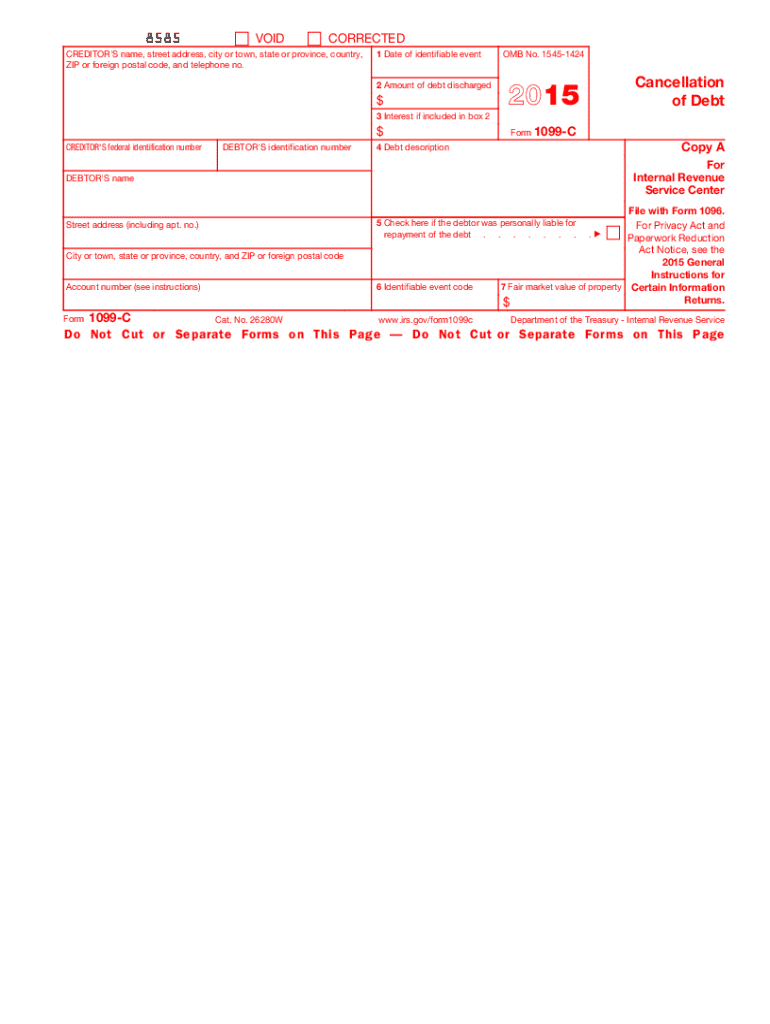

1099 C Form 2015

What is the 1099 C Form

The 1099 C Form, officially known as the Cancellation of Debt, is a tax document used in the United States. It is issued by financial institutions, creditors, or other entities to report the cancellation of a debt of $600 or more. When a debt is canceled, the amount forgiven may be considered taxable income by the Internal Revenue Service (IRS). This form is essential for both the debtor and the creditor, as it provides a record of the canceled debt and helps ensure proper tax reporting.

How to use the 1099 C Form

To use the 1099 C Form, individuals must first receive it from the creditor or financial institution that canceled the debt. The form will detail the amount of debt canceled and the date it occurred. Recipients should include this information when filing their tax returns, as it may affect their taxable income. It is important to keep the form for personal records and to consult a tax professional if there are questions about how the canceled debt impacts overall tax liability.

Steps to complete the 1099 C Form

Completing the 1099 C Form involves several key steps:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number.

- Enter the creditor's information, including the name, address, and taxpayer identification number.

- Fill in the amount of debt canceled in the appropriate box.

- Provide the date of cancellation.

- Complete any additional boxes that may apply, such as the type of debt canceled.

Once completed, the form should be submitted to the IRS and a copy sent to the debtor.

Legal use of the 1099 C Form

The legal use of the 1099 C Form is governed by IRS regulations. It is required for reporting canceled debts, which can have significant tax implications for the debtor. Failure to report canceled debt may result in penalties or additional taxes owed. It is crucial for both creditors and debtors to understand their responsibilities regarding this form to remain compliant with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 C Form typically align with the IRS's annual tax filing schedule. Creditors must provide the form to the debtor by January thirty-first of the year following the cancellation of the debt. Additionally, the form must be filed with the IRS by the end of February if submitting by paper or by the end of March if filing electronically. Keeping track of these dates is essential to avoid penalties.

Who Issues the Form

The 1099 C Form is issued by creditors, which may include banks, credit card companies, or any financial institution that has canceled a debt of $600 or more. These entities are responsible for accurately reporting the canceled debt to both the debtor and the IRS. It is important for debtors to ensure they receive this form if they have had any debts canceled during the tax year.

Quick guide on how to complete 2015 1099 c form

Prepare 1099 C Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 1099 C Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 1099 C Form effortlessly

- Find 1099 C Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign 1099 C Form and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 c form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 c form

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is a 1099 C Form?

The 1099 C Form is a tax document used to report cancellation of debt. It is essential for taxpayers to recognize how cancelled debts can affect their taxable income. This form must be filed by lenders when they cancel a debt of $600 or more.

-

How does airSlate SignNow help in managing the 1099 C Form?

airSlate SignNow simplifies the process of eSigning and sending your 1099 C Form securely. With our user-friendly interface, you can easily complete, sign, and distribute the form electronically. This ensures that your tax documents are handled efficiently and in compliance with regulations.

-

Is there a cost associated with using airSlate SignNow for the 1099 C Form?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. Whether you require basic features or advanced integrations, our solutions are competitively priced to help you manage your 1099 C Form efficiently. Sign up today to explore the best plan for your requirements.

-

What features does airSlate SignNow offer for handling the 1099 C Form?

airSlate SignNow provides robust features including customizable templates, advanced eSignature capabilities, and secure document storage for your 1099 C Form. These features streamline the documentation process and enhance collaboration with stakeholders, making tax reporting seamless.

-

Can I integrate airSlate SignNow with other tools for managing the 1099 C Form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software to help you manage your 1099 C Form more effectively. This connectivity allows you to automate workflows and ensure that all relevant data is synced across platforms.

-

How secure is airSlate SignNow when sending a 1099 C Form?

airSlate SignNow employs top-notch security measures to protect your documents, including the 1099 C Form. We use encryption and secure data storage to ensure that your information remains confidential and safe from unauthorized access.

-

Is eSigning the 1099 C Form legally binding?

Yes, eSigning the 1099 C Form through airSlate SignNow is legally binding and compliant with regulations. Our platform adheres to eSignature laws, making your signed documents valid for tax purposes and ensuring that you meet all necessary legal standards.

Get more for 1099 C Form

Find out other 1099 C Form

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free