Rita Form 37 Tax 2016

What is the Rita Form 37 Tax

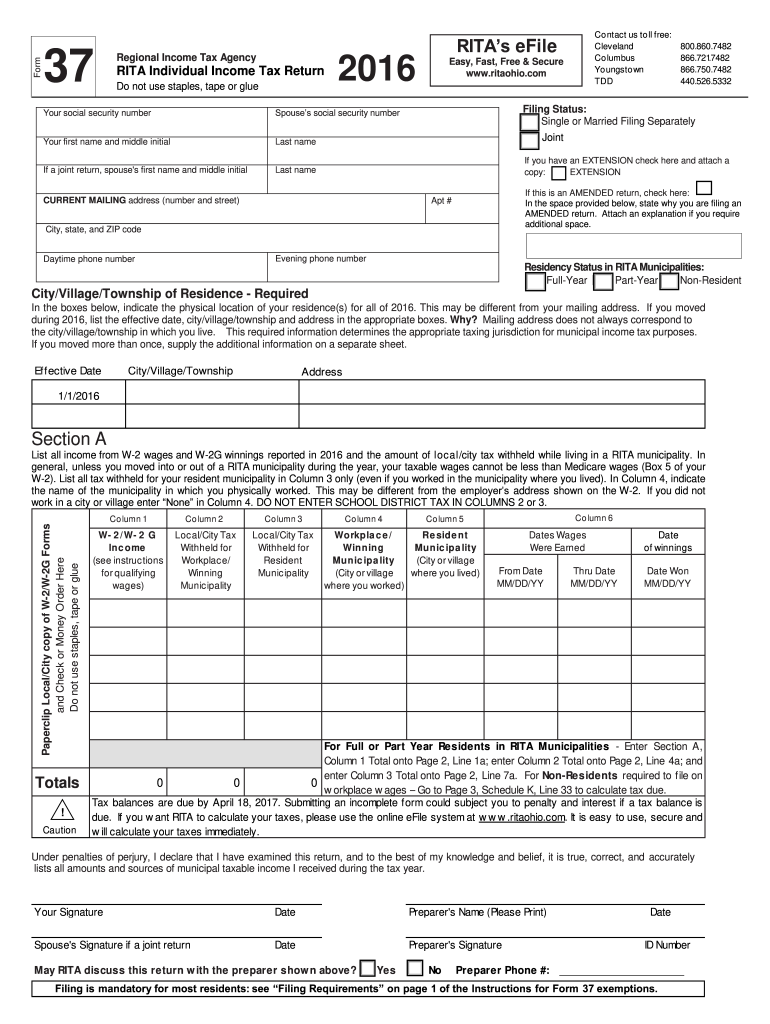

The Rita Form 37 is a tax form used in the United States for reporting income and calculating local taxes for residents of certain municipalities. This form is essential for individuals who earn income within the jurisdictions that require this tax reporting. The Rita Form 37 is specifically designed to ensure compliance with local tax laws and to facilitate the accurate assessment of local income taxes.

How to use the Rita Form 37 Tax

Using the Rita Form 37 involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income and any deductions or credits applicable to your situation. After completing the form, review it for accuracy before submitting it to the relevant tax authority.

Steps to complete the Rita Form 37 Tax

Completing the Rita Form 37 can be broken down into a series of straightforward steps:

- Collect all income documentation, such as W-2 forms and 1099s.

- Fill in your personal information accurately at the top of the form.

- Report your total income from all sources on the designated lines.

- Include any applicable deductions or credits to reduce your taxable income.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Rita Form 37 Tax

The Rita Form 37 is legally binding when completed and submitted according to the guidelines set forth by local tax authorities. To ensure its legal validity, it is crucial to provide accurate information and adhere to filing deadlines. The form must be signed by the taxpayer, affirming that the information provided is true and complete. Failure to comply with local tax regulations can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Rita Form 37 typically align with the federal tax deadlines, which are usually April fifteenth of each year. However, specific municipalities may have their own deadlines, so it is important to check with local tax authorities for any variations. Late submissions can incur penalties, so timely filing is essential to avoid additional charges.

Required Documents

To complete the Rita Form 37, several documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any additional income sources

- Records of deductions or credits claimed

Examples of using the Rita Form 37 Tax

Individuals may use the Rita Form 37 in various scenarios, such as:

- A full-time employee who works in a municipality that requires local income tax reporting.

- A freelancer who earns income from clients in different jurisdictions.

- A retiree receiving pension income subject to local taxes.

Quick guide on how to complete rita form 37 tax 2016

Handle Rita Form 37 Tax effortlessly on any gadget

Web-based document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your papers rapidly and without holdups. Manage Rita Form 37 Tax on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest method to modify and electronically sign Rita Form 37 Tax without hassle

- Obtain Rita Form 37 Tax and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you prefer to distribute your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Modify and electronically sign Rita Form 37 Tax to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rita form 37 tax 2016

Create this form in 5 minutes!

How to create an eSignature for the rita form 37 tax 2016

How to make an electronic signature for your Rita Form 37 Tax 2016 online

How to create an electronic signature for your Rita Form 37 Tax 2016 in Google Chrome

How to generate an electronic signature for putting it on the Rita Form 37 Tax 2016 in Gmail

How to make an eSignature for the Rita Form 37 Tax 2016 straight from your smart phone

How to generate an electronic signature for the Rita Form 37 Tax 2016 on iOS

How to make an electronic signature for the Rita Form 37 Tax 2016 on Android OS

People also ask

-

What is the Rita Form 37 Tax and why is it important?

The Rita Form 37 Tax is a tax document used for reporting income earned in specific regions. It is essential for individuals and businesses to understand their tax obligations and ensure compliance with local regulations. Using the Rita Form 37 Tax helps avoid penalties and ensures accurate tax filings.

-

How can airSlate SignNow help with Rita Form 37 Tax submissions?

With airSlate SignNow, you can easily eSign and send the Rita Form 37 Tax electronically, streamlining the submission process. Our platform offers a user-friendly interface that allows you to complete and send documents quickly and securely. This efficiency is crucial during tax season, especially for timely submissions.

-

What features does airSlate SignNow offer for managing Rita Form 37 Tax documents?

AirSlate SignNow provides features such as document templates, in-app signing, and real-time tracking for your Rita Form 37 Tax documents. These tools simplify the process of preparing and sending tax forms, ensuring that you have everything you need at your fingertips. Additionally, our platform is designed for maximum security, keeping your data safe.

-

Is there a cost associated with using airSlate SignNow for Rita Form 37 Tax?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions allow you to manage multiple Rita Form 37 Tax documents without breaking the bank. You can choose a plan that best fits your usage requirements and budget.

-

Can airSlate SignNow integrate with other tax software for Rita Form 37 Tax management?

Absolutely! AirSlate SignNow integrates seamlessly with various tax software solutions, enhancing your workflow for Rita Form 37 Tax management. This integration means you can easily import and export documents, reducing the time spent on manual data entry and ensuring accuracy.

-

How does airSlate SignNow ensure the security of my Rita Form 37 Tax documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption and authentication protocols to protect your Rita Form 37 Tax documents during transmission and storage. You can rest assured that your sensitive tax information remains confidential and secure.

-

What benefits can I expect from using airSlate SignNow for Rita Form 37 Tax eSigning?

Using airSlate SignNow for your Rita Form 37 Tax eSigning provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform enables you to collect signatures quickly, allowing you to focus on other important aspects of your tax preparation. Moreover, the convenience of eSigning can enhance collaboration with your team or tax professionals.

Get more for Rita Form 37 Tax

- Harborside counseling services form

- Counseling intake form

- Entrance counseling form asa

- Keuka college health immunization form

- Vvc prerequisite challenge form

- 4 h animal project record book university of idaho extension co custer id form

- Contract signature block template word form

- 919404h animal project record book complete one form

Find out other Rita Form 37 Tax

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document