DR 15EZ Florida Department of Revenue 2021

What is the DR 15EZ Florida Department Of Revenue

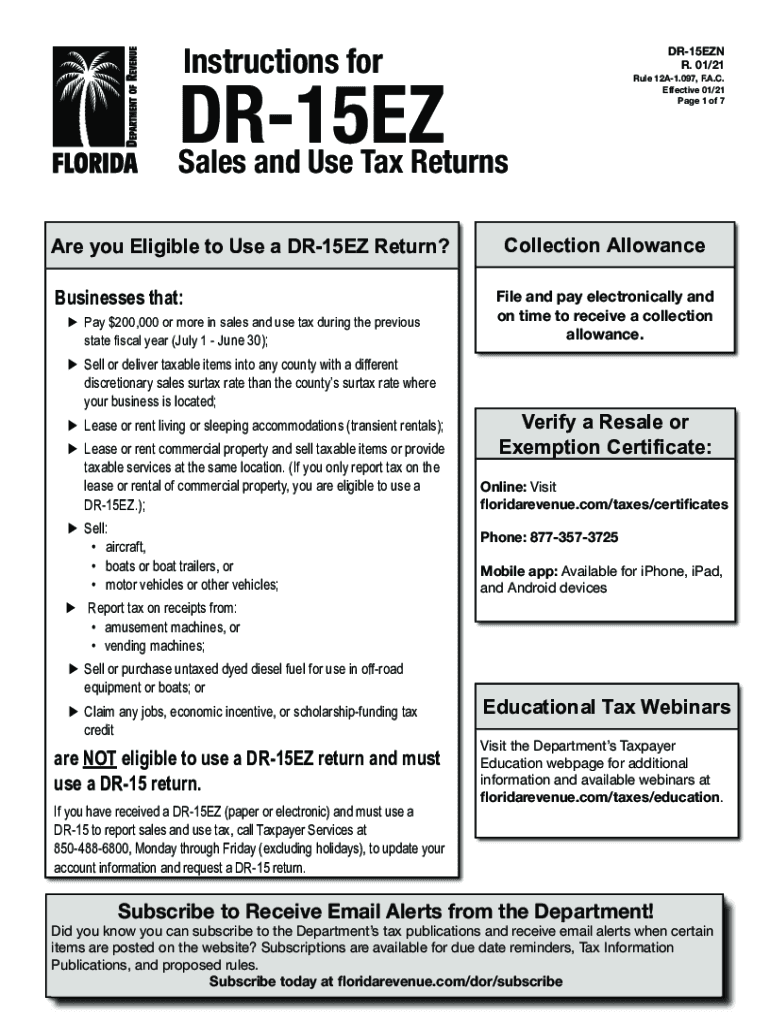

The DR 15EZ is a form issued by the Florida Department of Revenue that is used for reporting and paying sales and use tax. This form simplifies the process for businesses that have straightforward tax situations, allowing them to efficiently fulfill their tax obligations. The DR 15EZ is particularly beneficial for small businesses and individuals who may not have extensive tax liabilities or complex transactions.

How to use the DR 15EZ Florida Department Of Revenue

Using the DR 15EZ involves several steps to ensure accurate reporting and compliance with Florida tax laws. First, gather all necessary sales data, including total sales, taxable sales, and any exemptions. Next, complete the form by entering the required information, such as your business details and tax amounts. After filling out the form, review it carefully for accuracy before submitting it to the Florida Department of Revenue.

Steps to complete the DR 15EZ Florida Department Of Revenue

Completing the DR 15EZ requires a systematic approach:

- Collect all relevant sales data for the reporting period.

- Fill in your business information, including your name, address, and sales tax registration number.

- Input total sales and taxable sales figures in the appropriate fields.

- Calculate the total tax due based on the applicable rates.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the DR 15EZ Florida Department Of Revenue

The DR 15EZ form is legally binding when completed accurately and submitted in accordance with Florida tax regulations. It is essential to ensure that all information is truthful and complete, as any discrepancies can lead to penalties or legal issues. The form must be filed by the designated due dates to avoid late fees and maintain compliance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the DR 15EZ vary based on the reporting period. Typically, forms are due on a monthly or quarterly basis, depending on the volume of sales. It is crucial for businesses to be aware of these deadlines to avoid penalties. Staying informed about important dates can help ensure timely submissions and compliance with Florida tax requirements.

Form Submission Methods (Online / Mail / In-Person)

The DR 15EZ can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Florida Department of Revenue's website.

- Mailing the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated Department of Revenue offices.

Quick guide on how to complete dr 15ez florida department of revenue 547990108

Complete DR 15EZ Florida Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your files swiftly without interruptions. Handle DR 15EZ Florida Department Of Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign DR 15EZ Florida Department Of Revenue without hassle

- Obtain DR 15EZ Florida Department Of Revenue and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign DR 15EZ Florida Department Of Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 15ez florida department of revenue 547990108

Create this form in 5 minutes!

How to create an eSignature for the dr 15ez florida department of revenue 547990108

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What are the instructions dr 15ez for using airSlate SignNow?

The instructions dr 15ez for using airSlate SignNow provide a step-by-step guide on how to send and eSign documents efficiently. These instructions make it easy for users to navigate the platform and utilize its features without any confusion. Following these instructions ensures you can maximize the benefits of airSlate SignNow.

-

How much does it cost to use airSlate SignNow as per the instructions dr 15ez?

Pricing for airSlate SignNow varies depending on the chosen plan, but the instructions dr 15ez help you understand the pricing tiers. You can choose from different plans that cater to various business sizes and needs. Each plan offers competitive rates that provide excellent value for document signing solutions.

-

What features does airSlate SignNow include as outlined in the instructions dr 15ez?

The instructions dr 15ez highlight several key features of airSlate SignNow, including templates, document tracking, and mobile access. These features enhance user experience by making document management seamless and efficient. Users can also customize workflows and automate processes to save time.

-

Can airSlate SignNow integrate with other applications as per the instructions dr 15ez?

Yes, airSlate SignNow can integrate with a variety of third-party applications as mentioned in the instructions dr 15ez. Integrations include popular tools such as Google Drive, Salesforce, and Zapier, which enhance functionality and streamline workflows. This flexibility allows businesses to connect their existing systems easily.

-

What are the benefits of using airSlate SignNow as per the instructions dr 15ez?

According to the instructions dr 15ez, the benefits of using airSlate SignNow include improved efficiency and reduced paperwork. It offers a secure and legally binding way to eSign documents, accelerating transaction times and enhancing collaboration. Ultimately, it helps businesses move faster with their document processes.

-

How secure is airSlate SignNow, based on the instructions dr 15ez?

The instructions dr 15ez emphasize the security measures in place for airSlate SignNow, including encryption and authentication protocols. These features ensure that your documents are protected from unauthorized access. Users can have peace of mind knowing that their sensitive information is safe.

-

Is training available for using airSlate SignNow according to the instructions dr 15ez?

Yes, training materials are available to help users understand how to use airSlate SignNow effectively as described in the instructions dr 15ez. These materials include tutorials, webinars, and documentation that support users at every stage. Proper training can enhance your overall experience with the platform.

Get more for DR 15EZ Florida Department Of Revenue

Find out other DR 15EZ Florida Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors