Form 2106 2014

What is the Form 2106

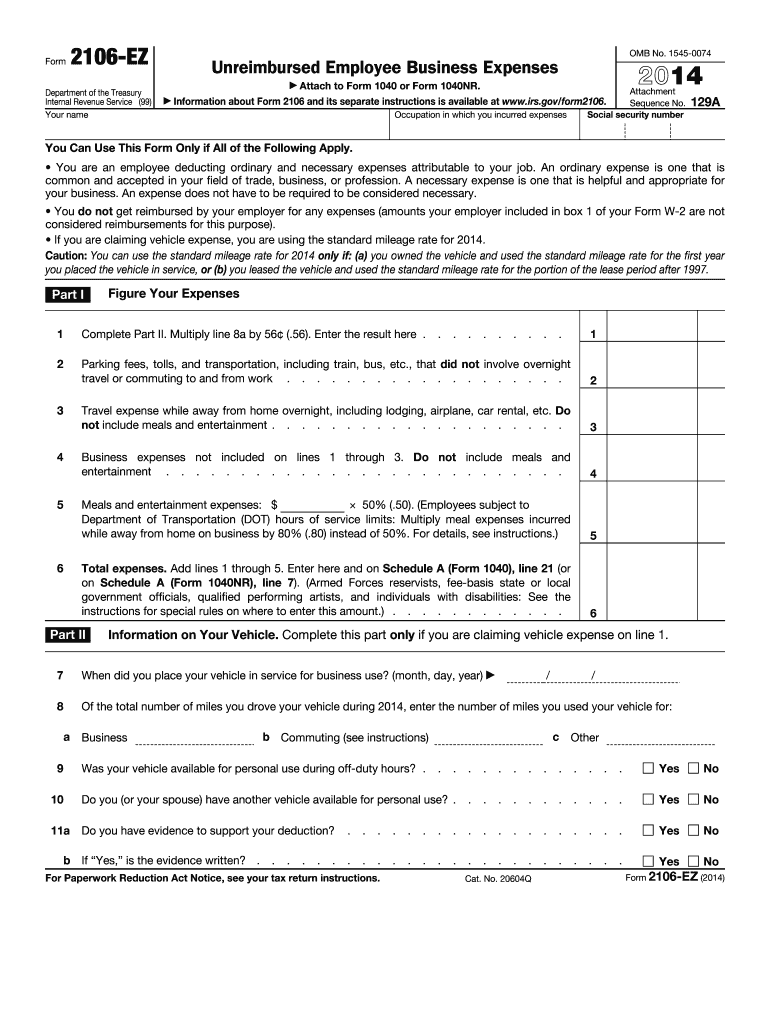

The Form 2106 is a tax document utilized by employees to claim deductions for unreimbursed business expenses. This form is particularly relevant for employees who incur costs related to their job that are not reimbursed by their employer, such as travel, meals, and other necessary expenditures. It is essential for individuals to understand the purpose of this form to maximize their potential deductions when filing their federal tax returns.

How to use the Form 2106

To effectively use the Form 2106, individuals must first gather all relevant documentation related to their business expenses. This includes receipts, invoices, and any other proof of expenditure. The form requires detailed information regarding the nature of the expenses, the amount spent, and the purpose of each expense. After completing the form, it should be attached to the individual's tax return to ensure that the deductions are considered by the IRS.

Steps to complete the Form 2106

Completing the Form 2106 involves several key steps:

- Gather all necessary documentation for unreimbursed business expenses.

- Fill out personal information, including name, address, and Social Security number.

- Detail each business expense in the appropriate sections, categorizing them as necessary.

- Calculate the total amount of deductions being claimed.

- Review the completed form for accuracy before submission.

Following these steps ensures that the form is filled out correctly, which is crucial for successful tax deductions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 2106. It is important for taxpayers to familiarize themselves with these rules to avoid errors. The IRS stipulates that only ordinary and necessary expenses related to the taxpayer's job can be claimed. Additionally, certain limitations may apply based on the taxpayer's employment status and the nature of the expenses. Adhering to these guidelines is essential for compliance and to avoid potential audits.

Legal use of the Form 2106

The legal use of Form 2106 requires that all claimed expenses are substantiated with appropriate documentation and are compliant with IRS regulations. Taxpayers must ensure that they are eligible to claim these deductions and that they maintain accurate records of all transactions. Utilizing electronic tools for submission can enhance the security and efficiency of the filing process, ensuring that the form is legally binding and recognized by the IRS.

Required Documents

To complete the Form 2106, taxpayers must have several documents on hand:

- Receipts for all unreimbursed business expenses.

- Invoices related to business-related purchases.

- Travel itineraries or logs showing the purpose of travel.

- Any correspondence from employers regarding expense reimbursements.

Having these documents readily available simplifies the completion of the form and supports the accuracy of the claimed deductions.

Quick guide on how to complete 2014 form 2106

Effortlessly Prepare Form 2106 on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Form 2106 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form 2106 with Ease

- Obtain Form 2106 and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which only takes moments and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 2106 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 2106

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 2106

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 2106 and how is it used?

Form 2106 is a tax form utilized by employees to deduct business expenses. It allows taxpayers to claim unreimbursed employee business expenses, ensuring they can reduce their taxable income effectively. Using airSlate SignNow, you can easily eSign Form 2106, streamlining the submission process.

-

What are the benefits of using airSlate SignNow for Form 2106?

airSlate SignNow offers businesses a seamless way to manage Form 2106 submissions. With its user-friendly interface, you can quickly send and eSign documents, reducing turnaround time signNowly. This efficiency ensures you can focus on your business while managing tax deductions effortlessly.

-

Is airSlate SignNow cost-effective for managing Form 2106?

Yes, airSlate SignNow is recognized for its competitive pricing, making it a cost-effective solution for managing Form 2106. With its affordable plans, businesses of all sizes can benefit from reduced paperwork and efficient document handling. The savings can also extend to potential tax deductions.

-

Can airSlate SignNow integrate with other software for Form 2106 processing?

Absolutely! airSlate SignNow offers a range of integrations with popular business tools, enhancing your workflow when dealing with Form 2106. This compatibility allows you to streamline processes, ensuring that your document management is both efficient and organized.

-

What features does airSlate SignNow provide to assist with Form 2106?

airSlate SignNow provides essential features such as templates, customizable workflows, and secure eSignature options for Form 2106. These tools simplify the process of managing your tax-related documents, ensuring you can easily input expenses and have them signed quickly.

-

How secure is the signing process for Form 2106 with airSlate SignNow?

The signing process for Form 2106 with airSlate SignNow is highly secure. The platform employs advanced encryption measures to protect sensitive information during the signing process, ensuring compliance with legal standards. This allows users to sign their tax-related documents confidently.

-

How does airSlate SignNow improve collaboration on Form 2106?

airSlate SignNow enhances collaboration on Form 2106 by allowing multiple users to review and provide input easily. Notifications and real-time status updates ensure all parties stay informed during the signing process. This collaborative environment leads to quicker completion and filing of your tax forms.

Get more for Form 2106

- Vision test report mv 619 520 form

- For faster processing the required statement for most corporations can be filed online at bizfile form

- For eligibility and additional information see reverse side

- Request for copy of kansas tax documents form

- Re 207 california department of real estate cagov form

- Fillable online form10qq22011 fax email print pdffiller

- Kw 100 kansas withholding tax guide kansas department form

- Nnaap nurse aide practice written exam packet form

Find out other Form 2106

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document