Form 1065 K 1 2011

What is the Form 1065 K-1

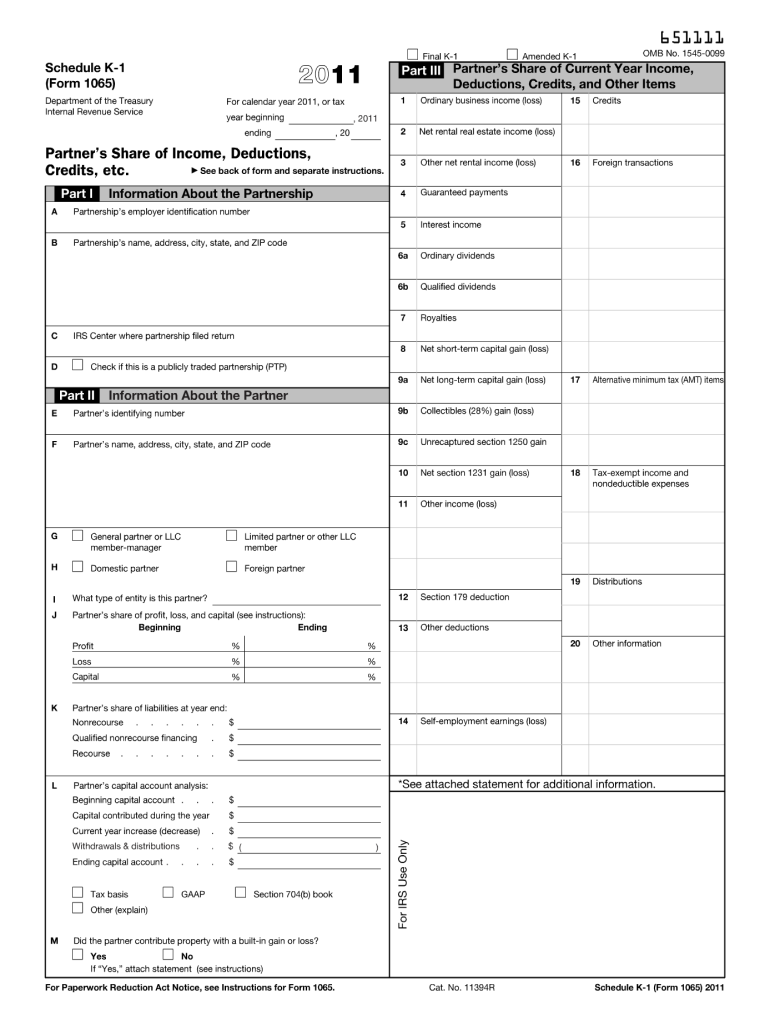

The Form 1065 K-1 is a tax document used by partnerships to report income, deductions, and credits to their partners. Each partner receives a K-1 that details their share of the partnership's income, which they must then report on their individual tax returns. This form is essential for ensuring that all partners accurately report their earnings and comply with IRS regulations. The K-1 provides transparency in the distribution of profits and losses among partners, facilitating proper tax calculations.

How to use the Form 1065 K-1

Using the Form 1065 K-1 involves several steps. First, partners should review the information provided on the form, including their share of income, deductions, and credits. This information must be accurately reported on their personal tax returns, typically on Schedule E of Form 1040. It is crucial for partners to ensure that the figures on their K-1 match their records of the partnership's financial activities. Any discrepancies should be addressed with the partnership before filing taxes to avoid complications with the IRS.

Steps to complete the Form 1065 K-1

To complete the Form 1065 K-1, follow these steps:

- Gather necessary financial information from the partnership's records.

- Fill out the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits as provided by the partnership.

- Ensure all amounts are accurate and reflect the partnership's financial statements.

- Review the completed form for errors before submission.

Legal use of the Form 1065 K-1

The legal use of the Form 1065 K-1 is governed by IRS regulations. The form must be completed accurately and filed on time to avoid penalties. Each partner is responsible for reporting their share of the partnership's income as indicated on the K-1. Failure to report this income can lead to audits, fines, or other legal consequences. Partners should retain copies of their K-1s for their records and to support their tax filings in case of inquiries from the IRS.

Filing Deadlines / Important Dates

The filing deadline for Form 1065, which includes the issuance of K-1s to partners, is typically March 15 for partnerships operating on a calendar year. Partners must receive their K-1s in time to report the information on their personal tax returns, which are due on April 15. It is essential to keep track of these deadlines to ensure compliance and avoid late filing penalties.

Who Issues the Form

The Form 1065 K-1 is issued by partnerships to their partners. The partnership must prepare the K-1 for each partner based on the partnership's financial results for the tax year. This form is then distributed to partners, who use it to report their share of the partnership's income, deductions, and credits on their individual tax returns. Accurate issuance and timely distribution of K-1s are crucial for both the partnership and its partners to meet their tax obligations.

Quick guide on how to complete form 1065 k 1 2011

Complete Form 1065 K 1 effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 1065 K 1 on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign Form 1065 K 1 without difficulty

- Obtain Form 1065 K 1 and then click Get Form to get started.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Decide how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1065 K 1 and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1065 k 1 2011

Create this form in 5 minutes!

How to create an eSignature for the form 1065 k 1 2011

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is Form 1065 K 1 and why is it important?

Form 1065 K 1 is a tax document used to report income, deductions, and credits for partnerships. It is crucial for partners to accurately report their share of the partnership's income on their personal tax returns. Understanding Form 1065 K 1 helps ensure compliance and avoids potential tax issues.

-

How can airSlate SignNow help with Form 1065 K 1 management?

airSlate SignNow streamlines the process of preparing and signing Form 1065 K 1 by providing an intuitive eSignature platform. With our solution, users can easily send, sign, and store tax documents securely in one place, enhancing efficiency and organization for partnerships.

-

Is there a pricing plan for using airSlate SignNow for Form 1065 K 1 eSignature?

Yes, airSlate SignNow offers flexible pricing plans tailored to various business needs, including those specifically for handling documents like Form 1065 K 1. You can choose a plan that fits your budget while gaining access to features that simplify the signing process.

-

What features does airSlate SignNow offer for Form 1065 K 1 eSigning?

airSlate SignNow provides features such as customizable templates, automated reminders, and real-time tracking for Form 1065 K 1 eSigning. These tools help ensure that all necessary signatures are collected promptly, making tax season less stressful.

-

Can airSlate SignNow integrate with accounting software for Form 1065 K 1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing for easy import and export of data related to Form 1065 K 1. This integration boosts productivity by reducing manual data entry and streamlining workflows.

-

Is it secure to use airSlate SignNow for Form 1065 K 1 documents?

Yes, security is a top priority at airSlate SignNow. We employ advanced encryption methods and comply with industry standards to ensure that your Form 1065 K 1 documents are protected throughout the signing process.

-

How can businesses ensure compliance when signing Form 1065 K 1 with airSlate SignNow?

With airSlate SignNow, businesses can maintain compliance while signing Form 1065 K 1 by utilizing features like audit trails and secure storage. These features provide documentation and verification of the signing process, which is essential for tax compliance.

Get more for Form 1065 K 1

- Articles of incorporation in compliance with chapter 617 fs form

- Attached is a form for filing articles of amendment to amend the articles of incorporation of a florida not for profit

- Ga withdrawal form

- Request for proposal illinois state toll highway authority form

- Trade license renewal form

- Il486 1730 form

- Tmsm 30 form

- Payment plan contract city of indianapolis indygov form

Find out other Form 1065 K 1

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms