Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable 2020

What is the Form N-311?

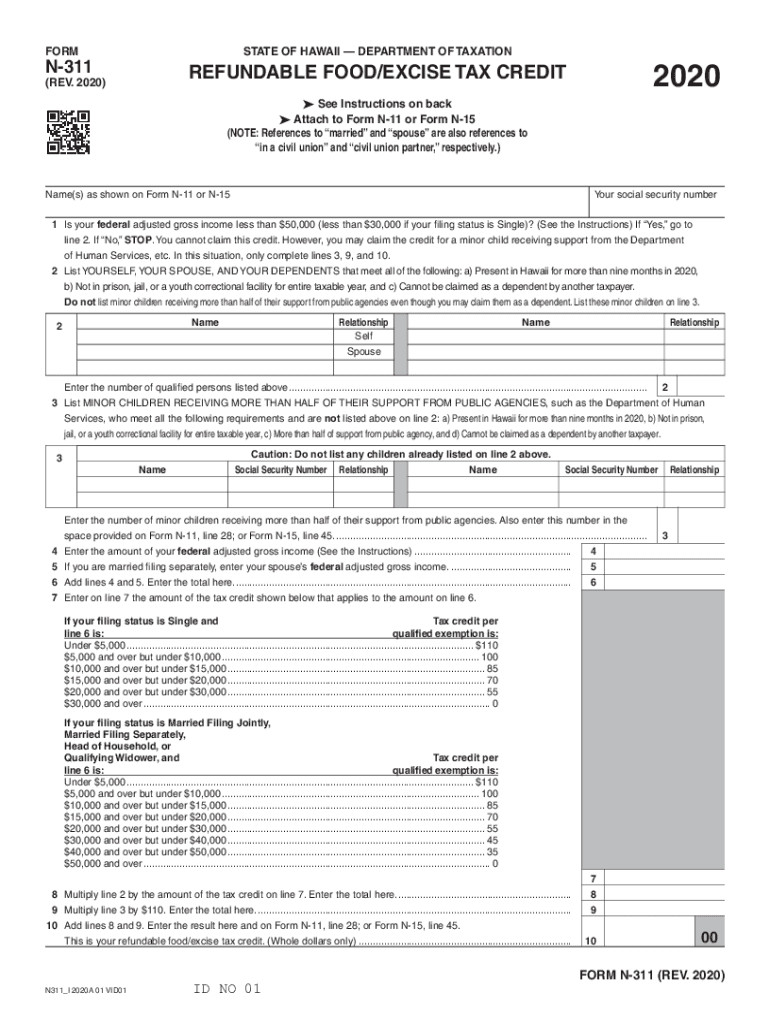

The Form N-311 is a state-specific tax document used in Hawaii for claiming the Refundable Food/Excise Tax Credit. This form allows eligible taxpayers to receive a credit against their income tax liability for certain food and excise taxes paid. It is particularly relevant for individuals and businesses that meet specific criteria set by the state, ensuring they can benefit from this tax relief program.

Steps to Complete the Form N-311

Completing the Form N-311 involves several key steps to ensure accuracy and compliance with state requirements. First, gather all necessary documentation, including proof of income and any receipts related to food and excise taxes paid. Next, fill out the form by entering personal information, including your name, address, and Social Security number. Be sure to accurately calculate the credit based on your qualifying expenses. Finally, review the completed form for any errors before submission.

Eligibility Criteria for the Form N-311

To qualify for the Refundable Food/Excise Tax Credit using the Form N-311, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of Hawaii and having a valid Social Security number. Additionally, the taxpayer's income must fall within certain limits, which can vary annually. It is essential to review the current guidelines provided by the Hawaii Department of Taxation to determine eligibility accurately.

Form Submission Methods

The Form N-311 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the Hawaii Department of Taxation's e-filing system. Alternatively, the completed form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Key Elements of the Form N-311

Understanding the key elements of the Form N-311 is crucial for successful completion. The form typically includes sections for personal information, income details, and calculations for the refundable credit. Taxpayers must also provide documentation supporting their claims, such as receipts for food purchases. Additionally, there are instructions included on the form that guide users through the completion process, ensuring all necessary information is provided.

Filing Deadlines and Important Dates

Filing deadlines for the Form N-311 are critical to ensure timely submission and avoid penalties. Generally, the form must be filed by the same deadline as the federal income tax return. It is essential to check the Hawaii Department of Taxation for any specific dates that may vary each year. Being aware of these deadlines helps taxpayers plan accordingly and ensures they do not miss out on potential tax credits.

Quick guide on how to complete form n 311 rev 2020 refundable foodexcise tax credit forms 2020 fillable

Complete Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable effortlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without hassles. Manage Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable without any hassle

- Locate Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from a device of your choosing. Alter and eSign Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev 2020 refundable foodexcise tax credit forms 2020 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev 2020 refundable foodexcise tax credit forms 2020 fillable

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the 2019 n 311 form and how do I use it?

The 2019 n 311 form is a document used for specific city requests and services. You can easily fill out and submit this form using airSlate SignNow's electronic signature capabilities. Our platform allows you to streamline the process, ensuring your requests are handled promptly and efficiently.

-

Is there a cost associated with using the 2019 n 311 form on airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, there are subscription plans that provide access to features for using the 2019 n 311 form. Our pricing is competitive and designed to provide value, helping you save time and money in managing your documents.

-

What features does airSlate SignNow offer for handling the 2019 n 311 form?

airSlate SignNow offers features such as document templates, e-signatures, and workflow automation specifically for the 2019 n 311 form. You can customize your forms, track document status in real time, and ensure secure submissions, enhancing efficiency in your processes.

-

How can I integrate airSlate SignNow with other tools while using the 2019 n 311 form?

airSlate SignNow easily integrates with various applications and platforms, allowing you to manage the 2019 n 311 form seamlessly. Whether you use CRM systems, cloud storage, or productivity tools, our integrations help you maintain a smooth workflow and enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the 2019 n 311 form?

Using airSlate SignNow for the 2019 n 311 form offers several benefits, including increased efficiency, reduced paperwork, and faster processing times. The platform's intuitive interface allows you to fill out and sign documents with ease, ensuring that you focus on what matters most in your business.

-

Can I access the 2019 n 311 form from mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access the 2019 n 311 form from your smartphone or tablet. This flexibility enables you to manage your documents on the go, making it convenient for busy professionals who need to stay productive.

-

What security measures does airSlate SignNow have for the 2019 n 311 form?

airSlate SignNow prioritizes security, especially for sensitive documents like the 2019 n 311 form. Our platform employs advanced encryption, two-factor authentication, and compliance with legal regulations to ensure that your data remains secure and protected.

Get more for Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable

- Private investigator contracts forms

- Voms form

- Doc scientia grade 10 physics answers pdf form

- Texas level 2 security license test answers form

- Ncpc application form

- Solo parent city government of muntinlupa us legal forms

- Employment use the sa102 supplementary pages to record your employment details when filing a tax return for the tax year ended 782153692 form

- Ls 119 e labor standards complaint form

Find out other Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors