California Form 589 2017

What is the California Form 589

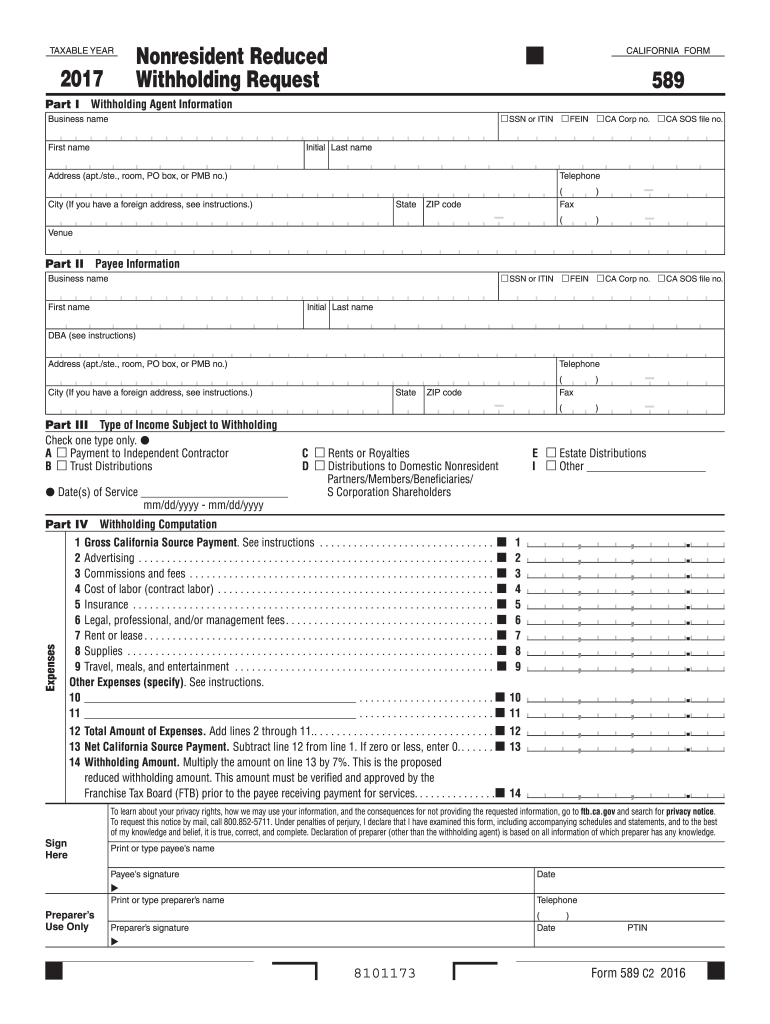

The California Form 589 is a tax form used by individuals and businesses to report certain types of income and claim tax credits. Specifically, it is designed for use by non-residents and part-year residents who earn income in California. This form allows taxpayers to calculate their California tax liability and determine the amount of tax owed or refunded. Understanding the purpose and requirements of this form is essential for compliance with California tax laws.

How to use the California Form 589

Using the California Form 589 involves several steps to ensure accurate reporting of income and tax credits. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and other income statements. Once the relevant information is collected, individuals can fill out the form, detailing their income sources and any applicable deductions or credits. After completing the form, it should be reviewed for accuracy before submission to the California Franchise Tax Board.

Steps to complete the California Form 589

Completing the California Form 589 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents related to your income.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income earned in California.

- Claim any eligible tax credits.

- Review the completed form for accuracy.

- Submit the form electronically or via mail to the appropriate tax authority.

Legal use of the California Form 589

The California Form 589 is legally binding when completed accurately and submitted in accordance with state tax laws. To ensure its legal validity, taxpayers must provide truthful information and comply with all filing requirements. Electronic signatures are acceptable under California law, provided they meet the necessary legal standards. Utilizing a reliable eSignature platform can enhance the security and compliance of the submission process.

Key elements of the California Form 589

Several key elements are essential for the proper completion of the California Form 589. These include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed breakdown of income earned in California.

- Tax Credits: Information on any credits being claimed.

- Signature: Required to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 589 are crucial for compliance. Typically, the form must be submitted by April 15 for the previous tax year. However, if April 15 falls on a weekend or holiday, the deadline may be extended. Taxpayers should always verify the specific deadlines for the current tax year to avoid penalties.

Quick guide on how to complete california form 589 2017

Complete California Form 589 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct version and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage California Form 589 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign California Form 589 with ease

- Find California Form 589 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to share your form—via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or disorganized documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign California Form 589 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 589 2017

Create this form in 5 minutes!

How to create an eSignature for the california form 589 2017

How to make an eSignature for your California Form 589 2017 online

How to generate an eSignature for the California Form 589 2017 in Google Chrome

How to create an electronic signature for putting it on the California Form 589 2017 in Gmail

How to create an electronic signature for the California Form 589 2017 straight from your smart phone

How to create an electronic signature for the California Form 589 2017 on iOS devices

How to create an electronic signature for the California Form 589 2017 on Android OS

People also ask

-

What is the California Form 589 used for?

The California Form 589 is used for reporting California source income for non-resident and part-year resident taxpayers. This form helps individuals ensure compliance with California tax laws and accurately report their income. By utilizing airSlate SignNow, you can easily eSign and submit your California Form 589 securely and conveniently.

-

How can airSlate SignNow assist with completing the California Form 589?

airSlate SignNow provides customizable templates, which can simplify the process of completing your California Form 589. With our platform, you can easily fill out, eSign, and store your forms all in one place. The user-friendly interface ensures a smooth document preparation experience while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for California Form 589?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. With a cost-effective solution, you can select a plan that fits your budget while enjoying the benefits of eSigning and document management for California Form 589 and other essential documents.

-

What features does airSlate SignNow offer for the California Form 589?

airSlate SignNow offers features such as customizable templates, real-time tracking, audit trails, and secure cloud storage for your California Form 589. These features enhance efficiency and ensure that your documents are organized and easily accessible, making the eSigning process hassle-free.

-

Can I integrate airSlate SignNow with other tools for managing California Form 589?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, enabling you to streamline your document management process. These integrations allow for enhanced collaboration and easy access to your California Form 589, ensuring a more efficient workflow.

-

How secure is my information when using airSlate SignNow for California Form 589?

Security is a top priority at airSlate SignNow. We use advanced encryption technology to protect your data while you complete and eSign your California Form 589. Additionally, our compliance with industry standards ensures that your sensitive information remains safe throughout the process.

-

Can I access my completed California Form 589 from anywhere?

Yes, with airSlate SignNow, you can access your completed California Form 589 from any device with an internet connection. This flexibility allows you to manage your documents on-the-go, ensuring that you can eSign and submit forms whenever and wherever you need.

Get more for California Form 589

- Minnesota uniform credentialing application initial

- Pdf filler 1561 form

- Occ form 1583

- Georgia permit application form

- Instructions for fence applications fences erected form

- Affidavit for missing check and authorization to stop payment code bk2 formform

- Ecochic boutique consignment agreement form

- New york city licensing center 42 broadway new yo form

Find out other California Form 589

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement