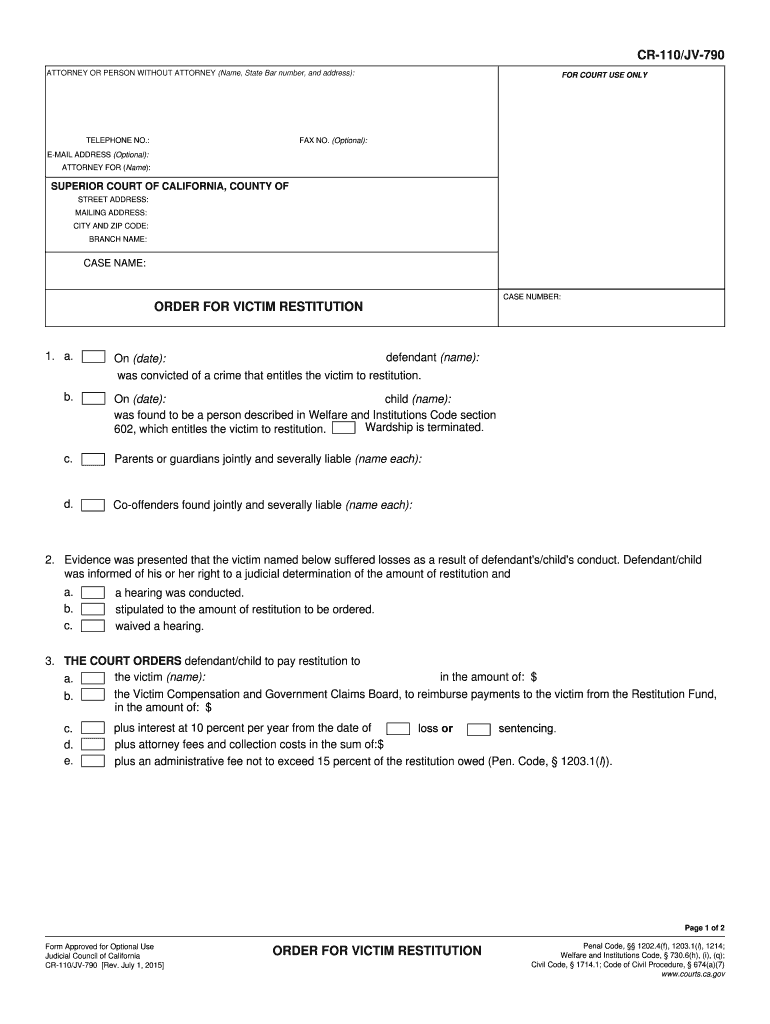

Cr 110 Form 2015

What is the Cr 110 Form

The Cr 110 Form is a specific document used primarily for tax-related purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for ensuring compliance with federal tax regulations.

How to use the Cr 110 Form

Using the Cr 110 Form involves several key steps. First, gather all necessary financial records and documentation that pertain to the information you need to report. Next, fill out the form accurately, ensuring that all entries are clear and complete. Once the form is completed, review it for any errors before submission. It is important to keep a copy for your records.

Steps to complete the Cr 110 Form

Completing the Cr 110 Form requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, such as income statements and expense reports.

- Obtain the latest version of the Cr 110 Form from the IRS website or authorized sources.

- Fill in the required fields, ensuring accuracy in all reported figures.

- Double-check your entries for any mistakes or omissions.

- Sign and date the form to validate it.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the Cr 110 Form

The legal use of the Cr 110 Form is governed by IRS regulations. It is crucial to ensure that the information provided is truthful and accurate, as any discrepancies can lead to penalties. The form must be submitted by the designated deadline to maintain compliance with tax laws. Failure to use the form correctly can result in legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Cr 110 Form are set by the IRS and can vary depending on the specific tax year and the taxpayer's situation. Typically, forms must be submitted by April fifteenth for individual taxpayers. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines to avoid late penalties.

Required Documents

When preparing to complete the Cr 110 Form, certain documents are essential. These may include:

- Income statements, such as W-2s or 1099s.

- Expense receipts and records.

- Previous tax returns for reference.

- Any supporting documentation required by the IRS for specific claims or deductions.

Form Submission Methods (Online / Mail / In-Person)

The Cr 110 Form can be submitted through various methods, depending on the taxpayer's preference and the IRS guidelines. Options include:

- Online submission through the IRS e-file system.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete cr 110 2015 form

Effortlessly Prepare Cr 110 Form on Any Gadget

Digital document organization has surged in usage among businesses and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the correct format and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without holdups. Manage Cr 110 Form on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Cr 110 Form with Ease

- Obtain Cr 110 Form and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize key sections of your files or obscure sensitive information using the tools that airSlate SignNow specifically supplies for that purpose.

- Formulate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a physical wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your document, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Adjust and electronically sign Cr 110 Form to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr 110 2015 form

Create this form in 5 minutes!

How to create an eSignature for the cr 110 2015 form

How to create an electronic signature for your Cr 110 2015 Form online

How to create an electronic signature for the Cr 110 2015 Form in Google Chrome

How to generate an electronic signature for signing the Cr 110 2015 Form in Gmail

How to make an eSignature for the Cr 110 2015 Form right from your mobile device

How to generate an electronic signature for the Cr 110 2015 Form on iOS

How to create an eSignature for the Cr 110 2015 Form on Android OS

People also ask

-

What is the Cr 110 Form and how is it used?

The Cr 110 Form is a crucial document used for various administrative purposes, particularly in legal and business settings. By utilizing airSlate SignNow, you can easily prepare, send, and eSign the Cr 110 Form, ensuring compliance and efficiency in your operations.

-

How does airSlate SignNow support the Cr 110 Form process?

With airSlate SignNow, the process of handling the Cr 110 Form becomes streamlined and user-friendly. Our platform allows you to create, edit, and sign the form digitally, eliminating the hassle of paper-based processes and enhancing your workflow.

-

What are the pricing options for using the Cr 110 Form with airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs while providing access to the Cr 110 Form and other essential features. You can choose from individual, business, or enterprise plans, ensuring that you only pay for what you need.

-

Can I integrate other tools with airSlate SignNow for the Cr 110 Form?

Yes, airSlate SignNow offers integration capabilities with numerous applications, allowing you to enhance your workflow when working with the Cr 110 Form. Integrate with tools like Google Drive, Dropbox, and CRM systems to manage your documents more efficiently.

-

What security measures does airSlate SignNow implement for the Cr 110 Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the Cr 110 Form. Our platform employs advanced encryption, secure access controls, and compliance with regulations to ensure your data remains safe and confidential.

-

How can airSlate SignNow improve my team's efficiency with the Cr 110 Form?

By using airSlate SignNow, your team can collaboratively edit and eSign the Cr 110 Form in real time, signNowly improving efficiency. The user-friendly interface and automated workflows help reduce the time spent on document management and approvals.

-

Is it easy to track the status of the Cr 110 Form in airSlate SignNow?

Absolutely! airSlate SignNow provides robust tracking features that allow you to monitor the status of the Cr 110 Form throughout the signing process. You'll receive notifications when the document is viewed, signed, or requires action, keeping you informed at all times.

Get more for Cr 110 Form

- Idaho w 9 form

- Usalliance membership form

- Humboldt university application form

- Kutztown university transcript form

- Office of the registrar berkeley form

- City of baltimore master electrical license form

- Civil service application schenectady county community college sunysccc form

- Business personal rendition form

Find out other Cr 110 Form

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation