Schedule Se Form 2015

What is the Schedule SE Form

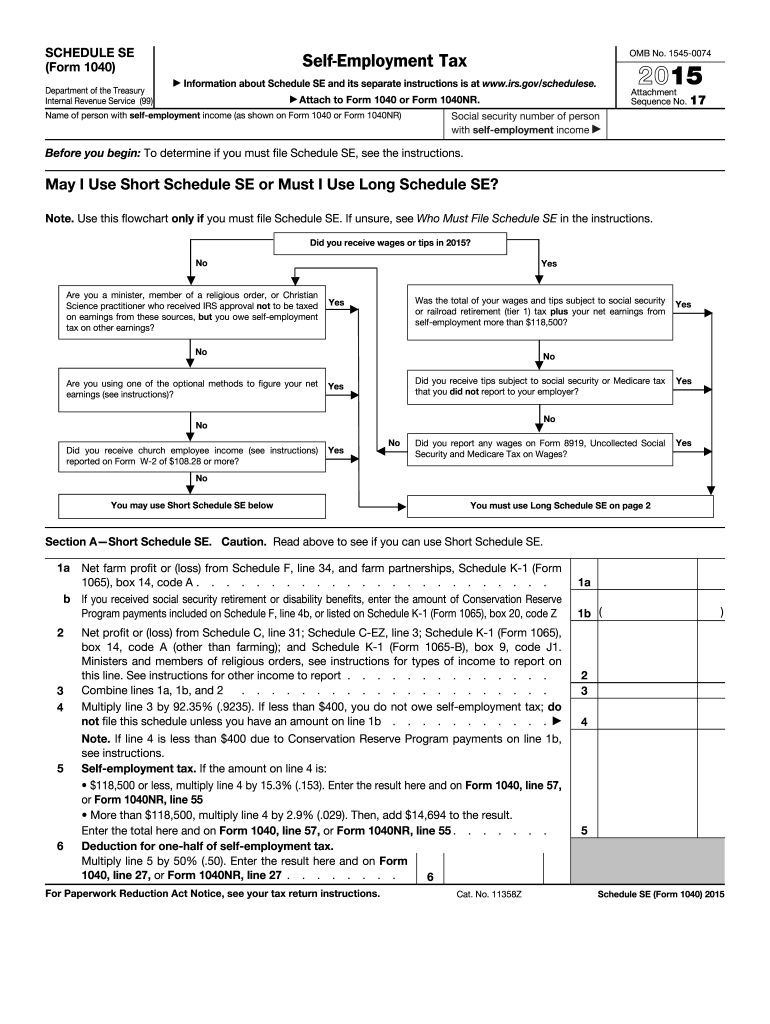

The Schedule SE Form, officially known as the Self-Employment Tax form, is used by individuals who earn income from self-employment. This form is crucial for calculating the self-employment tax, which covers Social Security and Medicare taxes for self-employed individuals. The Schedule SE is typically filed alongside the individual’s Form 1040 during tax season, ensuring that self-employed income is accurately reported and taxed. Understanding this form is essential for anyone operating as a freelancer, contractor, or small business owner in the United States.

How to use the Schedule SE Form

Using the Schedule SE Form involves several key steps. First, gather all necessary financial information related to your self-employment income, including any 1099 forms received. Next, complete the form by following the instructions provided, which guide you through calculating your net earnings and the corresponding self-employment tax. It is important to ensure that all figures are accurate to avoid potential issues with the IRS. After completing the form, attach it to your Form 1040 before submitting your tax return.

Steps to complete the Schedule SE Form

Completing the Schedule SE Form requires careful attention to detail. Here are the steps to follow:

- Gather your income documents, such as 1099-MISC or 1099-NEC forms.

- Determine your net earnings from self-employment by subtracting any allowable business expenses from your gross income.

- Fill out Part I of the form to calculate your self-employment tax based on your net earnings.

- Complete Part II if you qualify for the optional methods for calculating your self-employment tax.

- Transfer the calculated tax amount to your Form 1040.

Legal use of the Schedule SE Form

The Schedule SE Form is legally binding when completed accurately and submitted in accordance with IRS regulations. It is essential for self-employed individuals to file this form to fulfill their tax obligations. Failure to file or inaccuracies may result in penalties, interest, or audits. The form must be submitted by the tax filing deadline to avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE Form align with the general tax filing deadlines in the United States. Typically, individual tax returns, including the Schedule SE, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes to these dates annually to ensure timely submission.

Who Issues the Form

The Schedule SE Form is issued by the Internal Revenue Service (IRS), the U.S. federal agency responsible for tax collection and tax law enforcement. The form is available on the IRS website and can be downloaded or printed for use. It is important for taxpayers to use the most current version of the form to ensure compliance with any recent tax law changes.

Quick guide on how to complete schedule se 2015 form

Easily Prepare Schedule Se Form on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Schedule Se Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and eSign Schedule Se Form Effortlessly

- Obtain Schedule Se Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from a device of your choice. Edit and eSign Schedule Se Form and ensure effective communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule se 2015 form

Create this form in 5 minutes!

How to create an eSignature for the schedule se 2015 form

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Schedule Se Form feature in airSlate SignNow?

The Schedule Se Form feature in airSlate SignNow allows users to create, send, and manage documents efficiently. This feature streamlines the process of scheduling important documents for signature, ensuring timely completion and compliance. By leveraging this feature, businesses can enhance their workflow and reduce delays in document handling.

-

How does pricing work for using the Schedule Se Form feature?

Pricing for the Schedule Se Form feature in airSlate SignNow varies based on the subscription plan you choose. Each plan offers a range of features, including the ability to schedule forms for electronic signatures. We recommend checking our pricing page for detailed information on the different plans and their benefits.

-

Can I integrate the Schedule Se Form feature with other applications?

Yes, the Schedule Se Form feature in airSlate SignNow easily integrates with various applications such as Google Drive, Salesforce, and more. This integration allows you to manage your documents and workflows seamlessly across platforms. By connecting your tools, you can enhance productivity and streamline your document management process.

-

What benefits does the Schedule Se Form feature provide for businesses?

The Schedule Se Form feature offers numerous benefits, including improved efficiency in document handling and enhanced compliance through timely signatures. Businesses can save time and reduce errors associated with manual document processing. Additionally, it helps in maintaining a professional image by ensuring that all necessary documents are signed promptly.

-

Is the Schedule Se Form feature suitable for small businesses?

Absolutely! The Schedule Se Form feature in airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective solution make it easy for smaller teams to manage their document signing needs without overwhelming their resources.

-

How do I get started with the Schedule Se Form feature?

To get started with the Schedule Se Form feature, simply sign up for an account on airSlate SignNow. After setting up your account, you can easily create and schedule your forms for eSignature. Our platform provides helpful tutorials and support to guide you through the initial setup and usage.

-

What types of documents can I schedule using the Schedule Se Form feature?

You can schedule a wide range of documents using the Schedule Se Form feature, including contracts, agreements, and consent forms. This versatility allows you to handle various document types efficiently, ensuring that all necessary signatures are collected on time. The feature is perfect for both legal documents and everyday business paperwork.

Get more for Schedule Se Form

- Fingerprinting packet request form california board of accountancy dca ca

- Form arts gs articles of incorporation of a general stock corporation 399022038

- San mateo county death of real property owner form

- Boe 502 d fillable form

- Pta audit committee report form denver council ptsa

- Eclb13 form

- Blank ok llc form reinstatement

- Application for initial certification by examination or endorsement inspectors and plans form

Find out other Schedule Se Form

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast