Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable 2022

What is the 2020 Hawaii N 311 Tax Form?

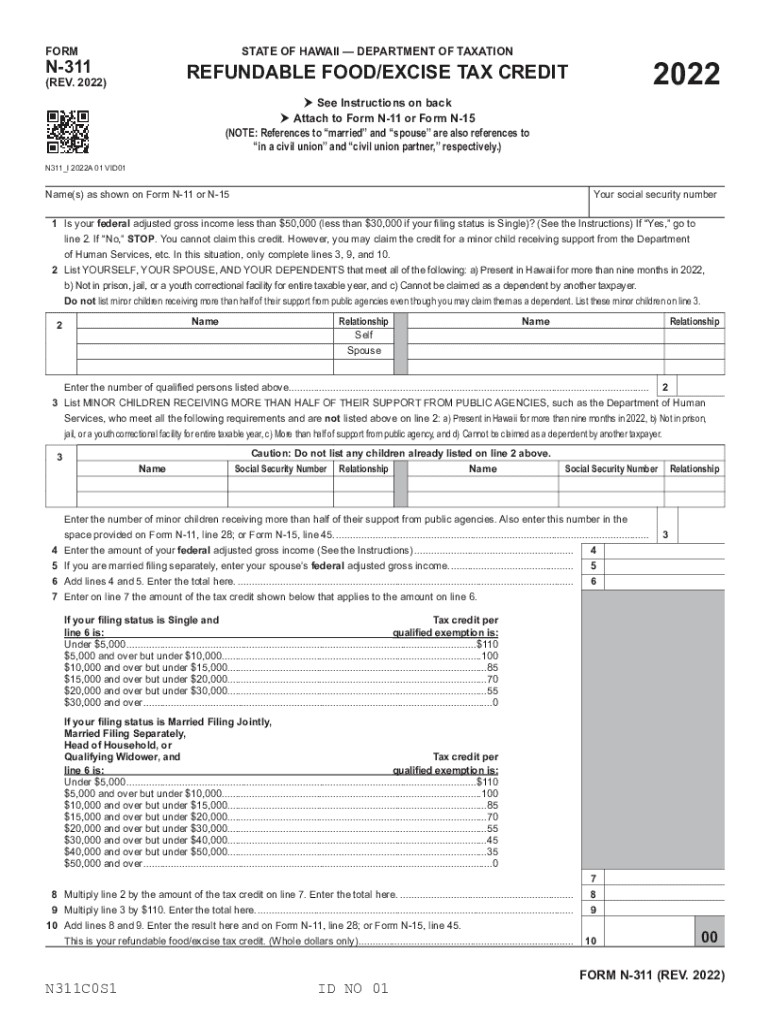

The 2020 Hawaii N 311 tax form, also known as the Refundable Food/Excise Tax Credit form, is designed for residents of Hawaii to claim a credit against certain excise taxes paid on food purchases. This form allows eligible taxpayers to receive a refund for a portion of the excise tax they have incurred throughout the year. Understanding the purpose and function of this form is essential for residents seeking to benefit from available tax credits.

Eligibility Criteria for the 2020 Hawaii N 311

To qualify for the 2020 Hawaii N 311 tax credit, taxpayers must meet specific eligibility requirements. These include:

- Being a resident of Hawaii for the entire tax year.

- Having a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Meeting income thresholds set by the state for the tax year.

It is important to review these criteria carefully to ensure that all qualifications are met before filing the form.

Steps to Complete the 2020 Hawaii N 311 Tax Form

Filling out the 2020 Hawaii N 311 form involves several key steps:

- Gather necessary documentation, including proof of income and any previous tax filings.

- Accurately fill out the personal information section, ensuring all details are correct.

- Calculate the amount of excise tax paid on food purchases and enter this figure in the designated section.

- Review the completed form for accuracy before submission.

Following these steps can help ensure a smooth filing process and increase the likelihood of receiving the credit.

How to Obtain the 2020 Hawaii N 311 Tax Form

The 2020 Hawaii N 311 tax form can be obtained through several methods:

- Visiting the official Hawaii Department of Taxation website, where the form is available for download.

- Requesting a physical copy by contacting the Hawaii Department of Taxation directly.

- Accessing local tax offices or community centers that may have copies available for residents.

Having the correct version of the form is crucial for accurate filing and compliance with state regulations.

Form Submission Methods for the 2020 Hawaii N 311

Taxpayers can submit the 2020 Hawaii N 311 form through various methods:

- Online submission via the Hawaii Department of Taxation's e-filing system.

- Mailing the completed form to the appropriate state tax office address.

- In-person submission at designated tax offices across Hawaii.

Choosing the right submission method can affect processing times and the overall experience of filing the tax credit claim.

Key Elements of the 2020 Hawaii N 311 Tax Form

Understanding the key elements of the 2020 Hawaii N 311 form is vital for accurate completion. Important sections include:

- Personal information, including name, address, and Social Security number.

- Income details to establish eligibility for the credit.

- Calculations related to excise tax paid on food purchases.

- Signature and date fields to validate the submission.

Each section must be filled out with care to ensure compliance and to facilitate a smooth review process by the tax authorities.

Quick guide on how to complete form n 311 rev 2022 refundable foodexcise tax credit forms 2022 fillable

Prepare Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable effortlessly on any device

The management of online documents has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable with ease

- Locate Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev 2022 refundable foodexcise tax credit forms 2022 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev 2022 refundable foodexcise tax credit forms 2022 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 Hawaii credit?

The 2020 Hawaii credit refers to a tax incentive designed to support residents and businesses in Hawaii during 2020. This credit helps alleviate financial burdens and promotes economic recovery. Understanding this credit can be beneficial for anyone looking to optimize their tax situation in Hawaii.

-

How can I apply for the 2020 Hawaii credit?

To apply for the 2020 Hawaii credit, you need to complete the required tax forms provided by the Hawaii Department of Taxation. It's important to gather the necessary documentation and follow the guidelines to ensure your application is processed smoothly. Consider consulting a tax professional if you need assistance.

-

What benefits does the 2020 Hawaii credit offer to businesses?

The 2020 Hawaii credit offers signNow financial relief to businesses by reducing their tax liabilities. This allows businesses to reinvest in operations and support employees, fostering economic growth. It is crucial for business owners in Hawaii to explore how they can maximize this credit for their benefit.

-

Can residents of Hawaii benefit from the 2020 Hawaii credit?

Yes, residents of Hawaii can benefit from the 2020 Hawaii credit, which provides tax relief to eligible individuals. By claiming this credit, residents can reduce their tax burden and improve their financial well-being. It's essential for individuals to assess their eligibility and file the proper documentation.

-

What documentation do I need for the 2020 Hawaii credit application?

You will need various documents to apply for the 2020 Hawaii credit, including proof of residency, income statements, and any other relevant tax documents. Ensuring that you have all the necessary paperwork will streamline your application process. It’s advisable to check the specific requirements on the Hawaii Department of Taxation's website.

-

How does the 2020 Hawaii credit impact my overall tax returns?

The 2020 Hawaii credit can positively impact your overall tax returns by reducing your taxable income and overall tax liability. This means you may receive a larger refund or owe less in taxes. It's important to include this credit in your tax calculations to understand its full effect on your financial situation.

-

Is the 2020 Hawaii credit available for non-residents?

The 2020 Hawaii credit is primarily aimed at residents and may not be available for non-residents. However, specific provisions could apply under certain circumstances. Non-residents should consult the Hawaii Department of Taxation to determine their eligibility for any similar credits.

Get more for Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable

- Will no children form

- Legal last will and testament form for married person with minor children south carolina

- South carolina codicil form

- Legal last will and testament form for married person with adult and minor children from prior marriage south carolina

- Legal last will and testament form for married person with adult and minor children south carolina

- Mutual wills package with last wills and testaments for married couple with adult and minor children south carolina form

- Legal last will and testament form for a widow or widower with adult children south carolina

- Legal last will and testament form for widow or widower with minor children south carolina

Find out other Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free