the Regional Income Tax Agency RITA City of Oberlin 2022

Understanding the Regional Income Tax Agency (RITA) for Oberlin

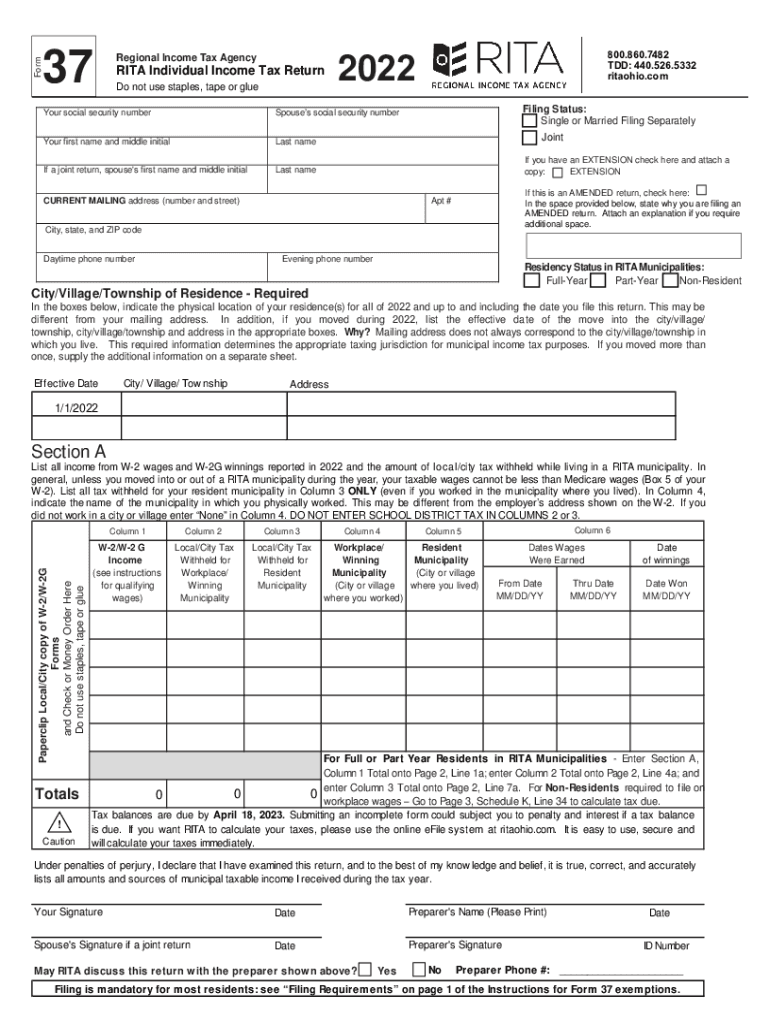

The Regional Income Tax Agency (RITA) serves municipalities in Ohio, including the City of Oberlin. This agency is responsible for the administration and collection of local income taxes. Residents and businesses in Oberlin must comply with RITA regulations to ensure they are meeting their tax obligations. The agency provides resources and support to help taxpayers navigate the local tax landscape, ensuring that individuals and businesses are informed about their responsibilities.

Steps to Complete the 2016 RITA Form

Filling out the 2016 RITA form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including income statements and previous tax returns. Next, accurately enter your personal information, including your name, address, and Social Security number. Be sure to report all income sources, including wages, self-employment income, and any other earnings. After completing the form, review it thoroughly for any errors before submitting it to RITA.

Legal Use of the 2016 RITA Form

The 2016 RITA form is legally binding when completed correctly and submitted in accordance with RITA guidelines. It is essential to provide accurate information to avoid penalties. Electronic submissions are accepted, and using a reliable eSignature platform can help ensure that your submission meets legal requirements. Compliance with local tax laws is critical, as failure to file or inaccuracies can lead to fines or legal repercussions.

Filing Deadlines and Important Dates

Taxpayers in Oberlin should be aware of key deadlines associated with the 2016 RITA form. Typically, the filing deadline for local income tax returns aligns with the federal tax deadline, which is April 15. However, it's important to check for any changes or extensions that may apply. Keeping track of these dates is crucial for timely submissions and to avoid potential penalties.

Required Documents for the 2016 RITA Form

When completing the 2016 RITA form, certain documents are essential to ensure a smooth filing process. These include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income received during the tax year. Additionally, documentation related to deductions or credits you plan to claim should be gathered in advance to support your entries on the form.

Form Submission Methods for the 2016 RITA Form

Taxpayers in Oberlin have several options for submitting the 2016 RITA form. The form can be filed electronically through RITA's online portal, which offers a secure and efficient way to submit your information. Alternatively, you can mail a completed paper form to RITA or visit their office in person. Each method has its advantages, so choose the one that best fits your needs.

Penalties for Non-Compliance with RITA Regulations

Failure to comply with RITA regulations can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for continued non-compliance. It is important for residents and businesses to understand their obligations and file their 2016 RITA form accurately and on time to avoid these consequences.

Quick guide on how to complete the regional income tax agency rita city of oberlin

Complete The Regional Income Tax Agency RITA City Of Oberlin effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly replacement for conventional printed and signed records, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage The Regional Income Tax Agency RITA City Of Oberlin on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign The Regional Income Tax Agency RITA City Of Oberlin with ease

- Locate The Regional Income Tax Agency RITA City Of Oberlin and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive content with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to secure your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Disregard about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you choose. Edit and eSign The Regional Income Tax Agency RITA City Of Oberlin and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the regional income tax agency rita city of oberlin

Create this form in 5 minutes!

How to create an eSignature for the the regional income tax agency rita city of oberlin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 rita form?

The 2016 rita form is a specific document used for various administrative purposes. It allows users to report certain information efficiently and accurately. By utilizing airSlate SignNow, you can easily fill out and eSign the 2016 rita form, streamlining your workflow.

-

How can I access the 2016 rita form using airSlate SignNow?

You can access the 2016 rita form by logging into your airSlate SignNow account and searching for the document template. The platform offers a vast library of forms, including the 2016 rita form, which can be customized to suit your needs. Once found, you can fill it out and eSign with ease.

-

Is there a cost associated with using the 2016 rita form on airSlate SignNow?

Using the 2016 rita form on airSlate SignNow comes with various pricing plans that cater to different budgets. The platform is known for its cost-effective solutions, and you can choose a plan that fits your requirements. Each plan also includes access to multiple features that enhance document management.

-

What features does airSlate SignNow offer for managing the 2016 rita form?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure eSigning for the 2016 rita form. These tools make it easy to manage and share documents efficiently. Additionally, you can track the status of the form in real-time to ensure timely completion.

-

How does airSlate SignNow ensure the security of the 2016 rita form?

Security is a top priority for airSlate SignNow while handling the 2016 rita form and other documents. The platform employs advanced encryption protocols to protect your data. Furthermore, audit logs are maintained to ensure compliance and transparency in document transactions.

-

Can I integrate airSlate SignNow with other applications while working on the 2016 rita form?

Yes, airSlate SignNow supports various integrations with popular applications, making it easy to work with the 2016 rita form alongside other tools you use. Whether it's CRM software, cloud storage, or productivity applications, integrations provide seamless workflows. This enhances efficiency and helps you manage documents better.

-

What are the benefits of using airSlate SignNow for the 2016 rita form?

Using airSlate SignNow for the 2016 rita form offers several benefits, including faster processing times and improved accuracy. The platform's user-friendly interface makes it easy for anyone to navigate, reducing the time spent on documentation. Additionally, the eSigning feature ensures that your forms are legally binding and easily sharable.

Get more for The Regional Income Tax Agency RITA City Of Oberlin

- Ac form 8060 56 14850738

- Joint affidavit of domestic partnership philippines 212754740 form

- Imm 5534 form

- Pre coaching questionnaire pdf form

- Bewilligung zur benutzung eines fahrzeugs durch drittpersonen form

- Check keeper form

- Rubrics for photography contest form

- Pickleball skills assessment worksheet 211508776 form

Find out other The Regional Income Tax Agency RITA City Of Oberlin

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template