Form Withholding 2020

What is the Form Withholding

The Form Withholding is a crucial document used primarily for tax purposes in the United States. It allows employers to report the amount of income tax withheld from employees' paychecks. This form ensures that the correct amount of taxes is deducted and reported to the Internal Revenue Service (IRS). Understanding this form is essential for both employers and employees to maintain compliance with federal tax laws.

How to use the Form Withholding

Using the Form Withholding involves several steps. First, employers must accurately calculate the amount of tax to withhold based on employee earnings and applicable tax rates. Once the calculations are made, the employer fills out the form, detailing the withheld amounts. This form must be submitted to the IRS along with the employer's payroll tax returns. Employees should also keep a copy for their records to verify their tax withholdings during tax season.

Steps to complete the Form Withholding

Completing the Form Withholding requires attention to detail. Follow these steps:

- Gather necessary employee information, including Social Security numbers and tax filing status.

- Determine the correct withholding amount using IRS guidelines and tax tables.

- Fill out the form accurately, ensuring all information is correct.

- Review the form for completeness and accuracy before submission.

- Submit the form to the IRS by the specified deadline.

Legal use of the Form Withholding

The legal use of the Form Withholding is governed by IRS regulations. Employers are required to withhold taxes accurately to comply with federal law. Failure to do so can result in penalties for both the employer and the employee. It is essential for employers to stay informed about any changes in tax laws that may affect withholding amounts and procedures.

Filing Deadlines / Important Dates

Timely filing of the Form Withholding is critical to avoid penalties. The IRS has set specific deadlines for submission, typically aligned with quarterly payroll tax returns. Employers should be aware of these dates:

- Quarterly filing deadlines for Form 941.

- Annual filing deadlines for Form W-2.

Staying updated on these deadlines helps ensure compliance and avoids unnecessary fines.

Penalties for Non-Compliance

Non-compliance with the Form Withholding can lead to significant penalties. The IRS may impose fines for late submissions, inaccurate reporting, or failure to withhold the correct amount of taxes. Employers could face penalties ranging from a percentage of the unpaid tax to additional fines for repeated violations. Understanding these risks emphasizes the importance of accurate and timely handling of the Form Withholding.

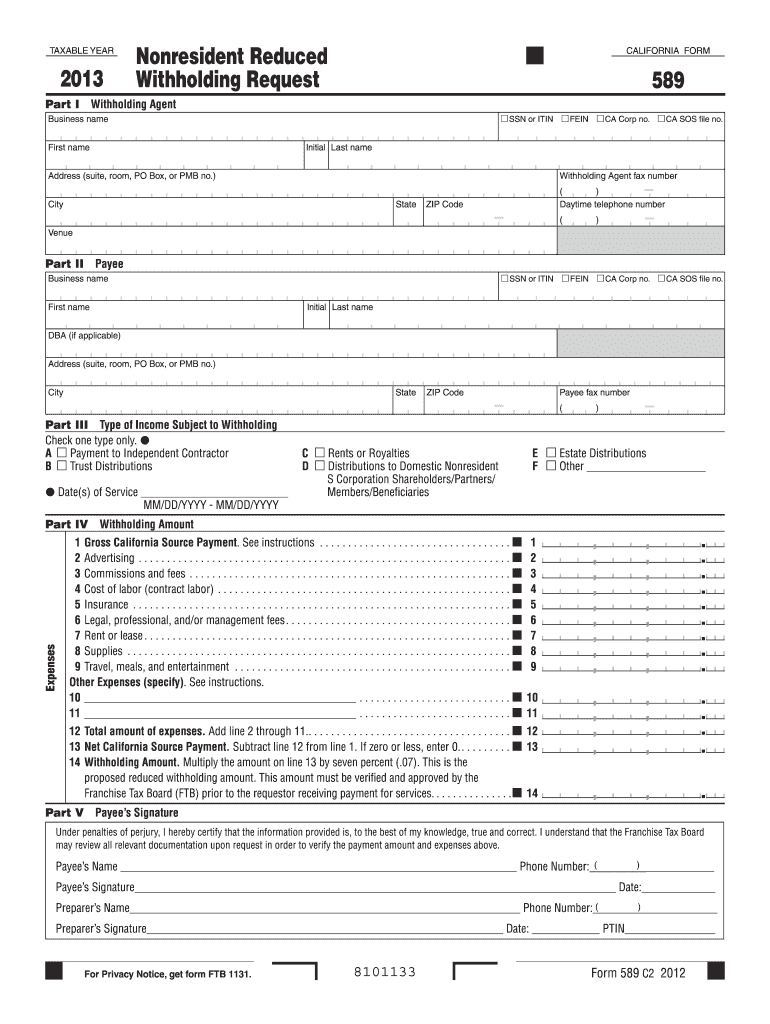

Quick guide on how to complete 2013 form withholding

Complete Form Withholding seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents rapidly and without interruptions. Manage Form Withholding on any device with airSlate SignNow Android or iOS applications and streamline any document-related activity today.

The easiest way to edit and eSign Form Withholding with ease

- Locate Form Withholding and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark relevant portions of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Form Withholding while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form withholding

Create this form in 5 minutes!

How to create an eSignature for the 2013 form withholding

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form Withholding in airSlate SignNow?

Form Withholding in airSlate SignNow refers to the process of securely collecting necessary tax information and documentation from clients or employees. This feature simplifies compliance by allowing businesses to manage withholding forms effectively, ensuring accurate tax calculations.

-

How does airSlate SignNow support Form Withholding?

airSlate SignNow supports Form Withholding by providing customizable templates that facilitate easy signing and submission of required forms. Users can create, send, and track these forms, allowing for seamless management and compliance with tax regulations.

-

Is there a cost associated with using Form Withholding in airSlate SignNow?

Yes, there is a cost associated with using Form Withholding in airSlate SignNow. The pricing plans offer various features, including Form Withholding management, tailored to fit different business needs. You can choose a plan that best suits your organization’s requirements.

-

What are the key benefits of using airSlate SignNow for Form Withholding?

Using airSlate SignNow for Form Withholding streamlines the process of gathering and submitting withholding forms digitally, saving time and reducing errors. The platform enhances security and maintains compliance, making it easier for businesses to manage complex tax documentation.

-

Can I integrate airSlate SignNow with other software for Form Withholding?

Absolutely! airSlate SignNow offers integrations with various software platforms, allowing for seamless data transfer and efficient management of Form Withholding. This feature enhances productivity by connecting your existing systems with our eSignature solution.

-

How secure is the Form Withholding process in airSlate SignNow?

The Form Withholding process in airSlate SignNow is highly secure, utilizing encryption and secure cloud storage to protect sensitive data. Our compliance with industry standards ensures that your withholding forms are handled with the utmost care and confidentiality.

-

Can I track the status of Form Withholding submissions?

Yes, airSlate SignNow allows you to track the status of Form Withholding submissions in real-time. You can easily monitor who has signed, reviewed, or submitted the necessary documents, ensuring a transparent and efficient workflow.

Get more for Form Withholding

Find out other Form Withholding

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast