Rita Form 37 Tax 2014

What is the Rita Form 37 Tax

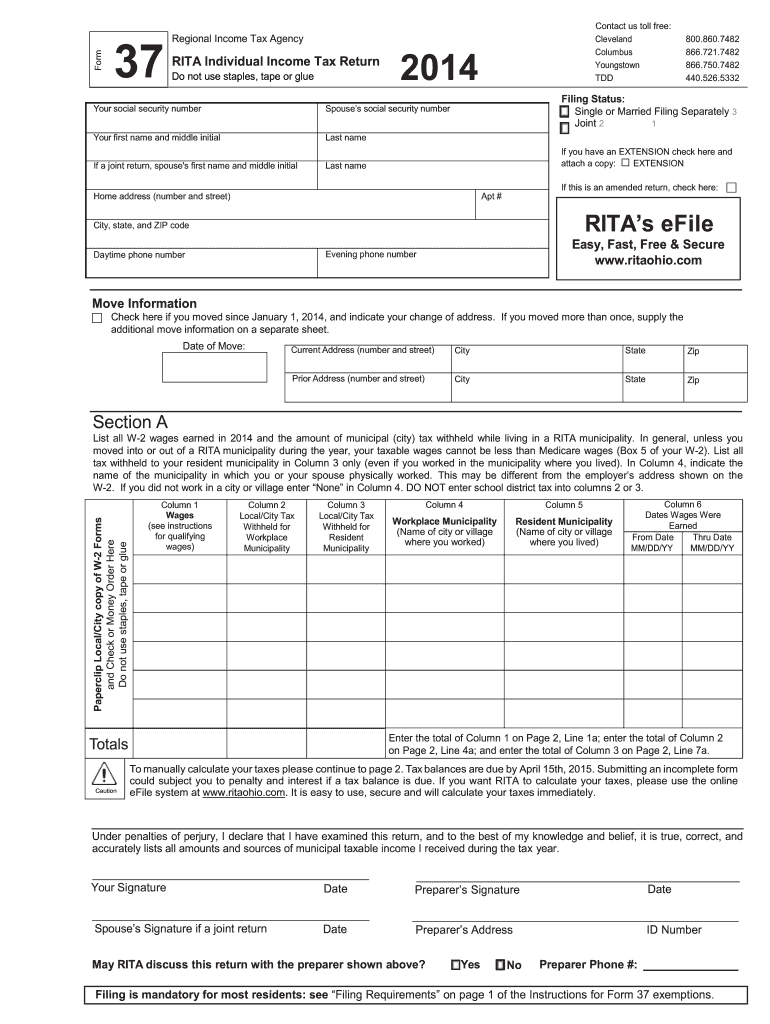

The Rita Form 37 Tax is a tax form used by residents of certain municipalities in the United States to report income and calculate local income taxes. This form is typically required by local governments to ensure compliance with municipal tax regulations. It is essential for individuals and businesses operating within these jurisdictions to accurately complete and submit this form to avoid penalties.

How to use the Rita Form 37 Tax

Using the Rita Form 37 Tax involves several steps to ensure proper completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with accurate information regarding your income, deductions, and any applicable credits. After completing the form, review it for accuracy before submitting it to the appropriate local tax authority. If filing electronically, ensure you use a compliant eSignature solution for a secure submission.

Steps to complete the Rita Form 37 Tax

Completing the Rita Form 37 Tax requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Include any deductions or credits you qualify for.

- Double-check all entries for accuracy.

- Sign and date the form, ensuring compliance with eSignature laws if submitting electronically.

Legal use of the Rita Form 37 Tax

The Rita Form 37 Tax is legally binding once completed and submitted. To ensure its legal validity, it must meet specific requirements, including accurate reporting of income and adherence to local tax laws. Utilizing a reliable eSignature solution enhances the legal standing of the form, as it provides a secure method for signing and submitting documents electronically. Compliance with laws such as the ESIGN Act and UETA is crucial for the form's acceptance by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Rita Form 37 Tax vary by municipality but are generally aligned with the federal tax filing deadline. It is important to check specific local regulations for exact dates. Missing these deadlines can result in penalties or interest on unpaid taxes. Taxpayers should mark their calendars and prepare their forms in advance to ensure timely submission.

Required Documents

To complete the Rita Form 37 Tax, several documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investment earnings.

- Documentation for any deductions or credits claimed.

Having these documents readily available will streamline the process and help ensure accurate reporting.

Quick guide on how to complete rita form 37 tax 2014

Effortlessly Prepare Rita Form 37 Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and store it securely online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly and without delays. Manage Rita Form 37 Tax on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Easily Modify and eSign Rita Form 37 Tax

- Obtain Rita Form 37 Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Rita Form 37 Tax and ensure exceptional communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rita form 37 tax 2014

Create this form in 5 minutes!

How to create an eSignature for the rita form 37 tax 2014

How to generate an eSignature for your Rita Form 37 Tax 2014 in the online mode

How to make an electronic signature for the Rita Form 37 Tax 2014 in Google Chrome

How to make an electronic signature for signing the Rita Form 37 Tax 2014 in Gmail

How to make an eSignature for the Rita Form 37 Tax 2014 right from your smart phone

How to make an electronic signature for the Rita Form 37 Tax 2014 on iOS devices

How to generate an eSignature for the Rita Form 37 Tax 2014 on Android OS

People also ask

-

What is the Rita Form 37 Tax?

The Rita Form 37 Tax is a document used for reporting income and calculating taxes for individuals and businesses in certain jurisdictions. It provides a structured format for taxpayers to ensure compliance with local tax regulations. Understanding this form is crucial for efficient tax filing.

-

How can airSlate SignNow help with Rita Form 37 Tax?

airSlate SignNow streamlines the process of completing and submitting the Rita Form 37 Tax by providing a user-friendly platform for electronic signatures and document management. This ensures that your tax forms are accurately completed and securely signed, reducing the likelihood of errors. Our solution makes tax submission faster and more reliable.

-

What pricing plans are available for using airSlate SignNow for Rita Form 37 Tax?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, including options for teams managing Rita Form 37 Tax submissions. Our flexible pricing structures ensure that businesses of all sizes can access powerful eSigning tools. Check our website for detailed pricing information.

-

Are there any benefits of eSigning the Rita Form 37 Tax with airSlate SignNow?

Yes, eSigning the Rita Form 37 Tax with airSlate SignNow provides numerous benefits, including enhanced security, faster processing times, and improved document tracking. Electronic signatures are legally binding, making compliance easier. Plus, it simplifies the workflow by reducing paper use and manual processing.

-

Can I integrate airSlate SignNow with other tools for managing Rita Form 37 Tax?

Absolutely! airSlate SignNow seamlessly integrates with various productivity and document management tools. This integration allows for improved efficiency when managing Rita Form 37 Tax documents alongside your existing workflows. Connect with apps such as Google Workspace, Dropbox, and more.

-

Is airSlate SignNow mobile-friendly for managing Rita Form 37 Tax?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing users to manage their Rita Form 37 Tax documents from anywhere, anytime. The mobile app provides the same features as the desktop version, ensuring that you can eSign and share your documents on the go. This flexibility makes it easier to meet deadlines.

-

What support does airSlate SignNow offer for Rita Form 37 Tax queries?

airSlate SignNow provides comprehensive support for users with questions about the Rita Form 37 Tax. Our knowledgeable customer service team is available to assist with any technical issues, provide guidance on eSigning processes, and ensure that you have the resources needed to successfully navigate tax submissions.

Get more for Rita Form 37 Tax

Find out other Rita Form 37 Tax

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form