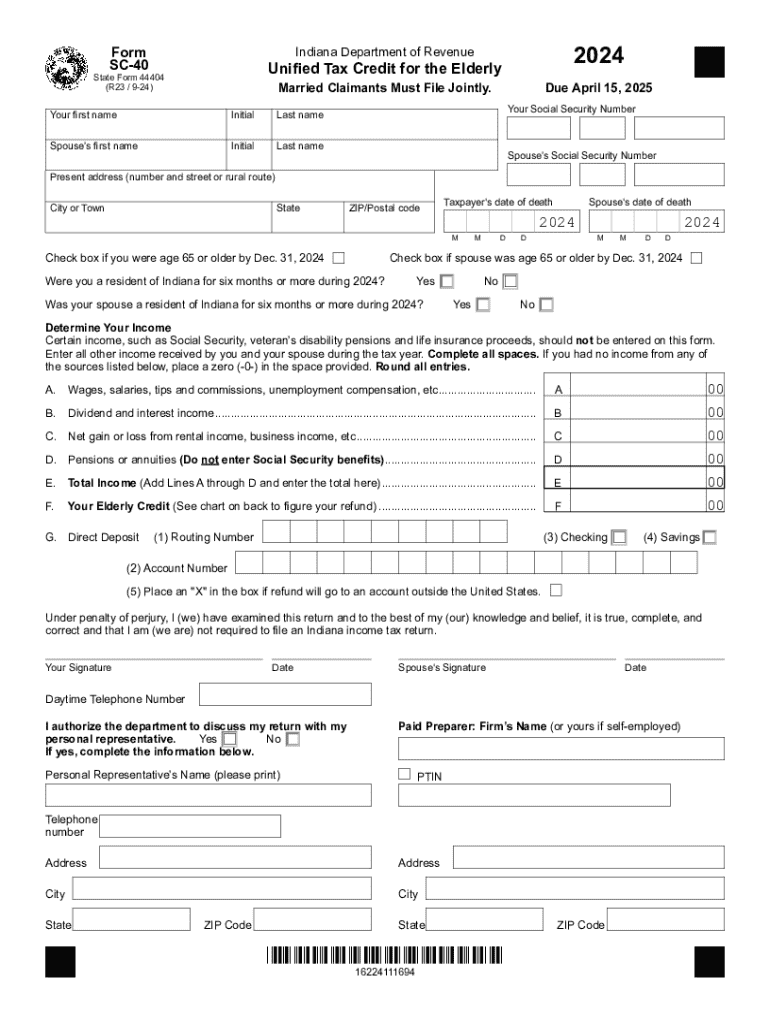

The SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly, is a tax form used in the United States to help eligible elderly individuals claim a tax credit. This credit is designed to provide financial relief to seniors who meet specific income and residency requirements. The SC 40 form allows taxpayers to report their eligibility for the credit, which can reduce their overall tax liability, thereby supporting their financial well-being in retirement.

Eligibility Criteria

To qualify for the Unified Tax Credit For The Elderly, applicants must meet certain criteria. Generally, individuals must be at least sixty-five years old by the end of the tax year. Additionally, they must have a qualifying income that falls below a specified threshold. This income limit may vary by state, so it is essential to check local guidelines. Furthermore, applicants must be U.S. citizens or resident aliens and must not have been claimed as a dependent on someone else's tax return.

Steps to complete the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly

Completing the SC 40 form involves several key steps:

- Gather necessary documentation, including proof of age, income statements, and any other relevant financial records.

- Fill out the form accurately, ensuring all personal information is correct and complete.

- Calculate the credit amount based on the provided instructions, considering any applicable deductions.

- Review the completed form for accuracy before submission to avoid delays or penalties.

- Submit the form by the designated deadline, either electronically or via mail.

Required Documents

When completing the SC 40 form, specific documents are necessary to verify eligibility and support claims. These typically include:

- Proof of age, such as a birth certificate or government-issued ID.

- Income documentation, including W-2 forms, 1099s, or other income statements.

- Any relevant tax returns from previous years that may support the claim.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the SC 40 Edition Of SC 40. Typically, the deadline for submitting this form aligns with the general tax filing deadline, which is usually April fifteenth of each year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any state-specific deadlines that may apply.

Form Submission Methods

The SC 40 form can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online submission through authorized tax software that supports the SC 40 form.

- Mailing a paper copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, where assistance may be available.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc 40 edition of sc 40 unified tax credit for the elderly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly?

The SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly, is a tax form designed to help eligible elderly individuals claim a credit against their state income tax. This credit aims to provide financial relief to seniors, ensuring they receive the benefits they deserve. Understanding this form is crucial for maximizing your tax benefits.

-

How can I access the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly?

You can access the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly through the official state tax website or by consulting with a tax professional. Many online tax preparation services also provide this form as part of their offerings. Ensure you have the necessary documentation to complete the form accurately.

-

What are the eligibility requirements for the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly?

To qualify for the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly, applicants must meet specific age and income criteria set by the state. Generally, individuals aged 65 or older with a certain income level are eligible. It's important to review the guidelines to ensure you meet all requirements before applying.

-

What benefits does the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly provide?

The SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly offers signNow tax savings for eligible seniors, reducing their overall tax burden. This credit can help improve financial stability for elderly individuals, allowing them to allocate funds to other essential needs. Understanding these benefits can help seniors make informed financial decisions.

-

Is there a cost associated with filing the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly?

Filing the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly typically does not have a direct cost, as it is a tax form submitted to the state. However, if you choose to use a tax preparation service, there may be fees associated with their assistance. It's advisable to compare options to find the most cost-effective solution.

-

Can I eSign the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly?

Yes, you can eSign the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly if you are using an electronic filing system that supports eSignature. This feature streamlines the filing process and ensures your documents are submitted securely and efficiently. Check with your tax software provider for eSigning capabilities.

-

What integrations are available for managing the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly?

Many tax preparation software solutions integrate with the SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly, allowing for seamless data entry and filing. These integrations can help automate calculations and ensure accuracy in your submissions. Look for software that offers comprehensive support for tax credits and forms.

Get more for SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly

- Funretrospectives pdf form

- Book club names form

- Form no 61 odisha

- Exposure form edison fire fighters association iaff local 1197 iafflocal3249

- Arthritis care amp research disclosure of interest form for

- Government of national capital territory of delhi e stamp form

- Snohomish county property exemption form

- Formato de solicitud de laboratorio clnico word

Find out other SC 40 Edition Of SC 40, Unified Tax Credit For The Elderly

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document