Overdraft Protection & Overdraft ServicesWells Fargo 2019-2026

Understanding Overdraft Protection Services

Overdraft protection is a financial service that helps account holders avoid declined transactions due to insufficient funds. This service can cover overdrafts by linking a checking account to a savings account or a line of credit. When the checking account balance falls below zero, funds from the linked account are automatically transferred to cover the shortfall. This service is particularly beneficial for individuals who may occasionally miscalculate their available balance or have unexpected expenses.

How to Utilize Overdraft Protection

To effectively use overdraft protection, account holders should first ensure that they have enrolled in the service through their bank or credit union. Once enrolled, it is essential to monitor account balances regularly. Setting up alerts for low balances can help prevent overdrafts. If an overdraft occurs, the service will automatically transfer funds from the linked account, thus avoiding fees associated with declined transactions. Understanding the terms and conditions of the overdraft protection service is crucial for managing potential fees and limits.

Obtaining Overdraft Protection Services

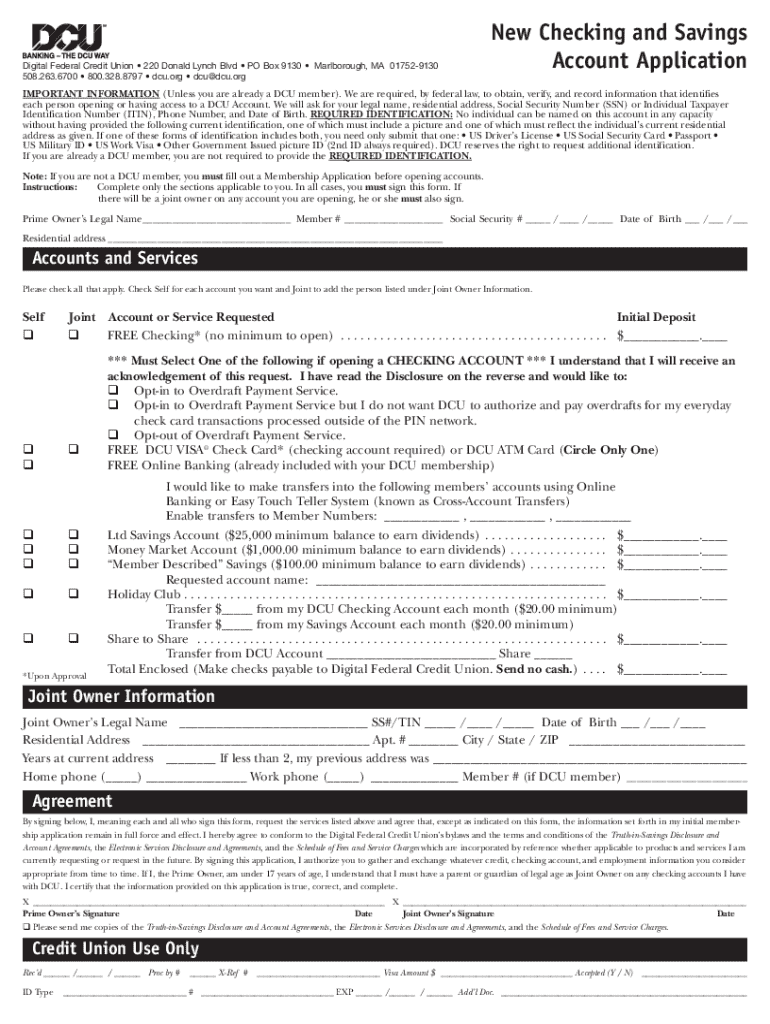

To obtain overdraft protection, individuals typically need to fill out an application form, which can often be completed online. This may involve providing personal information, including account details and financial history. After submission, the financial institution will review the application and notify the applicant of the approval status. It is important to understand any associated fees and the limits of the overdraft protection before finalizing the enrollment.

Steps to Complete the Overdraft Protection Application

Completing the application for overdraft protection generally involves several steps:

- Log into your online banking account or visit your financial institution's website.

- Locate the overdraft protection application section.

- Fill out the required information, including your checking and savings account details.

- Review the terms and conditions associated with the service.

- Submit the application for review.

After submission, keep an eye on your email or account notifications for updates regarding your application status.

Key Elements of Overdraft Protection Services

Several key elements define the effectiveness of overdraft protection services:

- Transfer Limits: Understand how much can be transferred from linked accounts.

- Fees: Be aware of any fees charged for using overdraft protection.

- Eligibility: Check if your accounts qualify for the service.

- Notification: Some institutions provide alerts when an overdraft occurs or when funds are transferred.

Being informed about these elements can help account holders make the most of their overdraft protection services.

Legal Considerations for Overdraft Protection

Overdraft protection services are subject to various legal regulations. Financial institutions must clearly disclose the terms of the service, including any fees and the process for opting in or out. Compliance with federal regulations, such as the Truth in Lending Act, ensures that consumers are protected from unfair practices. It is advisable for consumers to read all documentation provided by their bank or credit union regarding overdraft protection to fully understand their rights and responsibilities.

Examples of Overdraft Protection in Use

Consider a scenario where an individual has a checking account with a balance of fifty dollars. If they make a purchase of seventy dollars, the overdraft protection service can automatically transfer twenty dollars from their linked savings account to cover the transaction. This prevents the purchase from being declined and avoids potential overdraft fees. Another example is when a recurring bill is due, and the checking account balance is insufficient. The overdraft protection can ensure that the bill is paid on time, maintaining the individual's credit standing.

Quick guide on how to complete overdraft protection ampamp overdraft serviceswells fargo

Effortlessly prepare Overdraft Protection & Overdraft ServicesWells Fargo on any device

Digital document management has gained popularity among both businesses and individuals. It offers a great environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Overdraft Protection & Overdraft ServicesWells Fargo on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Overdraft Protection & Overdraft ServicesWells Fargo with ease

- Obtain Overdraft Protection & Overdraft ServicesWells Fargo and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Overdraft Protection & Overdraft ServicesWells Fargo and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct overdraft protection ampamp overdraft serviceswells fargo

Create this form in 5 minutes!

How to create an eSignature for the overdraft protection ampamp overdraft serviceswells fargo

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Overdraft Protection & Overdraft Services at Wells Fargo?

Overdraft Protection & Overdraft Services at Wells Fargo are financial tools designed to help customers manage their accounts effectively by preventing overdrafts. This service automatically covers transactions when you have insufficient funds, ensuring that bills and purchases are paid seamlessly. With these services, you can avoid costly overdraft fees and maintain peace of mind.

-

How much does Overdraft Protection & Overdraft Services cost at Wells Fargo?

The cost of Overdraft Protection & Overdraft Services at Wells Fargo may vary based on the specific account type and the terms of your agreement. Typically, customers may incur fees for overdraft transactions, but there are options to opt-in for a monthly fee that covers multiple overdrafts. It's important to review the fee schedule and speak with a Wells Fargo representative for detailed pricing information.

-

What are the benefits of using Overdraft Protection & Overdraft Services at Wells Fargo?

Utilizing Overdraft Protection & Overdraft Services at Wells Fargo provides numerous benefits, including the ability to avoid declined transactions and the associated fees. This service helps you manage your cash flow more effectively, ensuring that you can cover emergencies and unexpected expenses. Additionally, it offers peace of mind knowing that your payments will go through even when your account balance is low.

-

How do I enroll in Overdraft Protection & Overdraft Services at Wells Fargo?

Enrolling in Overdraft Protection & Overdraft Services at Wells Fargo is simple. You can sign up online through your Wells Fargo online banking account, visit a local branch, or contact customer service for assistance. Make sure to have your account information ready, as this will streamline the enrollment process.

-

Can I customize my Overdraft Protection & Overdraft Services options at Wells Fargo?

Yes, Wells Fargo allows customers to customize their Overdraft Protection & Overdraft Services options to suit their individual needs. You can choose to link your checking account to a savings account or a line of credit, providing flexibility in how overdrafts are covered. Review your options to select the best protection plan for your financial situation.

-

What happens if I exceed my overdraft limit with Wells Fargo's Overdraft Protection & Overdraft Services?

If you exceed your overdraft limit while using Wells Fargo's Overdraft Protection & Overdraft Services, your transactions may be declined, and you could incur additional fees. It's essential to monitor your account balance and understand the terms of your overdraft coverage to avoid such situations. Regularly checking your account can help you stay within your limits.

-

Are there any alternatives to Overdraft Protection & Overdraft Services at Wells Fargo?

Yes, there are alternatives to Overdraft Protection & Overdraft Services at Wells Fargo, including setting up alerts for low balances or maintaining a buffer in your account. Additionally, you might consider establishing a savings account for emergencies or exploring credit options that can provide financial flexibility. Always review your financial habits to find the best strategy for your needs.

Get more for Overdraft Protection & Overdraft ServicesWells Fargo

Find out other Overdraft Protection & Overdraft ServicesWells Fargo

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation