Irs Form 941 2012

What is the IRS Form 941

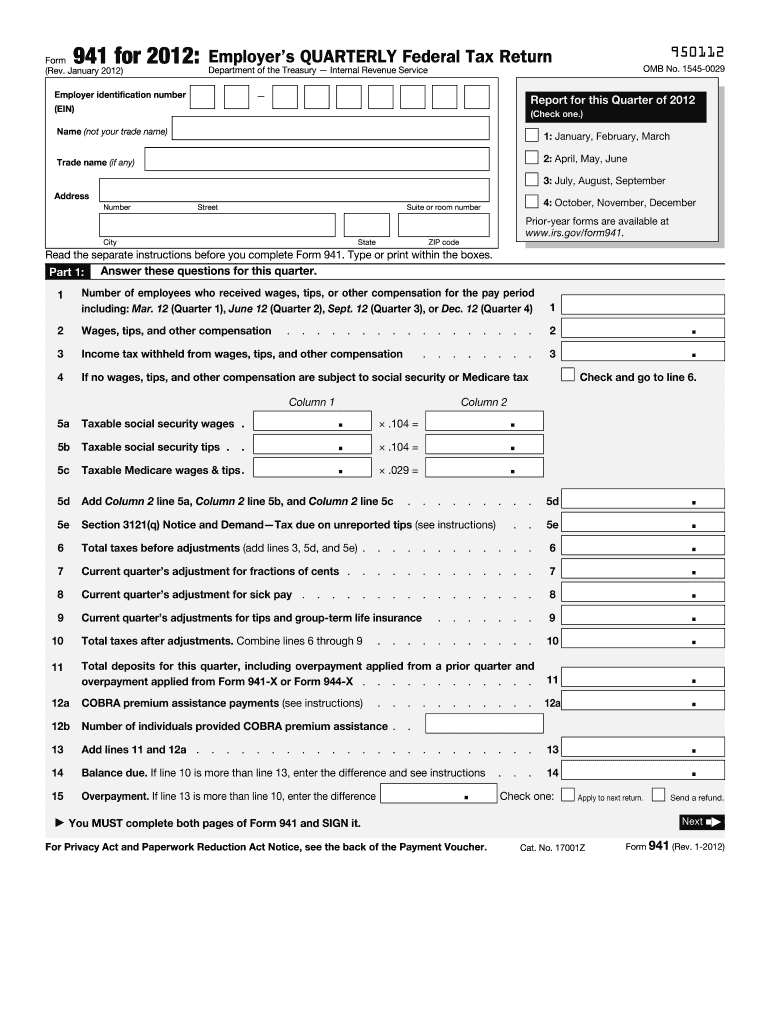

The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and provides the IRS with information about the taxes owed and the amounts that have been withheld throughout the quarter. Employers are required to submit this form to ensure compliance with federal tax regulations.

How to use the IRS Form 941

To use the IRS Form 941 effectively, employers must first gather relevant financial data, including total wages paid to employees, tips received, and any other compensation. The form requires specific details about the federal income tax withheld, Social Security wages, and Medicare wages. After completing the form, employers can file it electronically or via mail, depending on their preference and the IRS guidelines. It is essential to ensure accuracy to avoid penalties.

Steps to complete the IRS Form 941

Completing the IRS Form 941 involves several steps:

- Gather necessary information, including payroll records and tax withholding amounts.

- Fill out the form, ensuring all sections are completed accurately, including the employer identification number (EIN).

- Calculate the total taxes owed for the quarter, including federal income tax, Social Security, and Medicare taxes.

- Review the form for any errors or omissions.

- Submit the completed form electronically or through traditional mail before the deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the IRS Form 941. The due date for filing is the last day of the month following the end of each quarter. For example, for the first quarter (January to March), the form is due by April 30. It is crucial to file on time to avoid late fees and penalties. Employers should also keep track of any changes in deadlines due to holidays or IRS updates.

Legal use of the IRS Form 941

The IRS Form 941 is legally binding and must be completed accurately to comply with federal tax laws. Employers are responsible for the information provided on the form, and inaccuracies can lead to penalties or audits. It is essential to maintain proper records and documentation to support the figures reported on the form. Utilizing a reliable eSignature solution can enhance the legal validity of the completed form when submitting electronically.

Penalties for Non-Compliance

Failure to file the IRS Form 941 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, incorrect information may lead to further scrutiny and potential audits. Employers should prioritize compliance to avoid these financial repercussions and maintain a good standing with the IRS.

Quick guide on how to complete irs form 941 2012

Complete Irs Form 941 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 941 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Irs Form 941 without hassle

- Obtain Irs Form 941 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Irs Form 941 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 941 2012

Create this form in 5 minutes!

How to create an eSignature for the irs form 941 2012

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is IRS Form 941 and why is it important for businesses?

IRS Form 941 is a quarterly tax form used by employers to report income taxes, social security tax, and Medicare tax withheld from employee wages. It’s crucial for businesses to accurately complete IRS Form 941 to ensure compliance with federal tax regulations and avoid potential penalties.

-

How can airSlate SignNow help with IRS Form 941 submissions?

With airSlate SignNow, businesses can easily eSign and send IRS Form 941 electronically, streamlining the submission process. Our platform ensures that you can manage your documents efficiently and securely, making it simpler to stay compliant with IRS requirements.

-

What features does airSlate SignNow offer for handling IRS Form 941?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all tailored to simplify the management of IRS Form 941. These features help businesses quickly prepare and submit their forms without the hassle of traditional paperwork.

-

Is airSlate SignNow cost-effective for small businesses filing IRS Form 941?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. Our pricing plans are flexible and affordable, allowing you to manage IRS Form 941 filings without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for IRS Form 941?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, which makes it easy to manage your IRS Form 941 alongside your other financial documents. This integration ensures that all data is synchronized, reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for IRS Form 941 compared to paper filing?

Using airSlate SignNow for IRS Form 941 offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Additionally, electronic submissions help avoid common issues associated with paper filings such as lost documents or delayed mail.

-

How secure is my information when using airSlate SignNow for IRS Form 941?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance protocols to protect your information while you complete and submit IRS Form 941, ensuring that sensitive data remains confidential and secure.

Get more for Irs Form 941

- Nana shareholder verification fax form

- 2019 2020 application for use of alabama forest owners associations form

- Change of address form nana regional

- Ucc financing statement additional party form ucc1ap

- Request for deposit and cash verification form sb4horg sb4h

- Ira llc operating agreement template form

- Llc 3 4 7 4 8 info forwebdoc form

- Cit of tustin business license form

Find out other Irs Form 941

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement