Form 944 2010

What is the Form 944

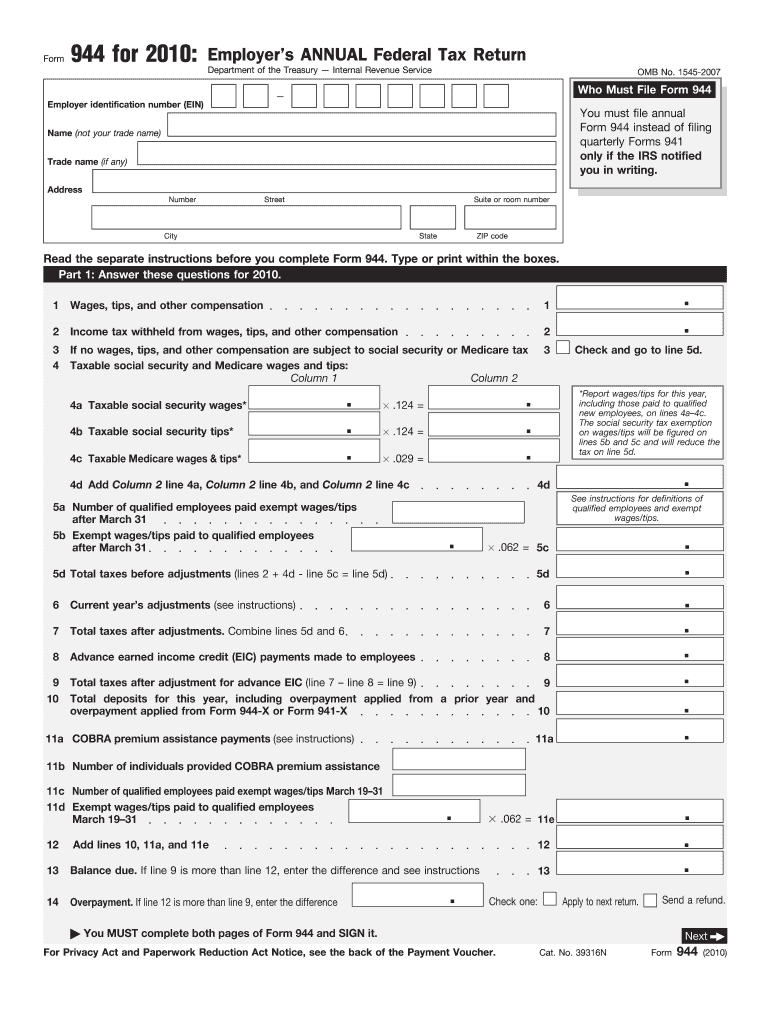

The Form 944 is an annual tax return form used by small employers in the United States to report and pay their federal payroll taxes. This form is specifically designed for those who owe less than $1,000 in payroll taxes annually. By using Form 944, eligible employers can simplify their tax reporting process, as they are required to file it only once a year instead of quarterly. This can be particularly beneficial for small businesses and self-employed individuals who may find it challenging to keep up with more frequent filings.

How to use the Form 944

Using Form 944 involves several steps to ensure accurate reporting of payroll taxes. First, employers must gather all necessary information regarding employee wages, tips, and other compensation. Next, they will calculate the total federal income tax withheld, Social Security tax, and Medicare tax. After completing the calculations, employers will fill out the form, providing details such as their business name, address, and Employer Identification Number (EIN). Finally, they must submit the completed form to the IRS by the designated filing deadline.

Steps to complete the Form 944

Completing Form 944 requires careful attention to detail. Here are the steps to follow:

- Gather information: Collect all relevant payroll records, including employee wages and tax withholdings.

- Calculate taxes: Determine the total federal income tax withheld, as well as Social Security and Medicare taxes.

- Fill out the form: Enter the calculated amounts and required business information on Form 944.

- Review for accuracy: Double-check all entries to ensure correctness before submission.

- Submit the form: Send the completed Form 944 to the IRS by the specified deadline.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines associated with Form 944. Generally, the form must be submitted by January 31 of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Employers should also keep track of any changes to these deadlines, as the IRS may occasionally adjust them.

Legal use of the Form 944

Form 944 is legally binding when completed and submitted correctly. It must be filed in compliance with IRS regulations, and all reported figures must accurately reflect the employer's payroll tax obligations. Failure to comply with the filing requirements can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential for employers to understand the legal implications of using Form 944 and to ensure that they meet all necessary requirements.

Key elements of the Form 944

Form 944 includes several key elements that employers must complete to ensure accurate reporting. These elements typically include:

- Employer Identification Number (EIN): A unique number assigned to the business for tax purposes.

- Business name and address: The official name and address of the employer.

- Payroll tax calculations: Detailed calculations of federal income tax withheld, Social Security tax, and Medicare tax.

- Signature: The form must be signed by an authorized individual, affirming the accuracy of the information provided.

Quick guide on how to complete 2010 form 944

Effortlessly Prepare Form 944 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Form 944 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to Edit and Electronically Sign Form 944 with Ease

- Locate Form 944 and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which requires only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 944 and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 944

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 944

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 944 and why do I need it?

Form 944 is an annual tax form used by small employers to report their federal payroll taxes. If your business qualifies, using Form 944 can simplify your tax reporting process, as you only need to file once a year instead of quarterly. airSlate SignNow makes it easy to eSign and send Form 944, ensuring compliance and efficiency.

-

How can airSlate SignNow help me with Form 944?

airSlate SignNow provides a user-friendly platform to prepare, send, and eSign Form 944 securely. Our solution streamlines the document workflow, allowing you to manage your tax forms efficiently and keep track of your submissions. With features like templates and reminders, you can ensure timely filing of Form 944.

-

Is there a free trial for using airSlate SignNow for Form 944?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including the management of Form 944. This trial includes access to all the tools you need to create, send, and eSign your documents. Experience the benefits of our platform without any initial commitment.

-

What features does airSlate SignNow offer for managing Form 944?

airSlate SignNow offers a variety of features for managing Form 944, including document templates, automated workflows, and secure cloud storage. You can easily create a personalized Form 944, set signers, and track the signing process in real-time. These features help you stay organized and compliant.

-

Can I integrate airSlate SignNow with my accounting software for Form 944?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your Form 944 alongside your financial records. This integration helps streamline your tax processes and ensures that all necessary data is synchronized for accurate reporting.

-

What is the pricing structure for airSlate SignNow when filing Form 944?

airSlate SignNow offers competitive pricing plans designed to fit the needs of businesses of all sizes. You can select a plan that suits your budget and usage for handling documents like Form 944. Check our pricing page for detailed information on the available packages and features.

-

How secure is airSlate SignNow for submitting Form 944?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your documents, including Form 944, during transmission and storage. Additionally, our platform complies with industry standards to ensure that your sensitive data remains confidential and secure.

Get more for Form 944

- Non represented and eligible represented employees ucm mtabsc form

- Combination storage contract bill of lading written bb milburn printing form

- Form 215 ohio secretary of state boe cuyahogacounty

- Okiepros form

- Form articles of dissolution corporation

- Monier tiles claim form

- Anjuman e shujaee houston form

- Or fiscal year enter month and year ended form

Find out other Form 944

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure