Self Employment Short If You're Self Employed, Have Relatively Simple Tax Affairs and Your Annual Business Turnover Was Bel 2024

Understanding the Self Employment Short Form

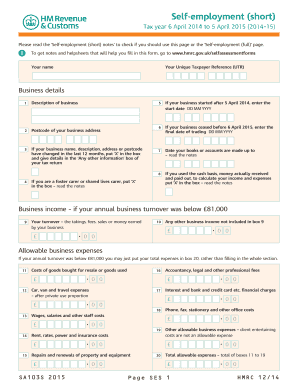

The Self Employment Short form, specifically the SA103S, is designed for individuals who are self-employed and have relatively simple tax affairs. This form is applicable when your annual business turnover is below seventy-three thousand dollars. Utilizing the SA103S allows for a streamlined approach to reporting your income and expenses, simplifying the tax filing process for eligible self-employed individuals.

How to Use the Self Employment Short Form

To use the SA103S, you must first determine your eligibility based on your business turnover and the simplicity of your tax affairs. If you qualify, you can complete the form by providing necessary details about your income, expenses, and any allowable deductions. The form is designed to be straightforward, making it easier to report your earnings without the complexities associated with longer forms.

Steps to Complete the Self Employment Short Form

Completing the SA103S involves several key steps:

- Gather all relevant financial documents, including income statements and expense receipts.

- Fill out the personal information section, ensuring accuracy in your name and contact details.

- Report your total income from self-employment.

- List your allowable business expenses, which can help reduce your taxable income.

- Calculate your profit by subtracting your expenses from your total income.

- Review the completed form for accuracy before submission.

Required Documents for the Self Employment Short Form

When completing the SA103S, you will need several documents to ensure accurate reporting:

- Income statements from your business activities.

- Receipts and records of business expenses.

- Any prior year tax returns that may provide context for your current filing.

IRS Guidelines for the Self Employment Short Form

The IRS provides specific guidelines for using the SA103S. It is essential to follow these guidelines to ensure compliance and avoid potential penalties. Key points include understanding eligibility criteria, maintaining accurate records, and adhering to submission deadlines. Familiarizing yourself with these guidelines can help streamline your tax filing process.

Filing Deadlines for the Self Employment Short Form

Filing deadlines for the SA103S align with the general tax filing deadlines set by the IRS. Typically, self-employed individuals must file their taxes by April fifteenth of each year. If you require additional time, you may file for an extension, but it is crucial to pay any owed taxes by the original deadline to avoid penalties.

Penalties for Non-Compliance with the Self Employment Short Form

Failure to comply with the requirements of the SA103S can result in penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits. It is important to ensure that all information is accurate and submitted on time to mitigate these risks.

Create this form in 5 minutes or less

Find and fill out the correct self employment short if youre self employed have relatively simple tax affairs and your annual business turnover was below

Create this form in 5 minutes!

How to create an eSignature for the self employment short if youre self employed have relatively simple tax affairs and your annual business turnover was below

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA103S form and who should use it?

The SA103S form is designed for self-employed individuals with relatively simple tax affairs. If you're self-employed, have an annual business turnover below £73,000, and your tax situation is straightforward, you should use the SA103S short version of the self-employment supplementary pages when filing a tax.

-

How does airSlate SignNow help with the SA103S form?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents, including tax forms like the SA103S. By using our solution, you can streamline the process of preparing and submitting your self-employment tax documents efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Our cost-effective solutions ensure that even self-employed individuals with simple tax affairs can access the tools they need, including support for the SA103S form.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This is particularly beneficial for self-employed individuals who need to manage their tax documents, including the SA103S form, alongside other business tools.

-

What are the benefits of using airSlate SignNow for self-employed individuals?

Using airSlate SignNow allows self-employed individuals to manage their documents efficiently and securely. With features tailored for those with relatively simple tax affairs, you can easily prepare and eSign your SA103S form, ensuring compliance and saving time.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that your sensitive tax documents, including the SA103S form, are protected. Our platform uses advanced encryption and security measures to keep your information safe.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore our features, including those that assist with the SA103S form for self-employed individuals. Once you're ready, choose a pricing plan that suits your needs.

Get more for Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Bel

- Verification of postgraduate training form

- Full text of ampquotthe sisters of the ihm the story of the form

- Forensic wchucks changesindd form

- Box 45027 form

- Bme medical education verification formindd

- Application for continuing education approval for course sponsors form

- Proposed plan of supervision form

- Health care service firms new jersey division of health care service firms new jersey division of inspection information for

Find out other Self employment Short If You're Self employed, Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Bel

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word