California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request 2025-2026

Understanding the California Form 589 Nonresident Reduced Withholding Request

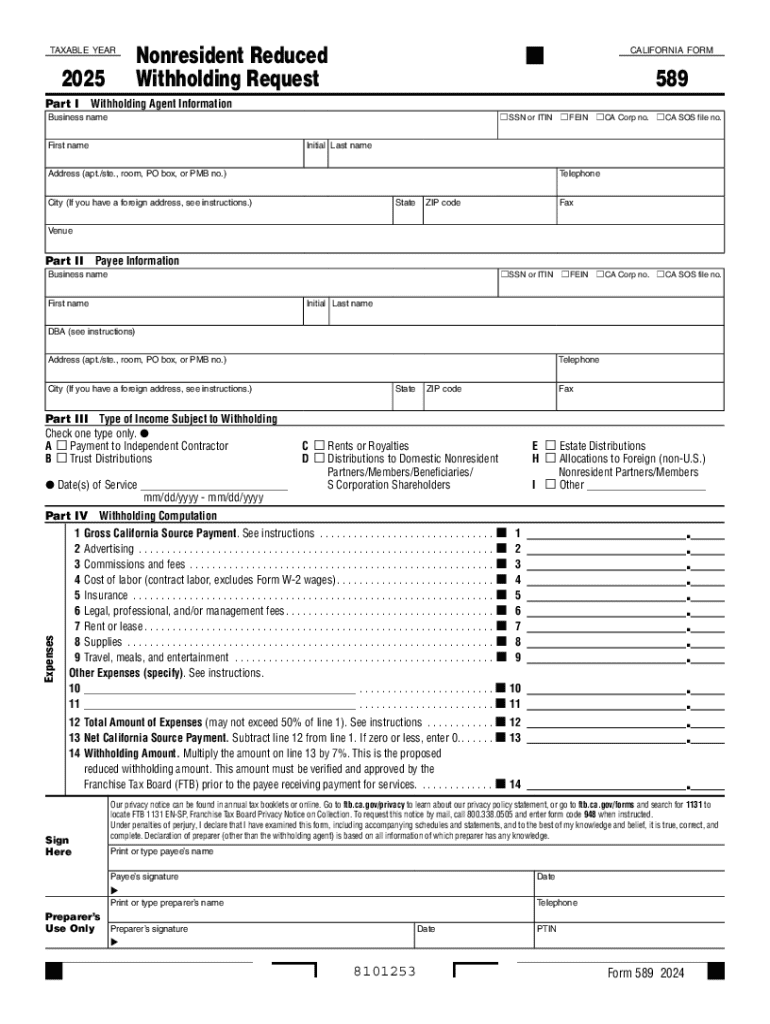

The California Form 589, known as the Nonresident Reduced Withholding Request, is a crucial document for nonresident individuals and entities receiving income from California sources. This form allows eligible nonresidents to request a reduction in the withholding tax on income earned in California, ensuring that the withholding aligns more closely with their actual tax liability. It is particularly relevant for individuals who may be subject to a higher withholding rate than what their income level warrants.

By submitting Form 589, nonresidents can potentially reduce the amount of tax withheld, which can improve cash flow and reduce the burden of filing a tax return at the end of the year. Understanding the eligibility criteria and the process for completing this form is essential for effective tax planning.

Steps to Complete the California Form 589 Nonresident Reduced Withholding Request

Completing the California Form 589 involves several key steps that ensure accuracy and compliance with state tax regulations. Here is a step-by-step guide:

- Gather Required Information: Collect all necessary information, including your name, address, and taxpayer identification number. You will also need details about the income for which you are requesting reduced withholding.

- Review Eligibility Criteria: Ensure that you meet the eligibility requirements for reduced withholding. This typically includes being a nonresident and having income that qualifies for a reduced rate.

- Fill Out the Form: Carefully complete all sections of Form 589. Be sure to provide accurate information to avoid delays in processing.

- Submit the Form: Once completed, submit the form to the appropriate withholding agent or payer. This could be an employer or other entity responsible for withholding taxes on your income.

Following these steps can help ensure that your request for reduced withholding is processed smoothly.

Eligibility Criteria for the California Form 589 Nonresident Reduced Withholding Request

To qualify for the California Form 589, nonresidents must meet specific eligibility criteria. Understanding these requirements is vital for successful application:

- The individual or entity must not be a resident of California.

- The income for which the reduced withholding is requested must be sourced from California.

- The applicant must provide evidence that their effective tax rate is lower than the standard withholding rate.

- Documentation supporting the request may be required, such as tax returns or other financial statements.

Meeting these criteria is essential to ensure that your request for reduced withholding is valid and accepted.

How to Obtain the California Form 589 Nonresident Reduced Withholding Request

Obtaining the California Form 589 is a straightforward process. The form is available through several channels, ensuring accessibility for all eligible nonresidents:

- Online: The form can be downloaded directly from the California Franchise Tax Board's website. This is the most efficient method for accessing the latest version of the form.

- By Mail: Nonresidents can request a physical copy of the form by contacting the California Franchise Tax Board. This option may take longer due to mailing times.

- In-Person: For those who prefer face-to-face assistance, visiting a local tax office can provide access to the form and additional guidance on completing it.

Choosing the most convenient method for obtaining the form can help streamline the process of requesting reduced withholding.

Key Elements of the California Form 589 Nonresident Reduced Withholding Request

The California Form 589 contains several key elements that are essential for its proper completion and submission. Understanding these components can enhance compliance and accuracy:

- Personal Information: This section requires the applicant's name, address, and taxpayer identification number, which are crucial for identification purposes.

- Income Details: Applicants must provide information about the income for which they are requesting reduced withholding, including the type of income and the amount.

- Reason for Request: A brief explanation of why the applicant believes they qualify for reduced withholding should be included, supported by relevant documentation.

- Signature: The form must be signed by the applicant or their authorized representative, confirming that the information provided is accurate and complete.

Each of these elements plays a vital role in the processing of the request and should be completed with care.

Create this form in 5 minutes or less

Find and fill out the correct california form 589 nonresident reduced withholding request california form 589 nonresident reduced withholding request

Create this form in 5 minutes!

How to create an eSignature for the california form 589 nonresident reduced withholding request california form 589 nonresident reduced withholding request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA 589 and how does it relate to airSlate SignNow?

CA 589 is a form used for various business transactions, and airSlate SignNow provides a seamless way to eSign and manage this document. With airSlate SignNow, you can easily fill out and send CA 589 forms electronically, ensuring a quick and efficient process.

-

How much does airSlate SignNow cost for using CA 589?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing documents like CA 589, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for CA 589?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like CA 589. These features streamline the signing process, making it easier for businesses to handle important documents.

-

Can I integrate airSlate SignNow with other applications for CA 589?

Yes, airSlate SignNow offers integrations with various applications, allowing you to manage CA 589 forms alongside your existing tools. This flexibility enhances your workflow and ensures that you can access all necessary resources in one place.

-

What are the benefits of using airSlate SignNow for CA 589?

Using airSlate SignNow for CA 589 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By digitizing your document processes, you can save time and resources while ensuring compliance.

-

Is airSlate SignNow user-friendly for completing CA 589?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete CA 589 forms. The intuitive interface allows users to navigate the signing process effortlessly, regardless of their technical skills.

-

How secure is airSlate SignNow when handling CA 589?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your CA 589 documents. You can trust that your sensitive information is safe while using our platform for eSigning.

Get more for California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request

- Pwd 309a texas parks amp wildlife department tpwd state tx form

- Texas pwd form

- Pwd 1055 form

- Form affidavit fact

- Affidavit for repossessed vessel texas parks amp wildlife department tpwd state tx form

- Texas certificate insurance form

- Certificate of insurance form texas state board of plumbing

- Texas school gas pipe testing form

Find out other California Form 589 Nonresident Reduced Withholding Request , California Form 589, Nonresident Reduced Withholding Request

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship