Tax Table Section 6 Form

What is the Tax Table Section 6

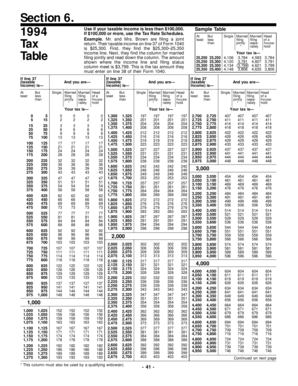

The Tax Table Section 6 is a crucial component of the U.S. tax system, specifically designed to assist taxpayers in determining their federal income tax liability. This section provides a simplified method for calculating taxes owed based on income levels and filing status. It is often used by individuals who prefer not to engage in complex calculations or who may not have access to tax preparation software. The table outlines various income brackets and corresponding tax rates, making it easier for taxpayers to estimate their tax obligations accurately.

How to use the Tax Table Section 6

Using the Tax Table Section 6 involves a straightforward process. First, identify your filing status, which can be single, married filing jointly, married filing separately, or head of household. Next, locate your total taxable income within the table. The corresponding tax amount will be indicated next to your income bracket. This allows you to quickly determine your tax liability without the need for detailed calculations. It is essential to ensure that your income is reported accurately to avoid discrepancies.

Steps to complete the Tax Table Section 6

Completing the Tax Table Section 6 requires a few key steps:

- Gather your financial documents, including W-2s and any other income statements.

- Determine your filing status based on your personal situation.

- Calculate your total taxable income, ensuring all deductions and credits are accounted for.

- Refer to the Tax Table Section 6 to find your income bracket.

- Record the corresponding tax amount next to your income on your tax return.

Legal use of the Tax Table Section 6

The legal use of the Tax Table Section 6 is governed by IRS regulations. Taxpayers must ensure that they adhere to the guidelines set forth by the IRS when utilizing this table for tax calculations. It is important to use the most current version of the tax table, as changes can occur annually based on tax law revisions. Proper use of the table not only ensures compliance but also helps in avoiding potential penalties or audits from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Table Section 6 align with the general tax filing schedule set by the IRS. Typically, individual tax returns are due on April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available, which may allow for additional time to file. It is crucial to stay informed about these dates to ensure timely submission and avoid late fees.

Examples of using the Tax Table Section 6

Examples of using the Tax Table Section 6 can clarify its practical application. For instance, a single filer with a taxable income of fifty thousand dollars would locate this amount in the table to find the corresponding tax liability. If the table indicates a tax amount of seven thousand dollars, this is the amount the taxpayer would report on their return. Such examples illustrate the table's utility in simplifying tax calculations for various income levels.

Quick guide on how to complete 1994 tax table section 6

Complete [SKS] effortlessly on any device

Digital document administration has gained more traction with businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the features you require to create, adjust, and electronically sign your documents promptly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The ultimate method to modify and electronically sign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Table Section 6

Create this form in 5 minutes!

How to create an eSignature for the 1994 tax table section 6

How to generate an electronic signature for the 1994 Tax Table Section 6 online

How to create an eSignature for the 1994 Tax Table Section 6 in Google Chrome

How to generate an eSignature for signing the 1994 Tax Table Section 6 in Gmail

How to create an eSignature for the 1994 Tax Table Section 6 from your mobile device

How to make an eSignature for the 1994 Tax Table Section 6 on iOS

How to make an electronic signature for the 1994 Tax Table Section 6 on Android OS

People also ask

-

What is the Tax Table Section 6 in airSlate SignNow?

The Tax Table Section 6 in airSlate SignNow refers to a specific section within our platform that allows users to manage tax-related documents efficiently. This feature enables businesses to ensure compliance with tax regulations and simplify their document processes. Using Tax Table Section 6 can help streamline your tax filing workflow.

-

How can airSlate SignNow help with Tax Table Section 6 management?

airSlate SignNow assists businesses in managing Tax Table Section 6 by providing user-friendly tools for document creation, eSigning, and tracking. Our platform integrates seamlessly with your existing processes, ensuring you can handle tax documents with ease and accuracy. This leads to a more organized and efficient tax handling experience.

-

Is there a cost associated with using Tax Table Section 6 in airSlate SignNow?

Yes, while airSlate SignNow offers a cost-effective solution for document management, the pricing may vary based on the features your business requires. The use of Tax Table Section 6 falls within our pricing plans, which are designed to provide value based on your specific needs. We recommend checking our pricing page for detailed information.

-

What are the benefits of using airSlate SignNow for Tax Table Section 6?

Using airSlate SignNow for Tax Table Section 6 provides numerous benefits including increased efficiency, enhanced compliance, and improved document security. Our platform simplifies the eSigning process, helping you avoid delays and errors related to tax documentation. Additionally, you'll enjoy the convenience of accessing all documents digitally.

-

Can I integrate airSlate SignNow with my existing software for Tax Table Section 6?

Absolutely! airSlate SignNow offers integrations with a variety of software applications to enhance your management of Tax Table Section 6. This allows you to maintain a seamless workflow by connecting our platform with your financial software and other necessary tools. Check our integrations page for a full list of compatible applications.

-

How does airSlate SignNow ensure the security of Tax Table Section 6 documents?

Security is a top priority for airSlate SignNow, especially concerning sensitive documents in Tax Table Section 6. We implement advanced encryption methods and secure storage solutions to protect your data from unauthorized access. Regular security audits are also conducted to maintain the integrity and safety of all documents.

-

Is airSlate SignNow user-friendly for managing Tax Table Section 6?

Yes, airSlate SignNow is designed to be user-friendly, allowing even those with limited technical expertise to manage Tax Table Section 6 easily. Our intuitive interface guides users through the document creation and signing process efficiently. Moreover, comprehensive resources and support are available to assist you whenever needed.

Get more for Tax Table Section 6

- Form fields doc judicial council forms

- Form icwa010a indian child inquiry attachment

- Court reporters notice that transcript is filed rule 11a form

- 028 termination of parental rights form

- Form 3f pub

- Petition to open trust estate form

- Respondents response to claimants form a application for change of physician

- Form 14 pub

Find out other Tax Table Section 6

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself