California Form 589 Nonresident Reduced Withholding Request 2024

What is the California Form 589 Nonresident Reduced Withholding Request

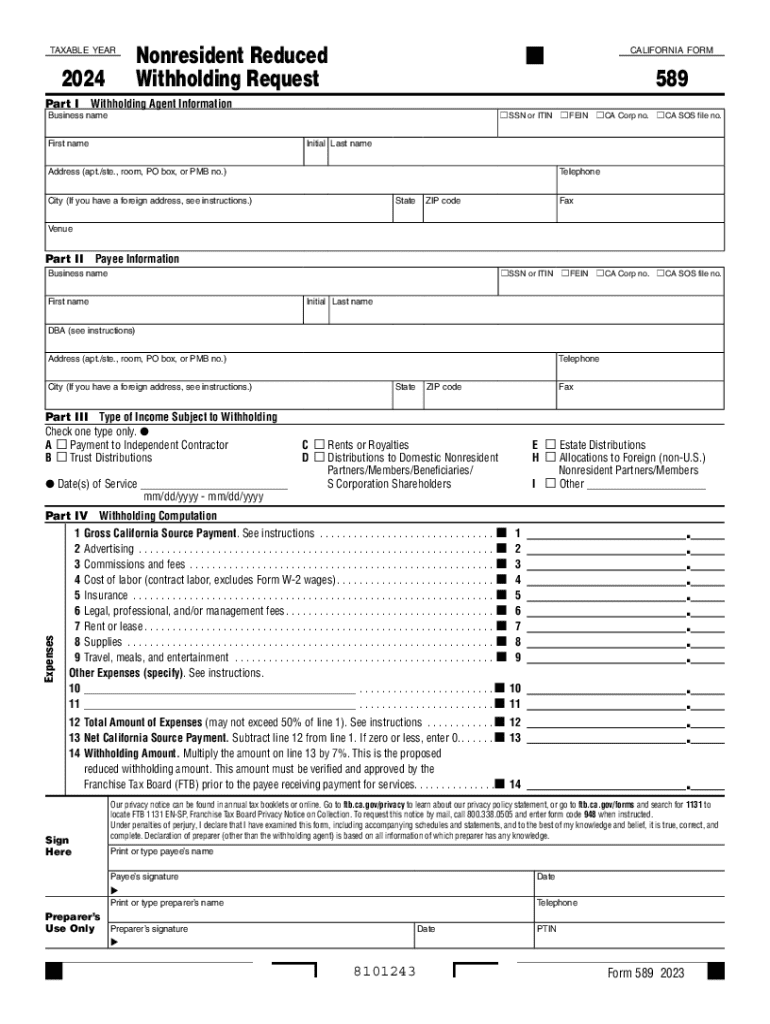

The California Form 589 Nonresident Reduced Withholding Request is a tax form used by nonresidents of California to request a reduced rate of withholding on certain types of income. This form is particularly relevant for individuals who earn income from California sources but do not reside in the state. By submitting this form, nonresidents can potentially lower the amount of state income tax withheld from their payments, which can improve cash flow and reduce the overall tax burden. It is essential for nonresidents to understand the specific circumstances under which they can qualify for reduced withholding.

How to use the California Form 589 Nonresident Reduced Withholding Request

To effectively use the California Form 589, nonresidents should first determine their eligibility for reduced withholding. This involves reviewing the types of income they receive and ensuring that they meet the criteria set by the California Franchise Tax Board. Once eligibility is confirmed, the form must be completed accurately, providing necessary details such as the taxpayer's identification information and the specific income sources. After filling out the form, it should be submitted to the appropriate withholding agent or payer, who will then apply the reduced withholding rate to future payments.

Steps to complete the California Form 589 Nonresident Reduced Withholding Request

Completing the California Form 589 involves several key steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Identify the income types for which you are requesting reduced withholding.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the form to validate your request.

- Submit the completed form to the withholding agent or payer responsible for your income payments.

Following these steps carefully can help ensure that your request for reduced withholding is processed smoothly.

Eligibility Criteria

Eligibility for the California Form 589 Nonresident Reduced Withholding Request is based on specific criteria outlined by the California Franchise Tax Board. Nonresidents must demonstrate that they are not subject to California income tax on all or part of their income. This may include individuals who qualify for tax treaties or those whose income falls below certain thresholds. It is crucial for applicants to review these criteria thoroughly to ensure they meet the necessary qualifications before submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 589 are essential for nonresidents to keep in mind. Typically, the form should be submitted before the first payment is made to ensure that the reduced withholding rate is applied. It is advisable to check the California Franchise Tax Board’s website for any updates or changes to deadlines, as they may vary depending on specific circumstances or tax years. Being aware of these important dates can help avoid unnecessary withholding and ensure compliance with state tax regulations.

Form Submission Methods

The California Form 589 can be submitted through various methods, including:

- Mail: Send the completed form directly to the withholding agent or payer.

- In-Person: Deliver the form in person to the appropriate office if required by the withholding agent.

- Online: Some withholding agents may offer electronic submission options, allowing for a more streamlined process.

Choosing the right submission method can enhance the efficiency of the request process and ensure timely processing.

Key elements of the California Form 589 Nonresident Reduced Withholding Request

The California Form 589 includes several key elements that must be completed accurately for the request to be valid. These elements typically include:

- Taxpayer identification information, such as name, address, and Social Security number or ITIN.

- Details of the income sources for which reduced withholding is requested.

- Signature of the taxpayer, affirming the accuracy of the information provided.

- Any applicable tax treaty information, if relevant.

Ensuring that all key elements are correctly filled out is crucial for the successful processing of the form.

Create this form in 5 minutes or less

Find and fill out the correct california form 589 nonresident reduced withholding request

Create this form in 5 minutes!

How to create an eSignature for the california form 589 nonresident reduced withholding request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 589 Nonresident Reduced Withholding Request?

The California Form 589 Nonresident Reduced Withholding Request is a tax form used by nonresidents to request a reduction in withholding on California-source income. This form allows eligible individuals to reduce the amount of tax withheld from their payments, ensuring they are not overtaxed. Understanding this form is crucial for nonresidents earning income in California.

-

How can airSlate SignNow help with the California Form 589 Nonresident Reduced Withholding Request?

airSlate SignNow provides a seamless platform for completing and eSigning the California Form 589 Nonresident Reduced Withholding Request. Our user-friendly interface simplifies the process, allowing you to fill out and submit the form quickly. With airSlate SignNow, you can ensure that your tax documents are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the California Form 589 Nonresident Reduced Withholding Request?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective while providing robust features for managing documents, including the California Form 589 Nonresident Reduced Withholding Request. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing the California Form 589 Nonresident Reduced Withholding Request?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the California Form 589 Nonresident Reduced Withholding Request. These features streamline the process, making it easier to complete and submit your tax forms. Additionally, our platform ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for the California Form 589 Nonresident Reduced Withholding Request?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the California Form 589 Nonresident Reduced Withholding Request. Whether you use CRM systems, cloud storage, or other productivity tools, our integrations enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the California Form 589 Nonresident Reduced Withholding Request?

Using airSlate SignNow for the California Form 589 Nonresident Reduced Withholding Request provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform minimizes the risk of errors and ensures that your documents are securely stored and easily accessible. This efficiency allows you to focus on other important aspects of your business.

-

How secure is airSlate SignNow when handling the California Form 589 Nonresident Reduced Withholding Request?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the California Form 589 Nonresident Reduced Withholding Request. You can trust that your sensitive information is safe and secure while using our platform.

Get more for California Form 589 Nonresident Reduced Withholding Request

Find out other California Form 589 Nonresident Reduced Withholding Request

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free