Hawaii N 311 Form 2018

What is the Hawaii N 311 Form

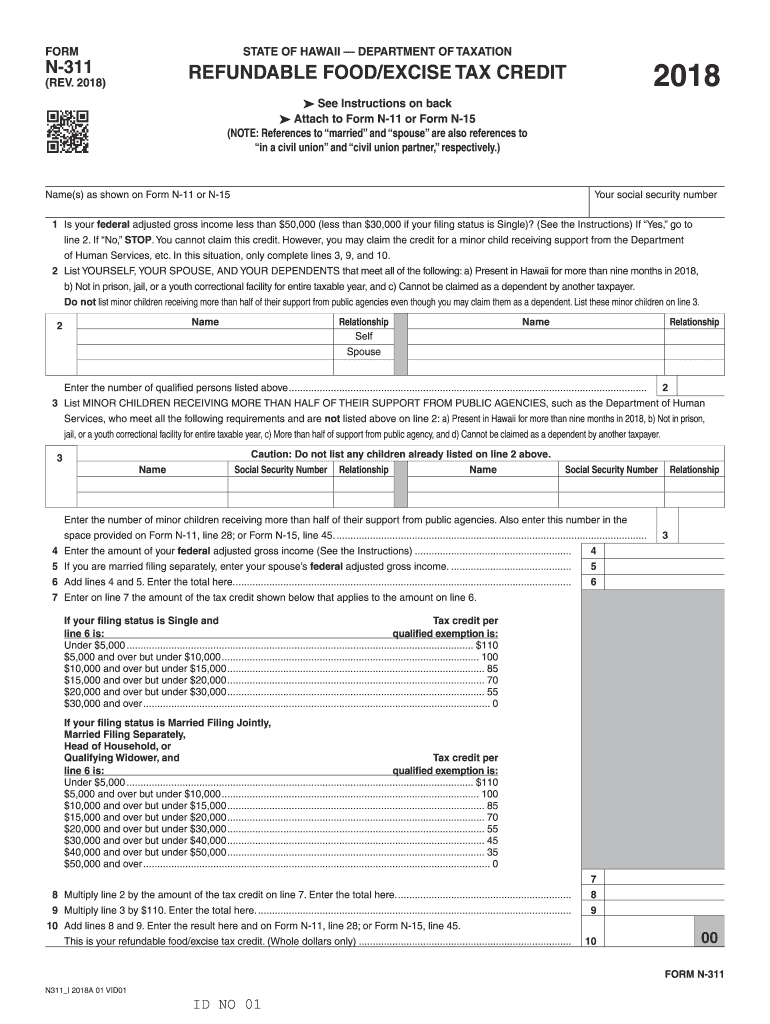

The Hawaii N 311 Form is a state-specific tax form used for reporting and calculating various tax obligations in Hawaii. This form is essential for residents and businesses to ensure compliance with state tax laws. It is typically utilized for income tax purposes, allowing taxpayers to report their income, deductions, and credits accurately. Understanding the purpose of the N 311 Form is crucial for effective tax management in Hawaii.

How to use the Hawaii N 311 Form

Using the Hawaii N 311 Form involves several key steps. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant deduction information. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Hawaii N 311 Form

Completing the Hawaii N 311 Form requires a systematic approach:

- Begin by downloading the form from the official state website or accessing it through your tax software.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income, including wages, self-employment earnings, and any other sources.

- Claim any eligible deductions and credits, ensuring you have the necessary documentation to support your claims.

- Review the completed form for accuracy before submitting it.

Legal use of the Hawaii N 311 Form

The Hawaii N 311 Form is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may result in penalties or legal repercussions. Utilizing a reliable electronic signature tool can enhance the legitimacy of the submission, as it provides an additional layer of security and compliance with eSignature laws.

Form Submission Methods

The Hawaii N 311 Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers prefer to file electronically through the state’s tax portal, which offers a streamlined process.

- Mail Submission: For those who prefer traditional methods, the completed form can be printed and mailed to the appropriate tax office.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated tax offices, ensuring immediate confirmation of receipt.

Required Documents

To complete the Hawaii N 311 Form accurately, several documents are typically required:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any deductions or credits claimed

- Previous tax returns for reference

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete form n 311 rev 2018 refundable foodexcise tax credit forms 2018 fillable

Finish Hawaii N 311 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage Hawaii N 311 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Hawaii N 311 Form with ease

- Locate Hawaii N 311 Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, hassle of form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choice. Alter and eSign Hawaii N 311 Form and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev 2018 refundable foodexcise tax credit forms 2018 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev 2018 refundable foodexcise tax credit forms 2018 fillable

How to create an eSignature for the Form N 311 Rev 2018 Refundable Foodexcise Tax Credit Forms 2018 Fillable online

How to generate an electronic signature for your Form N 311 Rev 2018 Refundable Foodexcise Tax Credit Forms 2018 Fillable in Google Chrome

How to generate an eSignature for putting it on the Form N 311 Rev 2018 Refundable Foodexcise Tax Credit Forms 2018 Fillable in Gmail

How to make an eSignature for the Form N 311 Rev 2018 Refundable Foodexcise Tax Credit Forms 2018 Fillable from your mobile device

How to create an eSignature for the Form N 311 Rev 2018 Refundable Foodexcise Tax Credit Forms 2018 Fillable on iOS devices

How to generate an electronic signature for the Form N 311 Rev 2018 Refundable Foodexcise Tax Credit Forms 2018 Fillable on Android OS

People also ask

-

What is the Hawaii 311 form and how can airSlate SignNow help with it?

The Hawaii 311 form is a vital document used by residents to request non-emergency services or information from local authorities. With airSlate SignNow, you can easily create, send, and eSign your Hawaii 311 form, ensuring a streamlined and efficient process for obtaining the assistance you need.

-

Is airSlate SignNow suitable for completing Hawaii 311 forms?

Yes, airSlate SignNow is perfectly suited for completing Hawaii 311 forms. Our platform allows for quick document preparation, electronic signatures, and secure storage, making it the ideal solution for managing your local requests efficiently.

-

What are the pricing plans for using airSlate SignNow to manage Hawaii 311 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Users can select from individual, business, and enterprise plans, all of which provide powerful features for managing Hawaii 311 forms at competitive rates.

-

Can airSlate SignNow integrate with other tools for processing Hawaii 311 forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Salesforce. This enables users to manage their Hawaii 311 forms along with other essential workflows in a more efficient and centralized manner.

-

What features does airSlate SignNow offer for eSigning Hawaii 311 forms?

With airSlate SignNow, you gain access to numerous features for eSigning Hawaii 311 forms, including templates, automated workflows, and mobile access. These tools simplify the signing process, enhancing user experience and speeding up submissions.

-

How secure is airSlate SignNow for submitting Hawaii 311 forms?

Security is a priority at airSlate SignNow. We implement robust encryption measures and adhere to industry standards, ensuring your Hawaii 311 forms and data remain confidential and secure throughout the entire signing process.

-

Can I track the status of my Hawaii 311 form in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Hawaii 311 forms. You can monitor the status of your submissions, receive notifications, and ensure that your requests are processed timely, enhancing your overall experience.

Get more for Hawaii N 311 Form

- Carta tel a ride form

- Computer user form 120 fmlscom

- Established patient treatment form brookwood internists pc

- Jack and jill national legacy form

- Form 103 long state of indiana wellscounty

- Q small claims court courts state co form

- Audition registration forms pdf peninsula youth theatre pytnet

- Divorce forms indiana

Find out other Hawaii N 311 Form

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast