Form 2106 Ez 2012

What is the Form 2106 Ez

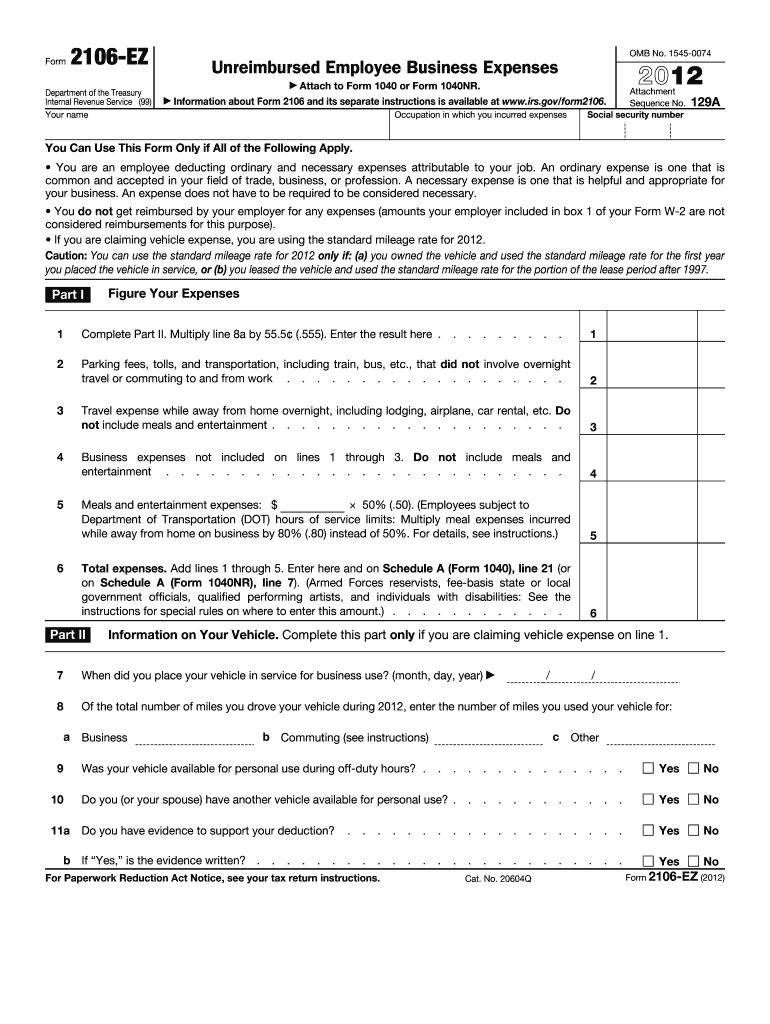

The Form 2106 Ez is a simplified version of the Form 2106, used by employees to claim deductions for unreimbursed business expenses. This form is particularly useful for individuals who do not itemize their deductions and are looking to report expenses related to their job. It allows taxpayers to easily calculate and report eligible expenses, such as travel, meals, and other necessary costs incurred while performing job duties. The streamlined nature of the Form 2106 Ez makes it accessible for those who may not have extensive tax knowledge.

How to use the Form 2106 Ez

Using the Form 2106 Ez involves a few straightforward steps. First, gather all relevant documentation, including receipts and records of business expenses. Next, fill out the form by entering your personal information, including your name and Social Security number. Then, list your expenses in the appropriate sections, ensuring that you categorize them correctly. After completing the form, review it for accuracy before submitting it with your tax return. It is important to keep copies of the form and any supporting documents for your records.

Steps to complete the Form 2106 Ez

Completing the Form 2106 Ez requires careful attention to detail. Follow these steps:

- Start by entering your personal information, including your name and address.

- List your business expenses in the designated sections, ensuring you categorize them accurately.

- Calculate the total expenses and ensure they align with IRS guidelines.

- Review the form for any errors or omissions.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 2106 Ez

The legal use of the Form 2106 Ez hinges on compliance with IRS regulations. To ensure that the form is legally valid, taxpayers must accurately report their business expenses and maintain supporting documentation. The IRS requires that all claimed expenses be ordinary and necessary for the business. Failure to comply with these regulations may result in penalties or disallowance of the claimed deductions. It is essential to understand the legal implications of using this form to avoid potential issues during tax season.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2106 Ez align with the standard tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 of each year. If you require additional time, you can file for an extension, which generally grants an extra six months. However, it is crucial to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates ensures timely filing and compliance with IRS regulations.

Eligibility Criteria

To be eligible to use the Form 2106 Ez, taxpayers must meet specific criteria set forth by the IRS. This form is available primarily for employees who incur unreimbursed business expenses related to their job. Additionally, individuals must not have any expenses related to the business use of a vehicle or any other complex deductions that would require the standard Form 2106. Understanding these eligibility criteria helps ensure that taxpayers select the appropriate form for their situation and maximize their deductions.

Quick guide on how to complete 2012 form 2106 ez

Effortlessly Prepare Form 2106 Ez on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 2106 Ez on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Form 2106 Ez with Ease

- Obtain Form 2106 Ez and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or disorganized files, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 2106 Ez to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 2106 ez

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 2106 ez

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 2106 Ez and how can airSlate SignNow help with it?

Form 2106 Ez is used by employees to deduct unreimbursed business expenses. With airSlate SignNow, you can easily fill out and sign this form electronically, saving time and ensuring accuracy.

-

Is airSlate SignNow a cost-effective solution for managing Form 2106 Ez?

Yes, airSlate SignNow offers a cost-effective solution for managing important documents like Form 2106 Ez. Our pricing plans are designed to fit businesses of all sizes without compromising on features.

-

What features does airSlate SignNow offer for Form 2106 Ez?

airSlate SignNow provides features like document templates, e-signatures, and real-time tracking specifically for Form 2106 Ez. This ensures you can complete and manage your expenses efficiently.

-

Can I integrate airSlate SignNow with other tools to manage Form 2106 Ez?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications, making it easier to manage Form 2106 Ez alongside other business processes and software for maximum efficiency.

-

How secure is airSlate SignNow when handling Form 2106 Ez?

Security is a priority at airSlate SignNow. When handling Form 2106 Ez, we implement robust encryption protocols to ensure that your data remains confidential and protected throughout the signing process.

-

What is the process for signing Form 2106 Ez using airSlate SignNow?

The process for signing Form 2106 Ez with airSlate SignNow is simple. After uploading your document, you can add your signature and any necessary fields, and then send it to others to sign digitally.

-

Can I save and reuse my Form 2106 Ez templates in airSlate SignNow?

Yes, with airSlate SignNow, you can save your Form 2106 Ez templates for future use. This feature allows you to streamline your process and reduce repetitive tasks, making document management more efficient.

Get more for Form 2106 Ez

Find out other Form 2106 Ez

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement