Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable 2023

Understanding the Form N-311

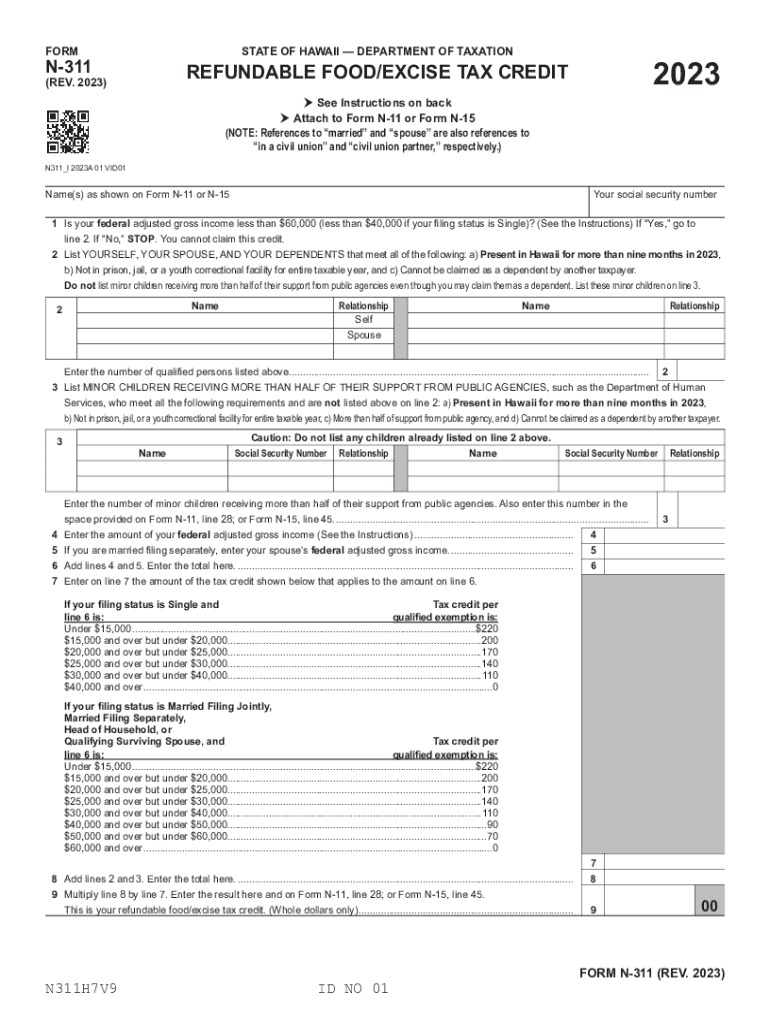

The Form N-311 is a crucial document for residents of Hawaii seeking to claim the Refundable Food Excise Tax Credit. This form allows eligible taxpayers to receive a refund for a portion of the food excise tax they have paid. The credit aims to alleviate the financial burden of food costs for low- and moderate-income households. Understanding this form is essential for ensuring that you receive the benefits to which you are entitled.

How to Complete the Form N-311

Filling out the Form N-311 requires attention to detail. Begin by gathering necessary information, including your Social Security number, income details, and any relevant tax documents. Follow the instructions on the form carefully, ensuring that all sections are completed accurately. Pay special attention to the eligibility criteria, as this will determine the amount of credit you may receive. Once completed, review the form for any errors before submission.

Eligibility Criteria for the Refundable Food Excise Tax Credit

To qualify for the Refundable Food Excise Tax Credit on Form N-311, you must meet specific eligibility requirements. Generally, you must be a resident of Hawaii and have a gross income below a certain threshold. Additionally, the credit is designed for low- and moderate-income households, so your financial situation will be assessed. Ensure you check the latest guidelines to confirm your eligibility before applying.

Filing Deadlines for Form N-311

Timely submission of Form N-311 is essential to receive your tax credit. The filing deadline typically aligns with the state income tax return deadline. For most taxpayers, this is usually April 20th of the following year. However, if you are filing for the 2020 Hawaii food tax credit, ensure you confirm the specific date for that tax year, as extensions may apply under certain circumstances.

Submitting the Form N-311

You can submit Form N-311 through various methods. Options typically include online submission via the Hawaii Department of Taxation's website, mailing a paper form, or submitting it in person at designated tax offices. Each method has its advantages, so choose the one that best fits your needs. Ensure you keep a copy of the submitted form for your records.

Key Elements of the Form N-311

Form N-311 includes several key elements that are essential for claiming the food excise tax credit. These elements typically include personal information, income details, and specific calculations related to the food excise tax paid. Understanding these components will help you accurately complete the form and maximize your potential refund.

Quick guide on how to complete form n 311 rev refundable foodexcise tax credit forms fillable

Complete Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable effortlessly

- Locate Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages your document administration needs in just a few clicks from your preferred device. Edit and electronically sign Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev refundable foodexcise tax credit forms fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev refundable foodexcise tax credit forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of documents can I eSign related to 2020 Hawaii food businesses?

You can eSign a variety of documents, including contracts, order forms, and agreements specific to 2020 Hawaii food businesses. This allows you to streamline operations and ensure compliance in your transactions. Utilizing airSlate SignNow makes it easy to manage all your documents efficiently.

-

How does airSlate SignNow support small businesses in the 2020 Hawaii food industry?

airSlate SignNow offers a cost-effective solution for small businesses in the 2020 Hawaii food industry by reducing the time spent on paperwork. With our platform, you can quickly send, sign, and organize documents, allowing you to focus more on your culinary creations and less on administrative tasks.

-

What are the pricing plans available for eSigning 2020 Hawaii food documents?

We provide several pricing plans to cater to different needs, starting from a basic plan suitable for startups in the 2020 Hawaii food sector to premium plans for larger businesses. Each plan includes specific features designed to help you manage your documents affordably. Check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other tools I use for my 2020 Hawaii food business?

Yes, airSlate SignNow offers integrations with various tools commonly used in the 2020 Hawaii food business, such as CRM systems, accounting software, and payment processors. This ensures a seamless workflow and helps you manage your business operations more effectively.

-

What features does airSlate SignNow offer that are beneficial for the 2020 Hawaii food sector?

AirSlate SignNow features tools such as templates, team collaboration, and automated reminders that are particularly beneficial for the 2020 Hawaii food sector. These features help you stay organized and ensure important documents are signed on time, improving overall efficiency in business processes.

-

Is there a mobile app available for managing 2020 Hawaii food eSignatures?

Yes, airSlate SignNow has a mobile app that allows you to manage your 2020 Hawaii food eSignatures on the go. Whether you're in the kitchen or meeting with clients, you can easily send and sign documents from your mobile device.

-

How secure is airSlate SignNow for handling sensitive 2020 Hawaii food documents?

airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption and comply with industry regulations to ensure that all sensitive data related to your 2020 Hawaii food business is protected from unauthorized access.

Get more for Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable

Find out other Form N 311, Rev , Refundable FoodExcise Tax Credit Forms Fillable

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form