1040 Instructions Form

Understanding the 1040 Instructions

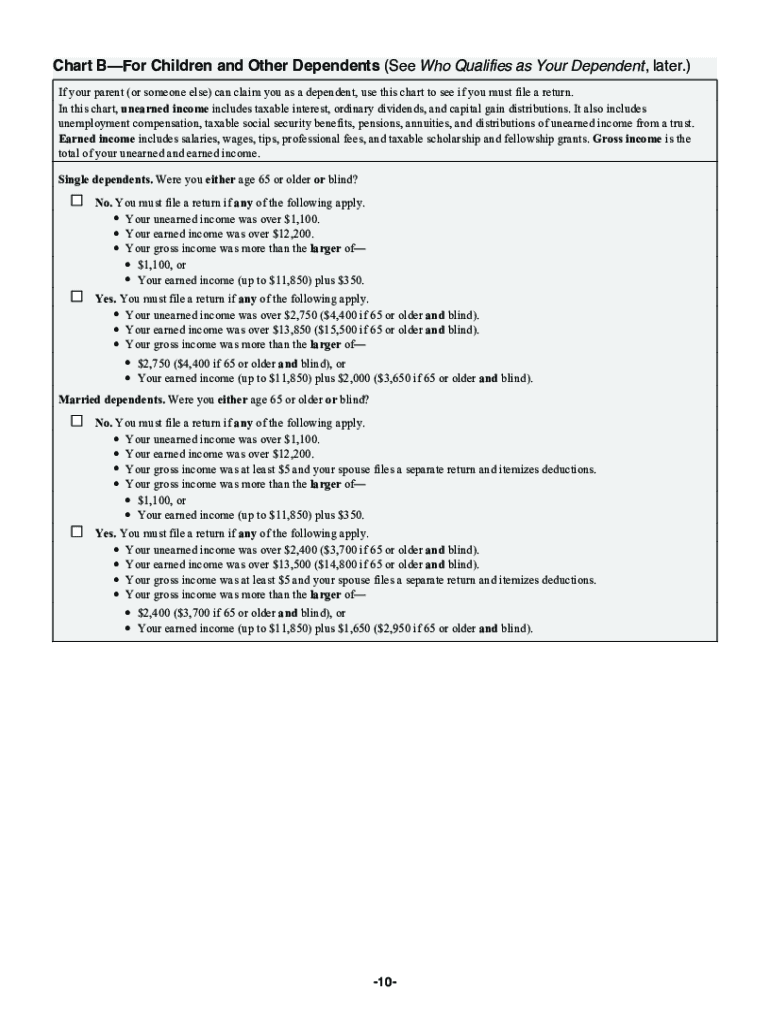

The 1040 Instructions are essential guidelines provided by the IRS to assist taxpayers in accurately completing their federal income tax returns. These instructions detail the requirements for filling out the IRS Form 1040, which is the primary document used by individuals to report their income, claim deductions, and calculate their tax liability. The instructions cover various aspects, including eligibility criteria, filing status, and available credits and deductions that can be claimed. Understanding these instructions is crucial for ensuring compliance and maximizing potential refunds.

Steps to Complete the 1040 Instructions

Completing the 1040 Instructions involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, determine your filing status, which affects your tax rates and eligibility for certain credits. Follow the instructions step-by-step, entering your income, deductions, and credits as applicable. It is important to double-check all entries for accuracy before submitting the form. Finally, review the filing options available, whether online, by mail, or in person, to ensure timely submission.

How to Obtain the 1040 Instructions

The 1040 Instructions can be easily obtained through the IRS website or by visiting a local IRS office. The instructions are available in PDF format for download, making it convenient to access and print. Additionally, taxpayers can request a physical copy by calling the IRS or visiting a tax professional who may have copies on hand. Ensuring you have the correct version for the tax year is important, as instructions may change annually.

Legal Use of the 1040 Instructions

The legal use of the 1040 Instructions is vital for compliance with federal tax regulations. These instructions are designed to help taxpayers fulfill their legal obligations when filing taxes. Utilizing the instructions correctly ensures that taxpayers can accurately report their income and claim eligible deductions and credits, which can significantly impact their tax liability. Failure to follow the instructions may result in penalties or audits, so it is essential to adhere to the guidelines provided by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 tax return are crucial to avoid penalties and interest. Typically, the deadline for submitting the 1040 Form is April 15 of the following year, although this may vary slightly if it falls on a weekend or holiday. Taxpayers should also be aware of extension deadlines if they choose to file for an extension, which usually extends the deadline to October 15. Keeping track of these important dates is essential for timely filing and compliance with IRS regulations.

Required Documents

To complete the 1040 Instructions accurately, several documents are required. Taxpayers should gather all income statements, such as W-2 forms from employers, 1099 forms for freelance work, and any other relevant income documentation. Additionally, documentation for deductions, such as mortgage interest statements or medical expense receipts, should be collected. Having these documents organized will facilitate a smoother filing process and help ensure that all applicable deductions and credits are claimed.

Quick guide on how to complete form 1040 sr should you use it for your 2019 tax return

Complete 1040 Instructions effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a flawless environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage 1040 Instructions on any platform with airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

The easiest way to modify and eSign 1040 Instructions with ease

- Locate 1040 Instructions and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign 1040 Instructions while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr should you use it for your 2019 tax return

How to create an electronic signature for your Form 1040 Sr Should You Use It For Your 2019 Tax Return in the online mode

How to generate an electronic signature for your Form 1040 Sr Should You Use It For Your 2019 Tax Return in Chrome

How to generate an eSignature for putting it on the Form 1040 Sr Should You Use It For Your 2019 Tax Return in Gmail

How to create an eSignature for the Form 1040 Sr Should You Use It For Your 2019 Tax Return straight from your smart phone

How to generate an eSignature for the Form 1040 Sr Should You Use It For Your 2019 Tax Return on iOS

How to create an electronic signature for the Form 1040 Sr Should You Use It For Your 2019 Tax Return on Android devices

People also ask

-

How can the 2019 federal tax tables impact my business's document processing?

Understanding the 2019 federal tax tables is crucial for preparing tax documents accurately. With airSlate SignNow, you can easily manage and send tax-related documents for eSigning, ensuring they comply with the latest tax regulations, including the 2019 federal tax tables. This helps streamline your workflow and minimize errors in tax reporting.

-

Are there features in airSlate SignNow that simplify dealing with the 2019 federal tax tables?

Yes, airSlate SignNow offers features that help you manage documents related to the 2019 federal tax tables effectively. Users can create templates specifically for tax forms that reference the 2019 federal tax tables, making it easier to ensure consistency and compliance throughout the document preparation process.

-

What pricing options does airSlate SignNow offer for businesses needing eSignature solutions related to the 2019 federal tax tables?

airSlate SignNow provides various pricing plans to suit different business needs, including those focusing on handling documents related to the 2019 federal tax tables. Whether you are a small business or a large enterprise, our flexible pricing allows you to choose a plan that best fits your document management and eSignature needs.

-

Can airSlate SignNow integrate with accounting software to manage the 2019 federal tax tables?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, allowing you to manage documents in line with the 2019 federal tax tables. This integration ensures that all your eSigned tax documents are automatically aligned with your accounting data, simplifying tax filing and compliance.

-

What benefits does airSlate SignNow offer for eSigning tax documents referencing the 2019 federal tax tables?

Using airSlate SignNow for eSigning tax documents based on the 2019 federal tax tables offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform provides a secure method for managing sensitive tax information while ensuring that your documents meet all necessary regulatory standards.

-

Are there templates available in airSlate SignNow specifically designed for the 2019 federal tax tables?

Yes, airSlate SignNow hosts a variety of templates designed for tax documents that incorporate the 2019 federal tax tables. These templates are easily customizable to fit your specific needs, ensuring that you maintain compliance with tax regulations while saving time during document preparation.

-

How does airSlate SignNow ensure the security of documents related to the 2019 federal tax tables?

Security is a top priority for airSlate SignNow. We utilize advanced encryption methods to protect all documents, including those related to the 2019 federal tax tables, so you can have peace of mind knowing that your sensitive information is safeguarded throughout the signing process.

Get more for 1040 Instructions

Find out other 1040 Instructions

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document