Tr2 Revenue Form

What is the TR2 Revenue?

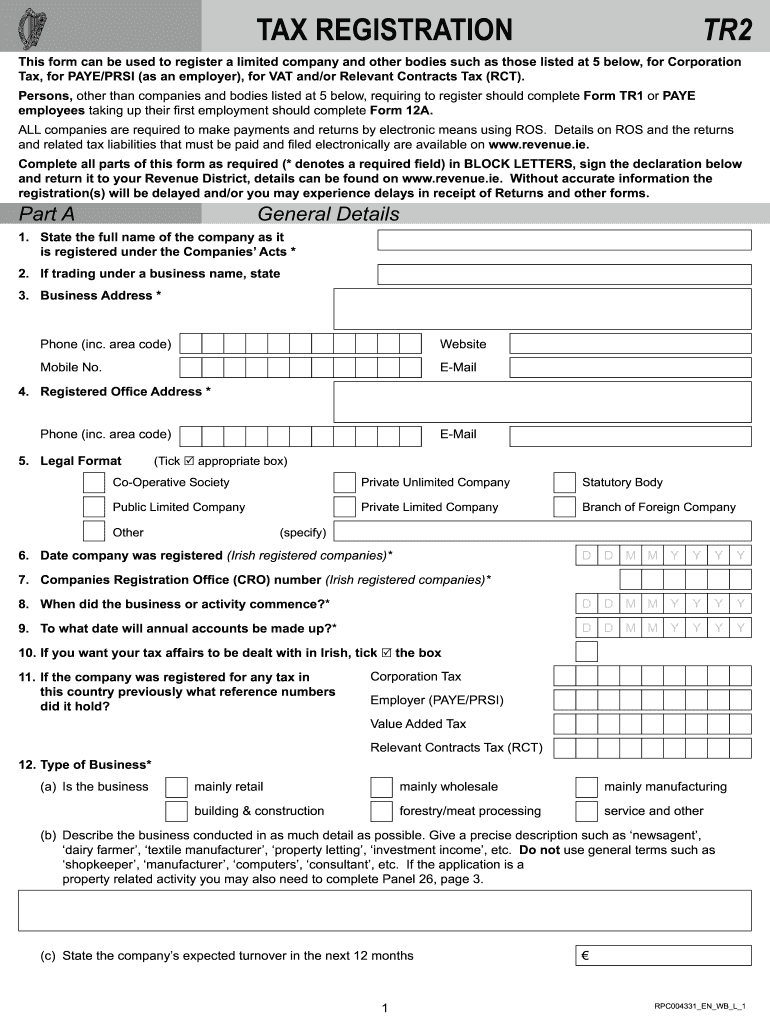

The TR2 form is a critical document used for tax registration in Ireland. It is primarily designed for individuals and businesses that need to register for tax purposes with Revenue Ireland. This form collects essential information about the taxpayer, including their personal details, business type, and tax obligations. Understanding the TR2 form is crucial for ensuring compliance with tax regulations and for facilitating smooth interactions with the tax authority.

Steps to Complete the TR2 Revenue

Completing the TR2 form involves several straightforward steps. First, gather all necessary personal and business information, such as your name, address, and tax identification number. Next, accurately fill out the form, ensuring that all fields are completed as required. It is essential to double-check the information for accuracy to avoid any delays in processing. Once completed, you can submit the form electronically or by mail, depending on your preference.

Legal Use of the TR2 Revenue

The TR2 form must be filled out correctly to be considered legally binding. It is essential to comply with all relevant tax laws and regulations when submitting this form. Electronic submissions are legally recognized, provided they meet specific criteria outlined by the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the TR2 form, when submitted electronically, holds the same legal weight as a paper document.

Required Documents

When filling out the TR2 form, certain documents may be required to support your application. These typically include proof of identity, such as a driver's license or passport, and documentation that verifies your business activities, like a business registration certificate. Having these documents ready can streamline the registration process and help ensure that your application is approved without unnecessary delays.

Form Submission Methods

The TR2 form can be submitted through various methods, providing flexibility for taxpayers. You can choose to submit the form online via the Revenue Ireland website, which is often the quickest option. Alternatively, you can print the form and mail it to the appropriate Revenue office. In-person submissions may also be possible at designated locations, depending on your circumstances. Each method has its own processing times, so consider your needs when choosing how to submit.

Penalties for Non-Compliance

Failing to submit the TR2 form or providing inaccurate information can lead to significant penalties. Revenue Ireland enforces strict compliance measures, and taxpayers who do not adhere to registration requirements may face fines or legal repercussions. It is crucial to ensure that the form is submitted on time and that all information is accurate to avoid any potential issues with the tax authority.

Quick guide on how to complete tr2 revenue

Complete Tr2 Revenue effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Tr2 Revenue on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Tr2 Revenue with ease

- Obtain Tr2 Revenue and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or via an invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Tr2 Revenue and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr2 revenue

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is Tr2 Revenue and how does it relate to airSlate SignNow?

Tr2 Revenue refers to the revenue generated through the sales and usage of the airSlate SignNow platform. By leveraging airSlate SignNow, businesses can streamline their document signing process, resulting in increased efficiency and ultimately higher revenue. This makes it a valuable tool for organizations looking to enhance their Tr2 Revenue.

-

How does airSlate SignNow enhance my business's Tr2 Revenue?

By adopting airSlate SignNow, businesses can reduce the time and resources spent on document management and signing processes. This efficiency translates into faster deal closures and improved customer satisfaction, both of which contribute positively to your Tr2 Revenue. Additionally, automated workflows minimize errors, ensuring a smoother transaction process.

-

What pricing plans are available for airSlate SignNow, and how do they support Tr2 Revenue?

airSlate SignNow offers flexible pricing plans designed to meet the needs of businesses of all sizes. Each plan is strategically priced to ensure that you maximize your return on investment, positively impacting your Tr2 Revenue. By choosing the right plan, you can gain access to essential features that enhance productivity and revenue generation.

-

What key features of airSlate SignNow can drive Tr2 Revenue growth?

Key features of airSlate SignNow include customizable templates, automated workflows, and advanced eSignature capabilities. These features not only simplify the signing process but also enhance collaboration, allowing teams to work more efficiently. By using these tools effectively, businesses can signNowly boost their Tr2 Revenue.

-

Can airSlate SignNow integrate with other software to improve Tr2 Revenue?

Yes, airSlate SignNow integrates seamlessly with various software applications, including CRMs, project management tools, and cloud storage services. These integrations help streamline operations and improve data flow, which in turn can enhance customer interactions and increase Tr2 Revenue. By connecting your existing tools with airSlate SignNow, you can create a more cohesive business environment.

-

How does airSlate SignNow ensure document security while increasing Tr2 Revenue?

airSlate SignNow prioritizes document security with features such as end-to-end encryption, secure cloud storage, and compliance with industry standards. This robust security framework not only protects sensitive information but also fosters trust with clients, which is essential for maintaining and increasing your Tr2 Revenue. Secure transactions encourage repeat business and referrals.

-

What are the benefits of using airSlate SignNow for small businesses focused on Tr2 Revenue?

For small businesses, airSlate SignNow offers an affordable and user-friendly solution to manage document signing efficiently. By reducing the time spent on paperwork, small businesses can focus on growth strategies that directly impact Tr2 Revenue. Moreover, the platform's scalability allows small businesses to adapt and expand as their revenue grows.

Get more for Tr2 Revenue

Find out other Tr2 Revenue

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy