N311 2019

What is the N311?

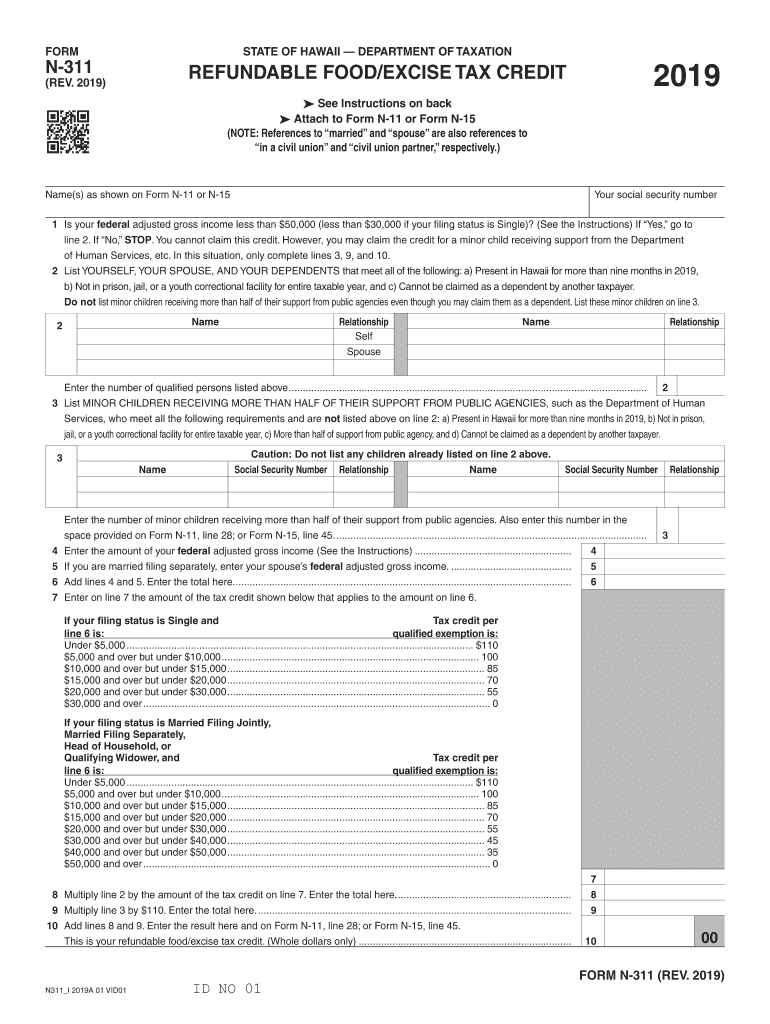

The N311 form, also known as the Hawaii state tax form N-311, is utilized by taxpayers in Hawaii to report their income and calculate their tax liability. This form is specifically designed for individuals who have income from sources outside of Hawaii or who are claiming certain tax credits. Understanding the purpose of the N311 is crucial for ensuring compliance with state tax regulations and for accurately reporting income.

How to obtain the N311

To obtain the 2019 N311 form, individuals can visit the official Hawaii Department of Taxation website, where the form is available for download. Additionally, paper copies of the form can be requested from local tax offices or by contacting the Hawaii Department of Taxation directly. It is important to ensure that you are using the correct version of the form for the relevant tax year.

Steps to complete the N311

Completing the N311 form involves several steps:

- Gather all necessary documentation, including income statements and any applicable tax credit information.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your income from all sources, ensuring that you accurately reflect any income earned outside of Hawaii.

- Calculate your total tax liability based on the instructions provided with the form.

- Review your completed form for accuracy before submitting it.

Legal use of the N311

The N311 form is legally binding when filled out correctly and submitted to the Hawaii Department of Taxation. It is essential to ensure that all information is accurate and truthful, as providing false information can lead to penalties or legal repercussions. Compliance with state tax laws is crucial for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

For the 2019 tax year, the filing deadline for the N311 form typically aligns with the federal tax deadline, which is April 15 of the following year. However, it is important to check for any specific extensions or changes that may apply. Timely submission of the form is essential to avoid penalties and interest on unpaid taxes.

Form Submission Methods

The N311 form can be submitted through various methods, including:

- Online submission via the Hawaii Department of Taxation's e-filing system.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at local tax offices, where assistance may also be available.

Key elements of the N311

When filling out the N311 form, it is important to pay attention to key elements, such as:

- Your personal identification information, including Social Security number.

- Accurate reporting of all income sources.

- Claiming any eligible tax credits or deductions.

- Signature and date to validate the submission.

Quick guide on how to complete form n 311 rev 2019 refundable foodexcise tax credit forms 2019 fillable

Complete N311 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage N311 on any device using airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest way to modify and eSign N311 effortlessly

- Locate N311 and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your updates.

- Select how you wish to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign N311 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev 2019 refundable foodexcise tax credit forms 2019 fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev 2019 refundable foodexcise tax credit forms 2019 fillable

How to create an electronic signature for your Form N 311 Rev 2019 Refundable Foodexcise Tax Credit Forms 2019 Fillable online

How to make an electronic signature for the Form N 311 Rev 2019 Refundable Foodexcise Tax Credit Forms 2019 Fillable in Google Chrome

How to create an eSignature for signing the Form N 311 Rev 2019 Refundable Foodexcise Tax Credit Forms 2019 Fillable in Gmail

How to create an eSignature for the Form N 311 Rev 2019 Refundable Foodexcise Tax Credit Forms 2019 Fillable from your mobile device

How to generate an electronic signature for the Form N 311 Rev 2019 Refundable Foodexcise Tax Credit Forms 2019 Fillable on iOS devices

How to create an eSignature for the Form N 311 Rev 2019 Refundable Foodexcise Tax Credit Forms 2019 Fillable on Android devices

People also ask

-

What is the 2019 n 311 form and why is it important?

The 2019 n 311 form is a document used for reporting non-emergency issues to city services. It is important because it helps streamline communication between citizens and government agencies, ensuring that concerns are addressed efficiently.

-

Can I eSign the 2019 n 311 form using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the 2019 n 311 form easily and securely. Our platform makes it simple to complete and sign documents electronically, eliminating the need for printing or scanning.

-

Is there a cost associated with using airSlate SignNow for the 2019 n 311 form?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for eSigning documents like the 2019 n 311 form. You can choose a plan that fits your needs, ensuring you only pay for what you use.

-

What features does airSlate SignNow provide for the 2019 n 311 form?

airSlate SignNow provides a range of features for the 2019 n 311 form, including easy document editing, secure eSigning, and real-time tracking. These tools enhance your ability to manage and submit your reports effectively.

-

Can I integrate airSlate SignNow with other applications while using the 2019 n 311 form?

Absolutely! airSlate SignNow supports integrations with several applications, allowing you to manage the 2019 n 311 form seamlessly alongside your other essential tools. This integration capability improves workflow efficiency and document handling.

-

How can airSlate SignNow improve the submission process for the 2019 n 311 form?

Using airSlate SignNow can signNowly improve the submission process for the 2019 n 311 form by reducing time delays and ensuring secure submissions. Our intuitive platform allows users to fill out and submit forms quickly, leading to faster resolutions.

-

Is the 2019 n 311 form submission through airSlate SignNow legally binding?

Yes, submissions of the 2019 n 311 form through airSlate SignNow are legally binding. Our platform follows industry standards for electronic signatures, ensuring that your signed documents are valid and enforceable.

Get more for N311

- Last will and testament of free arizona legal forms

- Form weight and balance

- City of greeley application amp permit form

- Assignment front page form

- California dmv information security agreement lexisnexis

- Alabama adoption report 2009 2019 form

- Troop roster form girl scouts of connecticut gsofct

- To download all documents new directions behavioral health form

Find out other N311

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement