Form N 311, Rev , Refundable FoodExcise Tax Credit 2024-2026

What is the Form N-311, Refundable Food Excise Tax Credit

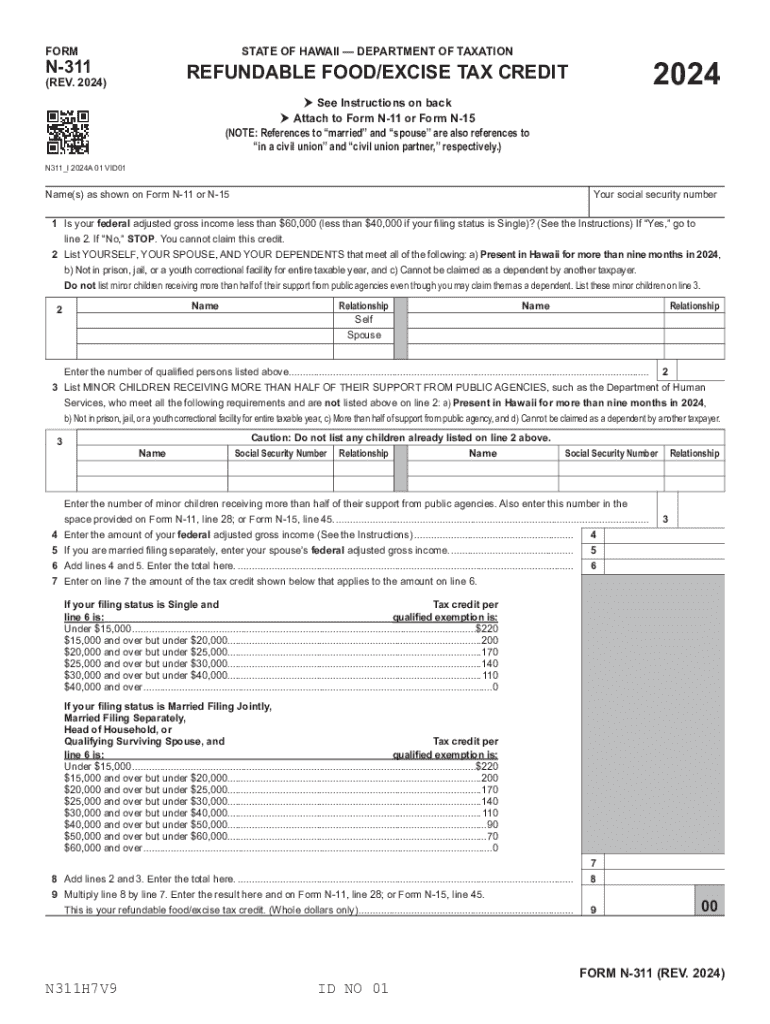

The Form N-311 is a tax form used in Hawaii for claiming the refundable food excise tax credit. This credit is designed to provide financial relief to eligible taxpayers by reimbursing them for the food excise tax paid on certain food purchases. The form is essential for individuals and families who meet specific income criteria and wish to benefit from this tax relief. Understanding the purpose of the Form N-311 is crucial for ensuring that taxpayers can accurately claim the credit and receive the appropriate refund.

Eligibility Criteria for the Refundable Food Excise Tax Credit

To qualify for the refundable food excise tax credit, taxpayers must meet certain eligibility requirements. These include:

- Residency in Hawaii for the entire tax year.

- Filing a Hawaii state tax return.

- Meeting specific income thresholds, which may vary based on family size.

It is important for applicants to review the latest guidelines to ensure they meet all criteria before completing the Form N-311.

Steps to Complete the Form N-311

Completing the Form N-311 involves several key steps. Taxpayers should follow these instructions to ensure accurate submission:

- Gather necessary documentation, including proof of income and any relevant tax information.

- Fill out the personal information section, including name, address, and Social Security number.

- Calculate the total food excise tax paid during the year.

- Determine eligibility based on income and family size.

- Complete the credit calculation section, ensuring all figures are accurate.

- Review the form for any errors before submission.

Taking these steps can help ensure a smooth filing process and expedite any potential refunds.

How to Obtain the Form N-311

The Form N-311 can be obtained through several channels. Taxpayers can access the form by:

- Visiting the official Hawaii Department of Taxation website, where the form is available for download.

- Requesting a physical copy by contacting the Hawaii Department of Taxation directly.

- Visiting local tax offices or community centers that may have copies available.

It is advisable to obtain the form early to allow sufficient time for completion and submission.

Form Submission Methods

Taxpayers have multiple options for submitting the Form N-311. They can choose to:

- File online through the Hawaii Department of Taxation's e-filing system, if available.

- Mail the completed form to the designated tax office address.

- Deliver the form in person at local tax offices during business hours.

Choosing the right submission method can help ensure timely processing of the tax credit claim.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-311 are crucial for taxpayers to remember. Typically, the form must be submitted by the same deadline as the Hawaii state income tax return. For the 2024 tax year, this is usually April 20. Taxpayers should also be aware of any changes to deadlines or special extensions that may apply. Staying informed about these dates can help prevent missed opportunities for claiming the refundable food excise tax credit.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev refundable foodexcise tax credit

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev refundable foodexcise tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the refundable food excise tax credit?

The refundable food excise tax credit is a financial incentive designed to support businesses in the food industry by reimbursing a portion of the excise taxes paid on food products. This credit can signNowly reduce your overall tax burden, allowing you to reinvest in your business. Understanding this credit can help you maximize your savings and improve your cash flow.

-

How can airSlate SignNow help me apply for the refundable food excise tax credit?

airSlate SignNow provides an efficient platform for managing and signing documents related to the refundable food excise tax credit application. With our easy-to-use interface, you can quickly prepare, send, and eSign necessary forms, ensuring a smooth application process. This streamlines your efforts and helps you focus on maximizing your tax benefits.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time collaboration to help you manage tax-related documents effectively. These tools ensure that your applications for the refundable food excise tax credit are organized and easily accessible. Additionally, our platform supports electronic signatures, making the process faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the refundable food excise tax credit?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can manage your documents and apply for the refundable food excise tax credit without breaking the bank. We provide transparent pricing with no hidden fees, allowing you to budget effectively.

-

What are the benefits of using airSlate SignNow for tax credits?

Using airSlate SignNow for managing your refundable food excise tax credit applications offers numerous benefits, including increased efficiency and reduced paperwork. Our platform simplifies the document signing process, allowing you to focus on your business rather than administrative tasks. Additionally, our secure system ensures that your sensitive information is protected.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your ability to manage the refundable food excise tax credit process. This integration allows for automatic data transfer, reducing the risk of errors and saving you time. You can streamline your workflow and ensure that all your tax-related documents are in one place.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, employing advanced encryption and secure cloud storage to protect sensitive information related to the refundable food excise tax credit. Our platform complies with industry standards and regulations, ensuring that your data remains confidential and secure. You can trust us to safeguard your important tax documents.

Get more for Form N 311, Rev , Refundable FoodExcise Tax Credit

- Cracker barrel wage statements form

- Unmarried certificate format for kanyashree pdf

- Pma entrance exam reviewer pdf form

- Restaurant business plan sample in ethiopia pdf form

- 11th class physics target pdf download form

- All things algebra unit 7 answer key form

- Participation affidavit form

- Bayonne opra request form forward jfcii edit doc

Find out other Form N 311, Rev , Refundable FoodExcise Tax Credit

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free