Maine Form 1120me Instructions 2018

What is the Maine Form 1120me Instructions

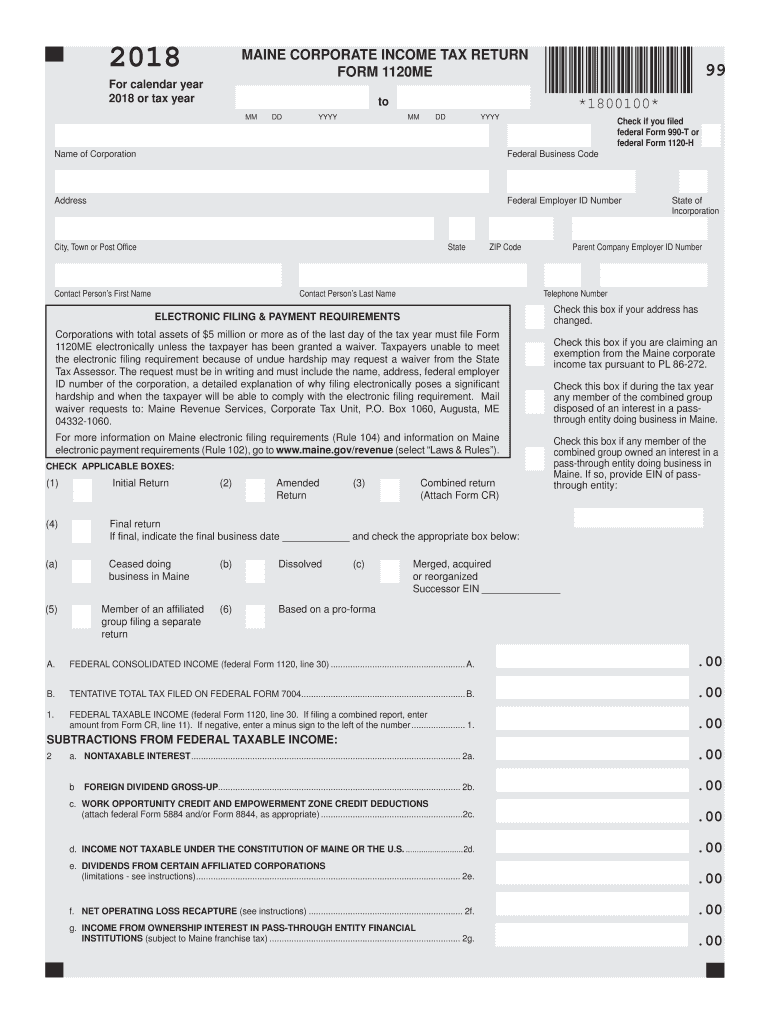

The Maine Form 1120me instructions provide detailed guidance for corporations filing their corporate income tax returns in the state of Maine. This form is specifically designed for corporations that are subject to Maine corporate income tax. Understanding the instructions is crucial for ensuring compliance with state tax laws and accurately reporting income, deductions, and credits. The instructions outline the necessary steps to complete the form, including the information required and how to calculate tax liability.

Steps to complete the Maine Form 1120me Instructions

Completing the Maine Form 1120me involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Fill out the identification section of the form, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and any other income sources, on the appropriate lines of the form.

- Calculate allowable deductions, such as business expenses, and enter them in the designated sections.

- Determine the corporation's tax liability based on the income and deductions reported.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Maine Form 1120me Instructions

The Maine Form 1120me instructions are legally binding documents that outline the requirements for filing corporate income tax returns in Maine. Adhering to these instructions ensures that corporations comply with state tax regulations. Electronic signatures and submissions are accepted, provided they meet the standards set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature platform can enhance the legal validity of the submission.

Filing Deadlines / Important Dates

Corporations must be aware of key filing deadlines to avoid penalties. The Maine Form 1120me is typically due on or before the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. Extensions may be available, but they must be requested before the original due date. It is essential to keep track of these dates to ensure timely filing and compliance.

Required Documents

To complete the Maine Form 1120me, corporations must gather various documents, including:

- Financial statements, such as income statements and balance sheets.

- Prior year tax returns for reference.

- Documentation of any credits or deductions being claimed.

- Records of any estimated tax payments made during the year.

Having these documents ready will facilitate a smoother and more accurate filing process.

Form Submission Methods (Online / Mail / In-Person)

The Maine Form 1120me can be submitted through various methods. Corporations have the option to file electronically using approved e-filing software, which often streamlines the process and reduces errors. Alternatively, the form can be mailed to the appropriate state tax authority. In-person submissions may also be possible at designated tax offices. Each method has its own advantages, and corporations should choose the one that best fits their needs.

Quick guide on how to complete 181120me 12618 downloadableindd

Effortlessly Prepare Maine Form 1120me Instructions on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Maine Form 1120me Instructions on any device using the airSlate SignNow Android or iOS applications and simplify your document-driven workflows today.

The easiest method to edit and eSign Maine Form 1120me Instructions seamlessly

- Obtain Maine Form 1120me Instructions and click on Get Form to begin.

- Take advantage of the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your updates.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate creating new copies. airSlate SignNow covers all your document management requirements in just a few clicks from your chosen device. Edit and eSign Maine Form 1120me Instructions and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 181120me 12618 downloadableindd

Create this form in 5 minutes!

How to create an eSignature for the 181120me 12618 downloadableindd

How to make an electronic signature for the 181120me 12618 Downloadableindd online

How to make an eSignature for your 181120me 12618 Downloadableindd in Chrome

How to generate an electronic signature for signing the 181120me 12618 Downloadableindd in Gmail

How to create an eSignature for the 181120me 12618 Downloadableindd right from your smart phone

How to create an eSignature for the 181120me 12618 Downloadableindd on iOS

How to generate an electronic signature for the 181120me 12618 Downloadableindd on Android OS

People also ask

-

What are the 1120me instructions for filing a corporate tax return?

The 1120me instructions detail the necessary steps and forms required for filing a corporate tax return. It is crucial to follow these guidelines to ensure compliance and avoid penalties. Make sure to review each section carefully, especially regarding deductions and credits applicable to your business.

-

How can airSlate SignNow help with the 1120me instructions?

AirSlate SignNow streamlines the process of preparing and submitting your 1120me instructions. With our eSigning capabilities, you can quickly send documents for signatures and store them securely. This efficiency helps you meet deadlines and keeps your taxed documents organized.

-

Is airSlate SignNow affordable for small businesses needing 1120me instructions?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing assistance with 1120me instructions. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning tools without overspending. This makes it an ideal option for businesses looking to streamline their tax preparation processes.

-

What features of airSlate SignNow assist with the 1120me instructions?

Key features of airSlate SignNow that assist with 1120me instructions include document templates, automated workflows, and secure cloud storage. These features simplify the document preparation and signing process, enabling you to focus on filing your taxes accurately. Additionally, you can track document status through our user-friendly dashboard.

-

Are there integrations available for airSlate SignNow related to 1120me instructions?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and document management platforms that can assist with your 1120me instructions. These integrations allow for a smoother data transfer between applications, enhancing overall efficiency and accuracy in your tax filing.

-

What are the benefits of using airSlate SignNow for 1120me instructions?

Using airSlate SignNow for 1120me instructions offers numerous benefits, such as improving workflow efficiency, reducing paper clutter, and ensuring document security. The platform’s intuitive design makes it easy for anyone to navigate while following the necessary compliance requirements. Additionally, eSigning reduces turnaround time, meaning you can file faster.

-

Can I get support with airSlate SignNow if I have questions about 1120me instructions?

Yes, airSlate SignNow provides excellent customer support to address any questions you may have about 1120me instructions. Whether you need assistance with document preparation or navigating our platform, our support team is available to help you find the answers you need. We also offer various resources and tutorials to guide you.

Get more for Maine Form 1120me Instructions

Find out other Maine Form 1120me Instructions

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later