Are You Eligible to Use a DR 15EZ Return 2020

What is the Are You Eligible To Use A DR 15EZ Return

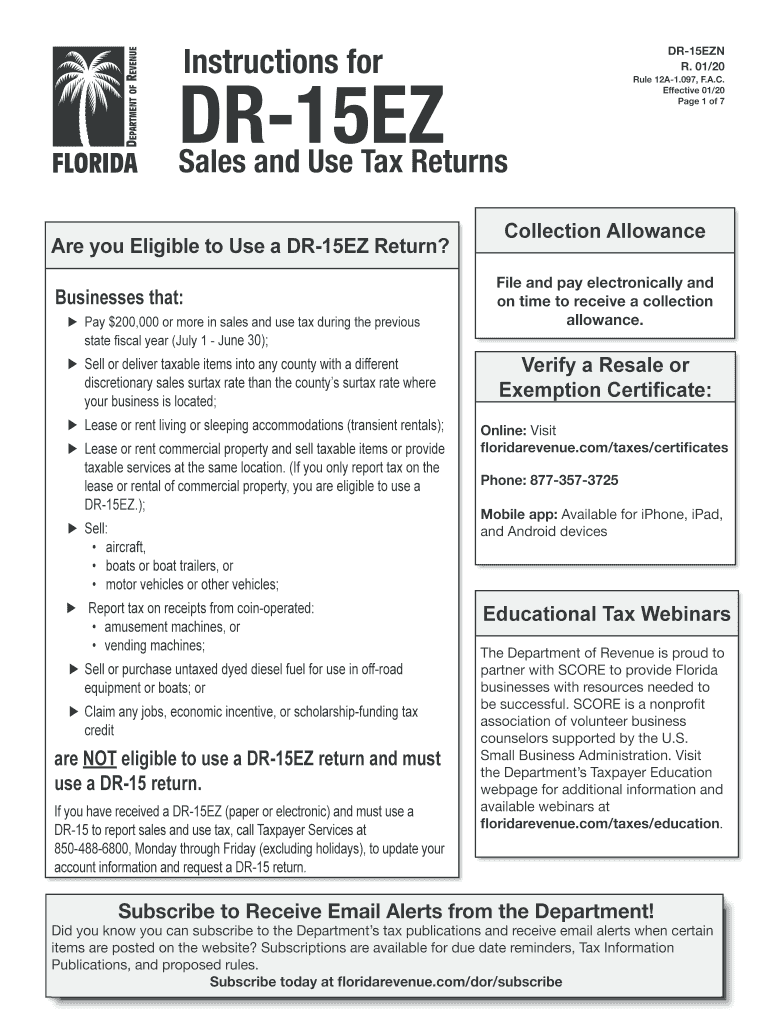

The Are You Eligible To Use A DR 15EZ Return is a simplified tax form designed for certain taxpayers in Florida who meet specific criteria. This form allows eligible individuals to file their state income taxes with less complexity compared to standard forms. Typically, it is intended for those with straightforward tax situations, such as single filers or those without significant deductions or credits. Understanding the qualifications is crucial to ensure compliance and to take advantage of the streamlined process.

Eligibility Criteria

To utilize the DR 15EZ Return, taxpayers must meet several eligibility criteria. Generally, these include:

- Filing status must be single or married filing jointly.

- Adjusted gross income must fall below a specified threshold, which is updated annually.

- No dependents can be claimed on the tax return.

- Taxpayers must not have any income from self-employment or rental properties.

It is important to review these criteria carefully to confirm eligibility before proceeding with the form.

Steps to Complete the Are You Eligible To Use A DR 15EZ Return

Completing the DR 15EZ Return involves several straightforward steps:

- Gather all necessary financial documents, including W-2 forms and any other income statements.

- Ensure you meet the eligibility criteria outlined for the DR 15EZ Return.

- Fill out the form accurately, providing all required information, such as income and deductions.

- Review the completed form for accuracy and completeness.

- Submit the form either online or via mail, depending on your preference.

Following these steps can help streamline the filing process and reduce the likelihood of errors.

How to Obtain the Are You Eligible To Use A DR 15EZ Return

The DR 15EZ Return form can be obtained through various channels. Taxpayers can download the form directly from the Florida Department of Revenue website or request a physical copy by contacting their local tax office. Additionally, many tax preparation software programs include the DR 15EZ form, allowing users to fill it out electronically. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax law.

Legal Use of the Are You Eligible To Use A DR 15EZ Return

The legal use of the DR 15EZ Return is governed by state tax laws. When completed correctly, this form serves as a legally binding document for filing state income taxes. It is essential to provide accurate information and adhere to all filing requirements to avoid potential penalties. Understanding the legal implications of submitting this form is vital for ensuring compliance and protecting oneself from future audits or legal issues.

Filing Deadlines / Important Dates

Timely filing of the DR 15EZ Return is crucial to avoid penalties. The general deadline for filing state income tax returns in Florida typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify any specific changes or extensions that may apply in a given tax year. Keeping track of these important dates can help ensure that all necessary forms are submitted on time.

Quick guide on how to complete are you eligible to use a dr 15ez return

Effortlessly Complete Are You Eligible To Use A DR 15EZ Return on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Are You Eligible To Use A DR 15EZ Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Alter and Electronically Sign Are You Eligible To Use A DR 15EZ Return with Ease

- Obtain Are You Eligible To Use A DR 15EZ Return and click on Get Form to begin.

- Utilize our tools to complete your document.

- Highlight pertinent sections of the documents or black out sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Are You Eligible To Use A DR 15EZ Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct are you eligible to use a dr 15ez return

Create this form in 5 minutes!

How to create an eSignature for the are you eligible to use a dr 15ez return

How to generate an electronic signature for your Are You Eligible To Use A Dr 15ez Return online

How to make an electronic signature for the Are You Eligible To Use A Dr 15ez Return in Chrome

How to make an eSignature for putting it on the Are You Eligible To Use A Dr 15ez Return in Gmail

How to create an eSignature for the Are You Eligible To Use A Dr 15ez Return straight from your mobile device

How to make an electronic signature for the Are You Eligible To Use A Dr 15ez Return on iOS devices

How to make an eSignature for the Are You Eligible To Use A Dr 15ez Return on Android OS

People also ask

-

What are the basic instructions dr 15ez for signing documents using airSlate SignNow?

To get started with airSlate SignNow, follow these simple instructions dr 15ez: first, create an account. Once logged in, upload your document, add fields for signatures, and then send it to your recipients. They can sign electronically, and you'll receive a notification once everything is completed.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on your needs. The basic plan starts at a competitive rate, giving you access to essential features. For advanced functionalities, like templates and integrations, you can review the instructions dr 15ez on the pricing page for more detailed options.

-

What features are included in the airSlate SignNow platform?

airSlate SignNow offers a range of features designed to enhance document management. Key functionalities include eSigning, document templates, and collaboration tools, all streamlined in easy-to-follow instructions dr 15ez. These features help simplify the signing process for users.

-

What are the benefits of using airSlate SignNow for eSignature needs?

The primary benefit of airSlate SignNow is its user-friendliness coupled with robust security. With electronic signatures that comply with legal standards, businesses reduce turnaround time signNowly. Following the instructions dr 15ez, users can automate tasks and enhance workflow efficiency.

-

Can airSlate SignNow be integrated with other applications?

Yes, airSlate SignNow boasts numerous integrations with popular applications like Google Drive and Salesforce. These integrations streamline your workflow and make document handling more efficient. Refer to the instructions dr 15ez on our website for a comprehensive list of integration options.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. With affordable pricing and user-friendly features, it’s a great choice for those looking to optimize their document signing process. Follow the instructions dr 15ez to get started easily.

-

How secure is airSlate SignNow for electronic signatures?

Security is a top priority for airSlate SignNow, as it adopts stringent measures to protect your data. The platform complies with various security regulations to ensure that electronic signatures are secure and valid. For detailed guidelines, check our instructions dr 15ez for security features.

Get more for Are You Eligible To Use A DR 15EZ Return

Find out other Are You Eligible To Use A DR 15EZ Return

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple