California State Withholding Form 2019

What is the California State Withholding Form

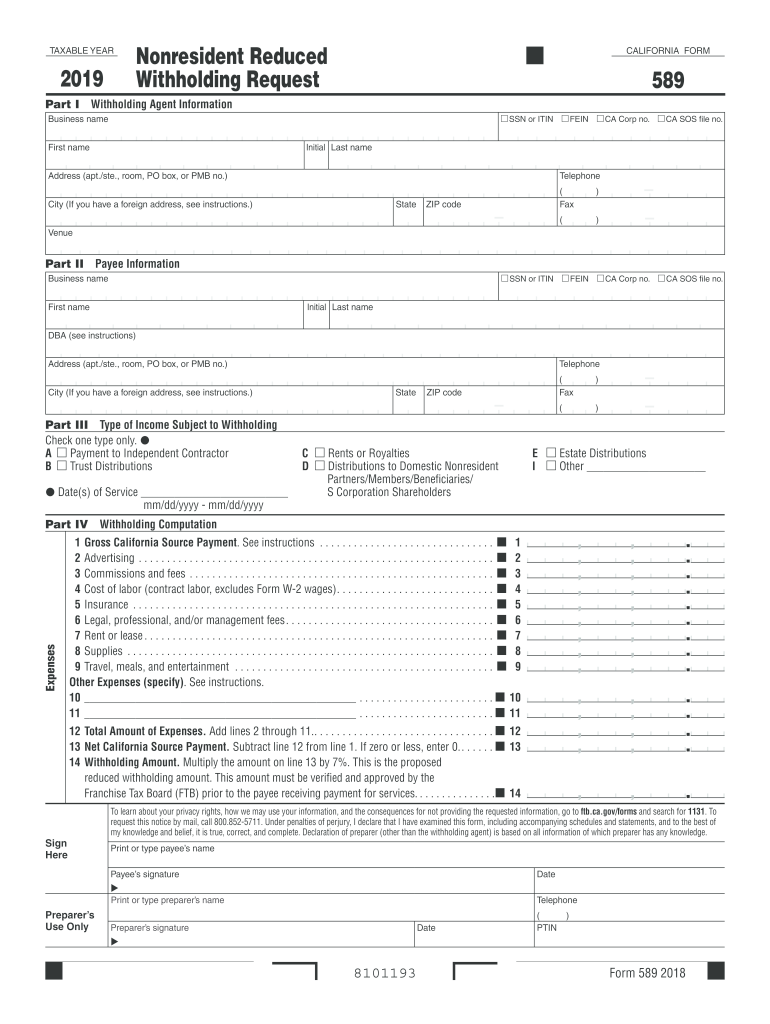

The California State Withholding Form, commonly referred to as Form 589, is a crucial document used by employers to determine the amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring compliance with California tax laws and helps employees manage their tax obligations throughout the year. It is particularly relevant for those who are newly hired or who have experienced changes in their tax situation, such as marital status or dependents.

How to use the California State Withholding Form

Using the California State Withholding Form involves a few straightforward steps. First, employees must complete the form by providing personal information, including their name, address, and Social Security number. They will also need to indicate their filing status and any additional allowances they wish to claim. Once completed, the form should be submitted to the employer, who will use this information to calculate the appropriate withholding amount from each paycheck. It is important for employees to review their withholding periodically, especially after major life events.

Steps to complete the California State Withholding Form

Completing the California State Withholding Form requires careful attention to detail. Here are the steps to follow:

- Gather personal information, including your Social Security number and address.

- Choose your filing status from the options provided on the form.

- Determine the number of allowances you are eligible to claim.

- Complete any additional sections that may apply, such as extra withholding amounts.

- Review the form for accuracy before submitting it to your employer.

Legal use of the California State Withholding Form

The legal use of the California State Withholding Form is governed by state tax regulations. Employers are required to provide this form to their employees and ensure that the information is accurately reflected in their payroll systems. Failure to comply with these regulations can result in penalties for both the employer and the employee. It is essential for employees to understand their rights and responsibilities regarding withholding to avoid any legal complications.

Form Submission Methods (Online / Mail / In-Person)

The California State Withholding Form can be submitted through various methods, providing flexibility for both employees and employers. Employees typically submit the form directly to their employer, either in person or via email. Some employers may also offer online platforms for form submission. Additionally, if an employee needs to submit a paper form, they can mail it directly to their employer's payroll department. It's important to follow the specific submission guidelines provided by the employer to ensure timely processing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the California State Withholding Form is crucial for employees to avoid any penalties. Generally, employees should submit their Form 589 to their employer before the first paycheck of the year or whenever there is a change in their tax situation. Employers are responsible for withholding the correct amount based on the information provided and must remit these withholdings to the state by the specified deadlines. Staying informed about these dates helps ensure compliance with state tax laws.

Quick guide on how to complete california form 589 2019

Complete California State Withholding Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage California State Withholding Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign California State Withholding Form with ease

- Find California State Withholding Form and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to secure your updates.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Adjust and eSign California State Withholding Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 589 2019

Create this form in 5 minutes!

How to create an eSignature for the california form 589 2019

How to make an eSignature for the California Form 589 2019 online

How to create an electronic signature for your California Form 589 2019 in Google Chrome

How to generate an electronic signature for putting it on the California Form 589 2019 in Gmail

How to make an eSignature for the California Form 589 2019 straight from your mobile device

How to create an eSignature for the California Form 589 2019 on iOS

How to create an electronic signature for the California Form 589 2019 on Android OS

People also ask

-

What is the significance of 589 in the context of airSlate SignNow?

The number 589 represents a crucial benchmark in the eSigning industry that airSlate SignNow embraces. It signifies the efficient processing time for signing documents, ensuring that businesses can complete transactions swiftly and effectively. Understanding this concept can help users appreciate the value airSlate SignNow brings to their document workflow.

-

How does pricing work with airSlate SignNow for small businesses?

airSlate SignNow offers competitive pricing tailored for small businesses, with plans starting around $589 annually. This pricing model provides access to essential features that help businesses streamline their eSigning processes at a cost-effective rate. By investing in airSlate SignNow, companies can save money while improving document management efficiency.

-

What features are included in airSlate SignNow’s plans?

airSlate SignNow includes a robust set of features designed to meet diverse business needs, starting from document templates to advanced eSignature tracking. One of its standout features is the ability to customize workflows that enhance process efficiency, important for users across all sectors viewed alongside the 589 standards. These capabilities make airSlate SignNow a powerful tool for any organization.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing work productivity across different platforms. Businesses can connect to popular CRM and cloud storage systems, facilitating the easy transfer of documents in line with the 589 workflow models. This flexibility means users can consolidate their tools for a more efficient signing experience.

-

What benefits does airSlate SignNow provide for remote teams?

For remote teams, airSlate SignNow offers signNow benefits such as enhanced collaboration and real-time document access. This tool enables teams to sign and send documents from anywhere, ensuring compliance with 589 standards for efficient eSigning practices. By using airSlate SignNow, businesses can keep their operations smooth, even when working remotely.

-

How secure are the signatures made with airSlate SignNow?

Security is a top priority for airSlate SignNow, which uses advanced encryption methods to protect signed documents. Each eSignature adheres to legal standards that align with the 589 guidelines, ensuring that signatures remain valid and secure. Users can trust that their sensitive information is safeguarded while maintaining compliance.

-

Is there a mobile app available for airSlate SignNow?

Yes, airSlate SignNow offers a mobile application for both iOS and Android devices, enabling users to manage their documents on the go. This app is designed to provide the same functionalities as the desktop version, aligning with the 589 efficiency benchmarks. Users can send, receive, and sign documents from anywhere, making it a convenient option.

Get more for California State Withholding Form

- Live scan form with cdcr

- Cdcr form 1432

- Incarcerated relativeassociate notification california department of cdcr ca form

- Cdcr form 7336

- Cdcr 2152 form

- Notification of address change board of optometry state of optometry ca form

- Building amp site assessment form final to pdffp5 national center parks ca

- Respirator form

Find out other California State Withholding Form

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy