CA FTB 589 Fill Out Tax Template US Legal Forms 2022

Understanding the CA FTB 589 Form

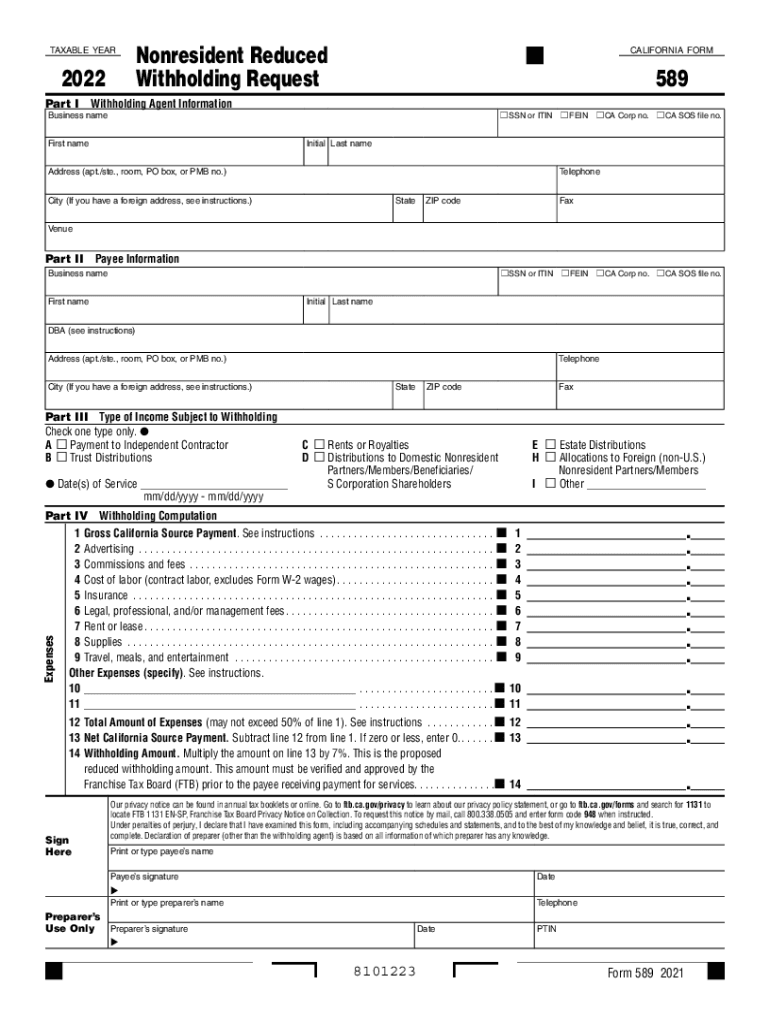

The CA FTB 589 form, also known as the Withholding California Request, is essential for individuals and entities who need to request a withholding exemption or to adjust the amount withheld from their California income. This form is particularly relevant for non-residents or those who may qualify for a reduced withholding rate. Understanding its purpose helps ensure compliance with California tax regulations.

Steps to Complete the CA FTB 589 Form

Completing the CA FTB 589 form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number or Individual Taxpayer Identification Number. Next, fill out the form by providing details about your income and the reasons for your withholding request. Be sure to review the instructions carefully to avoid common mistakes. After completing the form, sign and date it before submitting it to the appropriate tax authority.

Key Elements of the CA FTB 589 Form

The CA FTB 589 form includes several important sections that must be filled out correctly. Key elements include your personal information, the type of income you receive, and the specific reasons for requesting a withholding exemption. Additionally, the form may require you to provide supporting documentation to substantiate your claims. Understanding these elements is crucial for a successful submission.

Legal Use of the CA FTB 589 Form

The CA FTB 589 form is legally binding when completed and submitted correctly. It must comply with California tax laws and regulations to be considered valid. Utilizing a reliable eSignature solution can enhance the legal standing of your submission, ensuring that it is recognized by tax authorities. This compliance is essential for avoiding potential penalties or issues regarding your tax status.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the CA FTB 589 form. Generally, the form should be submitted before the tax year begins to ensure that the correct withholding amount is applied. Missing these deadlines can lead to unnecessary tax withholding or complications with your tax filings. Always check for any updates regarding deadlines to stay informed.

Form Submission Methods

The CA FTB 589 form can be submitted through various methods, including online submission, mailing, or in-person delivery. Each method has its own set of guidelines and processing times. For online submissions, ensure you have access to a secure platform that complies with eSignature regulations. If you choose to mail the form, be mindful of postal service times to ensure timely delivery.

Eligibility Criteria for the CA FTB 589 Form

Eligibility to file the CA FTB 589 form typically includes individuals who receive income from California sources and may qualify for reduced withholding. This includes non-residents or those with specific tax situations that warrant an exemption. Understanding these criteria helps determine if you need to file the form, ensuring compliance with California tax laws.

Quick guide on how to complete ca ftb 589 2021 fill out tax template us legal forms

Effortlessly Prepare CA FTB 589 Fill Out Tax Template US Legal Forms on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage CA FTB 589 Fill Out Tax Template US Legal Forms on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign CA FTB 589 Fill Out Tax Template US Legal Forms with Ease

- Locate CA FTB 589 Fill Out Tax Template US Legal Forms and select Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind misplaced or lost documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign CA FTB 589 Fill Out Tax Template US Legal Forms and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca ftb 589 2021 fill out tax template us legal forms

Create this form in 5 minutes!

How to create an eSignature for the ca ftb 589 2021 fill out tax template us legal forms

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a withholding California request?

A withholding California request is a form used by individuals or businesses to manage the withholding of taxes in California. This request can be essential for ensuring compliance with state tax regulations while effectively managing your tax liabilities.

-

How can airSlate SignNow simplify my withholding California request process?

airSlate SignNow provides an easy-to-use platform that allows you to create, send, and eSign withholding California requests seamlessly. With a streamlined workflow, you can reduce administrative tasks and enhance efficiency in managing your documents.

-

Is there a cost associated with using airSlate SignNow for my withholding California request?

airSlate SignNow offers flexible pricing plans tailored to various business needs. Whether you require basic features or advanced options for your withholding California request, you can find a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for my withholding California request?

Yes, airSlate SignNow offers integrations with a variety of popular software applications, allowing you to connect your existing tools for managing your withholding California request. This integration ensures a seamless flow of information across platforms, enhancing productivity.

-

What features does airSlate SignNow offer for managing withholding California requests?

Some key features of airSlate SignNow include document templates, real-time tracking, and automatic reminders for your withholding California requests. These functionalities help simplify the document management process and keep everything organized.

-

How secure is my information when using airSlate SignNow for withholding California requests?

airSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures to protect your sensitive information. Your withholding California requests are kept safe, ensuring that only authorized users have access to your documents.

-

Can I customize my withholding California request forms using airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of your withholding California request forms. You can easily add your company logo, adjust the formatting, and include any specific fields required for your business needs.

Get more for CA FTB 589 Fill Out Tax Template US Legal Forms

- Louisiana procedures 497309326 form

- Newly divorced individuals package louisiana form

- Contractors forms package louisiana

- Louisiana vehicle form

- Wedding planning or consultant package louisiana form

- Hunting forms package louisiana

- Identity theft recovery package louisiana form

- Louisiana power of attorney for health care louisiana form

Find out other CA FTB 589 Fill Out Tax Template US Legal Forms

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile