Form N 311 "Refundable FoodExcise Tax Credit" Hawaii 2021

What is the Form N-311 "Refundable Food Excise Tax Credit" Hawaii

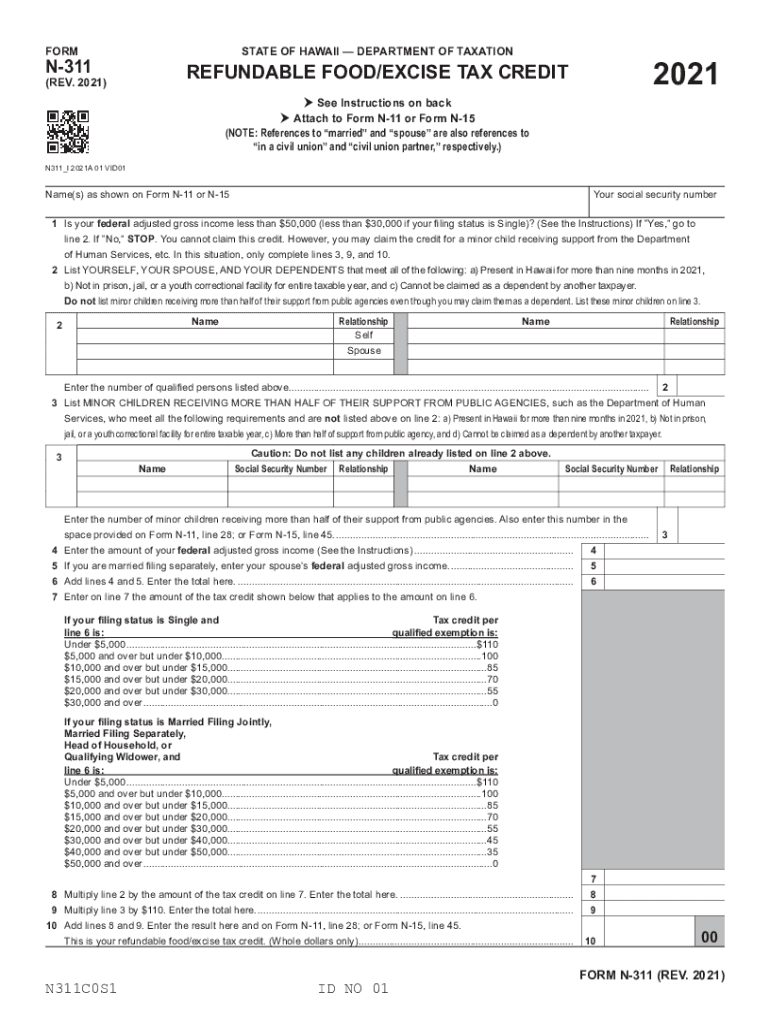

The Form N-311 is a tax form used in Hawaii to claim the Refundable Food Excise Tax Credit. This credit is designed to provide financial relief to eligible taxpayers, particularly those who may be struggling with the cost of food and other essential goods. The form allows individuals and families to receive a refund on a portion of the excise tax they have paid on food purchases, thereby easing the financial burden associated with living expenses.

How to use the Form N-311 "Refundable Food Excise Tax Credit" Hawaii

Using the Form N-311 involves several steps to ensure that the application is completed accurately. Taxpayers must first determine their eligibility based on income levels and family size. After confirming eligibility, individuals should fill out the form with the required personal information, including Social Security numbers and income details. It is essential to follow the instructions carefully to avoid errors that could delay processing.

Steps to complete the Form N-311 "Refundable Food Excise Tax Credit" Hawaii

Completing the Form N-311 requires attention to detail. Here are the key steps:

- Gather necessary documents, such as proof of income and identification.

- Fill out personal information, including name, address, and Social Security number.

- Indicate the number of qualifying dependents.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Refundable Food Excise Tax Credit using Form N-311, taxpayers must meet specific criteria. Generally, eligibility is based on household income, the number of dependents, and residency status in Hawaii. It is important for applicants to review the detailed eligibility requirements outlined in the form instructions to ensure they qualify for the credit.

Form Submission Methods (Online / Mail / In-Person)

The Form N-311 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the Hawaii Department of Taxation's website, ensuring a quicker processing time. Alternatively, individuals can mail the completed form to the designated tax office or submit it in person at local tax offices. Each method has its own guidelines, so it's essential to follow the instructions provided with the form.

Key elements of the Form N-311 "Refundable Food Excise Tax Credit" Hawaii

The Form N-311 includes several key elements that are crucial for its completion. These include:

- Taxpayer identification information.

- Income details and calculation of the credit.

- Information on dependents.

- Signature and date to certify the accuracy of the information provided.

Quick guide on how to complete form n 311 ampquotrefundable foodexcise tax creditampquot hawaii

Finish Form N 311 "Refundable FoodExcise Tax Credit" Hawaii effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly without interruptions. Manage Form N 311 "Refundable FoodExcise Tax Credit" Hawaii on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest method to alter and eSign Form N 311 "Refundable FoodExcise Tax Credit" Hawaii with ease

- Obtain Form N 311 "Refundable FoodExcise Tax Credit" Hawaii and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form inspections, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in several clicks from any device you prefer. Modify and eSign Form N 311 "Refundable FoodExcise Tax Credit" Hawaii and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 ampquotrefundable foodexcise tax creditampquot hawaii

Create this form in 5 minutes!

How to create an eSignature for the form n 311 ampquotrefundable foodexcise tax creditampquot hawaii

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

What is n 311 and how does it benefit my business?

n 311 is an innovative solution that simplifies the document signing process for businesses. By integrating n 311 into your operations, you can streamline workflows, reduce paper usage, and enhance team collaboration. This results in improved efficiency and a faster turnaround on essential business agreements.

-

How does airSlate SignNow pricing work for n 311?

airSlate SignNow offers competitive pricing for n 311 that caters to businesses of all sizes. You can choose from various subscription plans based on your organization’s document signing needs. Each plan is designed to provide flexibility and scalability, ensuring you only pay for what you use.

-

Can I integrate n 311 with other software solutions?

Yes, n 311 seamlessly integrates with a variety of software solutions, enhancing your existing workflows. Whether you use CRM systems or project management tools, airSlate SignNow ensures smooth operations through effective integrations. This connectivity helps businesses work more efficiently and increases overall productivity.

-

What features does n 311 offer?

n 311 comes with a range of features aimed at simplifying the eSigning experience. Key features include customizable templates, audit trails, and secure storage. These tools empower businesses to manage their documents easily while ensuring compliance and security.

-

Is n 311 secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes document security within n 311. It employs advanced encryption methods and complies with industry standards to protect your sensitive information. Businesses can confidently use n 311 knowing their data is safeguarded.

-

How can n 311 improve my team's productivity?

By utilizing n 311, your team can execute document signing remotely and electronically, which greatly reduces the time spent on manual tasks. This efficiency allows employees to focus on higher-priority projects, enhancing overall productivity. With n 311, you’ll see a noticeable improvement in team collaboration and project timelines.

-

What types of documents can I manage using n 311?

n 311 supports a wide variety of document types, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses across different industries. Whether you need to send a simple document or a complex multi-page contract, n 311 handles it effortlessly.

Get more for Form N 311 "Refundable FoodExcise Tax Credit" Hawaii

- Md financing addendum form

- Legal last will and testament form for single person with no children maryland

- Legal last will and testament form for a single person with minor children maryland

- Legal last will and testament form for single person with adult and minor children maryland

- Legal last will and testament form for single person with adult children maryland

- Legal last will and testament for married person with minor children from prior marriage maryland form

- Legal last will and testament for domestic partner with minor children from prior marriage maryland form

- Legal last will and testament form for married person with adult children from prior marriage maryland

Find out other Form N 311 "Refundable FoodExcise Tax Credit" Hawaii

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement