Form 37 Rita 2019

What is the Form 37 Rita

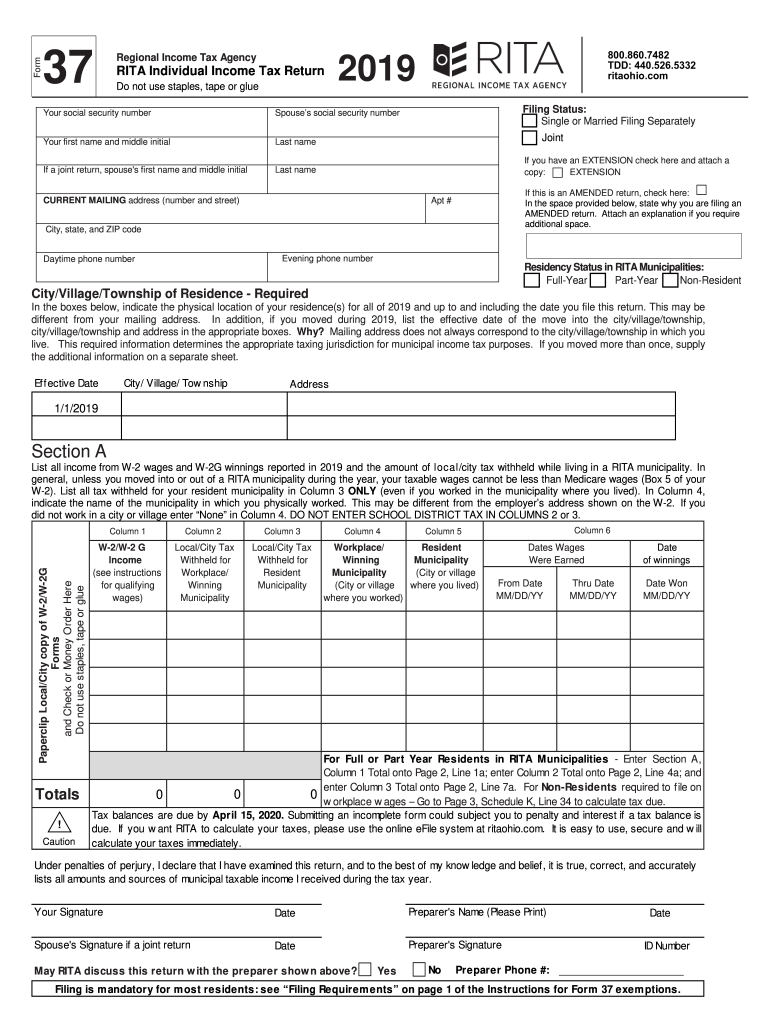

The Rita local tax form 37 is a document used by residents of specific municipalities in Ohio to report their income for local tax purposes. This form is essential for individuals who earn income within these jurisdictions, as it helps ensure compliance with local tax regulations. The form allows taxpayers to detail their income, deductions, and credits, ultimately calculating the amount of local tax owed.

How to Obtain the Form 37 Rita

To obtain the Rita tax Ohio form 37, individuals can visit the official RITA website or contact their local tax office. The form is typically available for download in a fillable PDF format, making it easy for taxpayers to complete. Additionally, local tax offices may provide printed copies of the form upon request. It is advisable to check for the most recent version to ensure accuracy in filing.

Steps to Complete the Form 37 Rita

Completing the form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, including name, address, and Social Security number.

- Report total income earned within the municipality.

- Apply any eligible deductions and credits to reduce taxable income.

- Calculate the total local tax owed based on the municipality's tax rate.

- Sign and date the form before submission.

Legal Use of the Form 37 Rita

The Rita tax form 2019 is legally binding when completed accurately and submitted on time. To ensure its legal standing, taxpayers must adhere to local tax laws and regulations. Digital signatures, when used through compliant platforms, can also enhance the form's validity. It is important to maintain copies of submitted forms and any supporting documents for record-keeping and potential audits.

Form Submission Methods

Taxpayers can submit the Rita local tax form 37 through various methods:

- Online: Many municipalities allow electronic filing through their websites or authorized e-filing services.

- Mail: Completed forms can be sent via postal service to the designated local tax office address.

- In-Person: Taxpayers may also choose to deliver their forms directly to local tax offices for immediate processing.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines to avoid penalties. Typically, the deadline for submitting the Rita tax form 37 aligns with the federal tax filing deadline, which is usually April fifteenth. However, specific municipalities may have different deadlines, so it is advisable to check local regulations for the exact dates.

Quick guide on how to complete form 96 fill out and sign printable pdf templatesignnow

Prepare Form 37 Rita effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, adjust, and eSign your documents quickly and without issues. Handle Form 37 Rita on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

How to adjust and eSign Form 37 Rita with ease

- Obtain Form 37 Rita and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Decide how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Form 37 Rita while ensuring excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 96 fill out and sign printable pdf templatesignnow

Create this form in 5 minutes!

How to create an eSignature for the form 96 fill out and sign printable pdf templatesignnow

How to generate an eSignature for the Form 96 Fill Out And Sign Printable Pdf Templatesignnow in the online mode

How to create an eSignature for your Form 96 Fill Out And Sign Printable Pdf Templatesignnow in Google Chrome

How to create an electronic signature for putting it on the Form 96 Fill Out And Sign Printable Pdf Templatesignnow in Gmail

How to make an eSignature for the Form 96 Fill Out And Sign Printable Pdf Templatesignnow right from your smartphone

How to make an eSignature for the Form 96 Fill Out And Sign Printable Pdf Templatesignnow on iOS devices

How to generate an electronic signature for the Form 96 Fill Out And Sign Printable Pdf Templatesignnow on Android devices

People also ask

-

What is the rita local tax form 37, and why do I need it?

The rita local tax form 37 is a document used to report local taxes for residents in certain jurisdictions. Completing this form is essential for compliance with local tax laws and helps ensure that you accurately report your income and pay the correct amount of taxes. By using airSlate SignNow, you can easily eSign and submit this form electronically, simplifying the process.

-

How can airSlate SignNow help me complete the rita local tax form 37?

AirSlate SignNow provides a user-friendly platform that allows you to fill out and eSign the rita local tax form 37 quickly and securely. With its intuitive interface, you can easily upload the form, add necessary information, and gather signatures from required parties. This streamlines tax filing and keeps your documents organized.

-

Is there a cost associated with using airSlate SignNow for the rita local tax form 37?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, all of which include the ability to handle documents such as the rita local tax form 37. With competitive pricing, you can choose a plan that fits your budget while accessing essential features to enhance your document management process.

-

Can I integrate airSlate SignNow with other tools for managing my rita local tax form 37?

Absolutely! AirSlate SignNow supports integrations with various applications such as CRM systems and accounting software, which can help you manage the rita local tax form 37 more efficiently. This connectivity allows you to streamline your workflow and maintain accurate records across platforms.

-

What are the benefits of using airSlate SignNow for my rita local tax form 37?

Using airSlate SignNow for your rita local tax form 37 provides several advantages, including reduced processing time, enhanced security, and the convenience of electronic signing. You can complete your form from anywhere, at any time, ensuring that you meet tax deadlines without hassle.

-

How secure is my information when using airSlate SignNow for the rita local tax form 37?

AirSlate SignNow prioritizes the security of your information with advanced encryption and secure storage. When you're completing the rita local tax form 37, you can trust that your personal and financial data are safe from unauthorized access and bsignNowes, ensuring peace of mind.

-

Can I save my rita local tax form 37 and come back to it later in airSlate SignNow?

Yes! AirSlate SignNow allows you to save your progress on the rita local tax form 37 so that you can return to it at any time before finalizing your submission. This feature is ideal for those who might need additional time to gather information or review their entries before eSigning.

Get more for Form 37 Rita

- Plea in abatement usa the republic form

- Shippers letter form

- Ceva logistics sli form

- Shellstock oyster haccp plan form

- Truck bill of lading form

- Authorization to release medical information emory healthcare emoryhealthcare

- Veterinary medical records release form

- Medical records release form texas orthopedics

Find out other Form 37 Rita

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple