for Calendar Year ToCheck If You ? Led 2020

Understanding Form 1120 ME

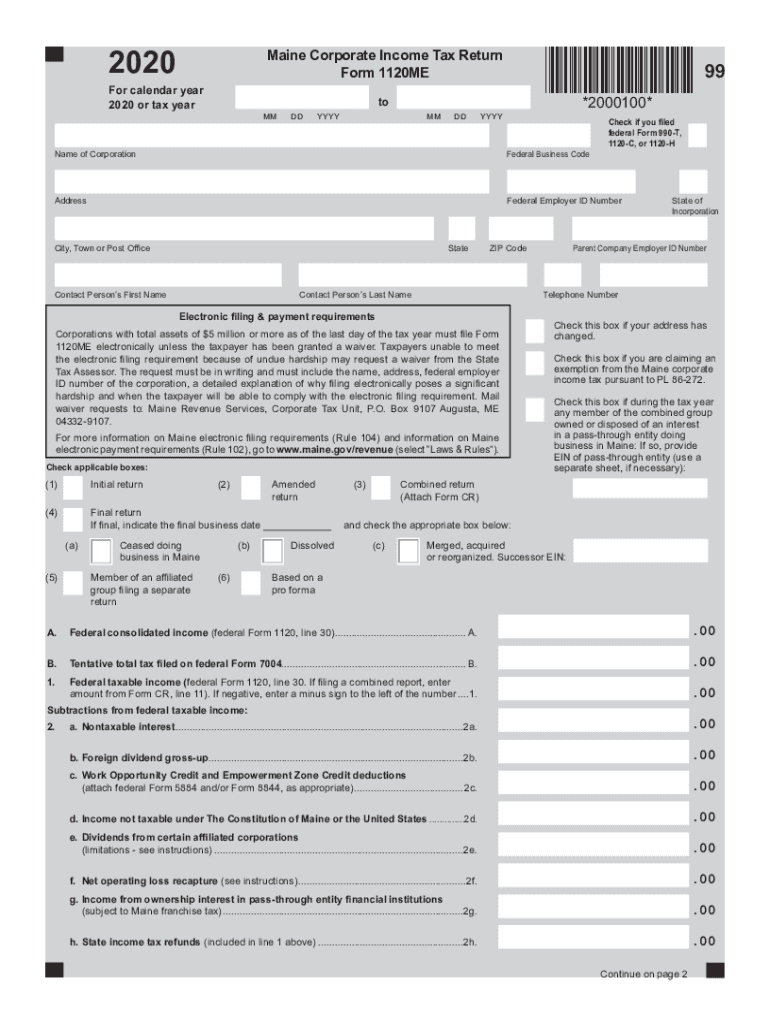

The Form 1120 ME is a crucial document for corporate income tax filing in Maine. It is specifically designed for corporations operating in the state, allowing them to report their income, deductions, and credits accurately. Understanding the purpose and requirements of this form is essential for compliance with state tax regulations. Corporations must ensure they meet all necessary criteria to avoid penalties and ensure their filings are processed smoothly.

Steps to Complete Form 1120 ME

Completing the Form 1120 ME involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form with the required information, which includes corporate income, deductions, and any applicable credits. It is crucial to double-check all entries for accuracy before submission. Finally, ensure that the form is signed by an authorized corporate officer to validate the submission.

Filing Deadlines for Form 1120 ME

Filing deadlines for the Form 1120 ME are critical for corporations to adhere to in order to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable for corporations to plan ahead and prepare their filings well in advance of the deadline to ensure timely submission.

Legal Use of Form 1120 ME

The legal use of Form 1120 ME is governed by Maine state tax laws. This form must be completed accurately to ensure that the information reported is legally binding. Corporations should be aware that any discrepancies or inaccuracies can lead to audits or penalties. Using a trusted electronic signature solution can enhance the legal validity of the submitted form, ensuring compliance with eSignature laws and regulations.

Required Documents for Form 1120 ME

To successfully complete and submit the Form 1120 ME, certain documents are required. Corporations must provide financial statements that detail their income and expenses, along with any supporting documentation for deductions claimed. Additionally, records of any tax credits and prior year returns may be necessary to substantiate the current filing. Having all required documents organized and ready will facilitate a smoother filing process.

Form Submission Methods for Form 1120 ME

Corporations have several options for submitting the Form 1120 ME. The form can be filed electronically through approved e-filing platforms, which is often the most efficient method. Alternatively, corporations may choose to submit the form by mail, ensuring it is sent to the appropriate state tax office. In-person submissions may also be possible, depending on local regulations and office availability. Each method has its own advantages, and corporations should select the one that best fits their needs.

IRS Guidelines for Form 1120 ME

While Form 1120 ME is a state-specific document, it is essential to align with IRS guidelines for corporate tax filings. Corporations must ensure that their federal tax obligations are also met, as the information reported on Form 1120 ME may affect federal tax returns. Understanding how state and federal tax laws interact can help corporations maintain compliance and avoid potential issues with tax authorities.

Quick guide on how to complete for calendar year tocheck if you led

Complete For Calendar Year ToCheck If You ? Led seamlessly on any device

Digital document management has become increasingly favored by enterprises and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle For Calendar Year ToCheck If You ? Led on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign For Calendar Year ToCheck If You ? Led with ease

- Locate For Calendar Year ToCheck If You ? Led and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign For Calendar Year ToCheck If You ? Led and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year tocheck if you led

Create this form in 5 minutes!

How to create an eSignature for the for calendar year tocheck if you led

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Form 1120 ME and why is it important?

Form 1120 ME is a crucial tax return form for corporations operating in Maine. It helps businesses report their income and expenses accurately, ensuring compliance with state tax laws. Properly filing Form 1120 ME can help avoid penalties and ensure that your business remains in good standing.

-

How can airSlate SignNow assist with Form 1120 ME?

airSlate SignNow streamlines the process of signing and sending Form 1120 ME electronically. With our platform, you can easily prepare, eSign, and send your tax documents securely and efficiently. This not only saves time but also enhances the accuracy of your submissions.

-

What features does airSlate SignNow offer for managing Form 1120 ME?

airSlate SignNow includes features like document templates, customizable workflows, and secure cloud storage. These tools simplify the creation and management of Form 1120 ME, providing an organized and efficient way to handle your corporate filings. Additionally, eSigning technology ensures that your documents are legally binding.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including those for managing Form 1120 ME. This trial period is a great opportunity to assess how our platform can meet your business needs before committing to a subscription. Take advantage of this offer to experience the benefits firsthand.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides several pricing plans tailored to different business sizes and needs. Whether you're a small business or a large corporation, you can select a plan that fits your budget while ensuring you have the tools necessary for handling Form 1120 ME effectively. Visit our pricing page for detailed options.

-

Can airSlate SignNow integrate with other software for Form 1120 ME?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for managing Form 1120 ME. This capability ensures that you can synchronize data across different platforms, reducing errors and improving efficiency in your document management processes.

-

What advantages does eSigning offer for Form 1120 ME?

eSigning with airSlate SignNow for Form 1120 ME speeds up the entire process by allowing you to sign documents electronically rather than printing and scanning. This reduces delays and enhances the accuracy of submissions. Additionally, eSigned documents are legally recognized, providing assurance for your business filings.

Get more for For Calendar Year ToCheck If You ? Led

Find out other For Calendar Year ToCheck If You ? Led

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast