Irs Form 2106 Ez 2013

What is the IRS Form 2106 EZ

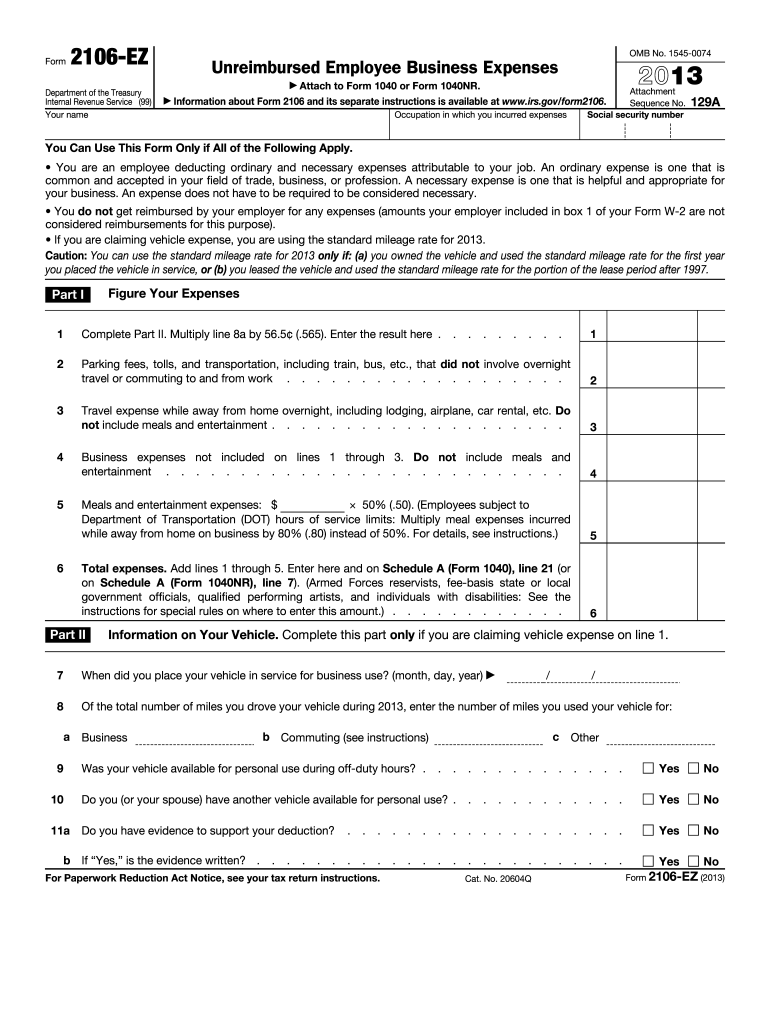

The IRS Form 2106 EZ is a simplified version of the standard Form 2106, designed for employees who incur unreimbursed business expenses. This form allows taxpayers to deduct certain expenses related to their job, such as travel, meals, and entertainment. It is specifically tailored for employees who do not receive reimbursement from their employer for these costs, making it easier to report and claim deductions on their tax returns.

How to use the IRS Form 2106 EZ

To use the IRS Form 2106 EZ, individuals must first determine their eligibility based on their employment status and the nature of their expenses. Once confirmed, taxpayers can fill out the form by providing necessary information, including details about their employer and the expenses incurred. The form is straightforward, requiring only essential data, which simplifies the filing process. After completing the form, taxpayers can attach it to their tax return when filing.

Steps to complete the IRS Form 2106 EZ

Completing the IRS Form 2106 EZ involves several key steps:

- Gather all relevant documentation, including receipts for business expenses.

- Fill in personal information, including your name, Social Security number, and employer details.

- List all unreimbursed business expenses, categorizing them as necessary, such as travel, meals, and entertainment.

- Calculate the total amount of expenses and ensure they align with IRS guidelines.

- Review the form for accuracy before submitting it with your tax return.

Legal use of the IRS Form 2106 EZ

The IRS Form 2106 EZ is legally valid when completed accurately and submitted according to IRS regulations. It is essential to maintain proper documentation to support any claimed expenses. The form must be used in compliance with the IRS guidelines to ensure that the deductions are recognized and accepted during tax processing. Failure to adhere to these regulations can result in penalties or disallowance of deductions.

Key elements of the IRS Form 2106 EZ

Key elements of the IRS Form 2106 EZ include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Employer Information: Taxpayers must provide details about their employer, including the name and address.

- Expense Categories: The form includes sections to categorize expenses, such as travel, meals, and entertainment.

- Total Expenses: A summary section where the total amount of unreimbursed expenses is calculated.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 2106 EZ align with the general tax filing deadlines in the United States. Typically, individual taxpayers must submit their tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines or extensions provided by the IRS to ensure timely submission of the form and associated tax returns.

Quick guide on how to complete 2013 irs form 2106 ez

Easily prepare Irs Form 2106 Ez on any device

Managing documents online has gained popularity among organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Irs Form 2106 Ez on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Irs Form 2106 Ez effortlessly

- Find Irs Form 2106 Ez and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Irs Form 2106 Ez and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs form 2106 ez

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs form 2106 ez

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Irs Form 2106 Ez?

The Irs Form 2106 Ez is a simplified form for unreimbursed employee business expenses. It allows employees to deduct certain expenses related to their job. Using airSlate SignNow, you can easily fill out and electronically sign this form to streamline your tax preparation process.

-

How much does airSlate SignNow cost for filling out Irs Form 2106 Ez?

airSlate SignNow offers competitive pricing plans that cater to various budgets. The cost includes access to features that support managing documents like the Irs Form 2106 Ez. You can choose a plan that fits your needs, ensuring a cost-effective solution for your document signing requirements.

-

What features does airSlate SignNow offer for the Irs Form 2106 Ez?

airSlate SignNow provides features such as document templates, electronic signatures, and secure cloud storage. You can easily create, edit, and manage your Irs Form 2106 Ez within the platform. These features enhance your workflow efficiency when dealing with tax documents.

-

Can I integrate airSlate SignNow with other applications for Irs Form 2106 Ez?

Yes, airSlate SignNow offers various integrations with popular applications, allowing you to streamline your document management process. You can connect tools like Google Drive, Dropbox, and accounting software to enhance how you handle the Irs Form 2106 Ez. This integration minimizes manual work and improves productivity.

-

What benefits does airSlate SignNow provide for completing the Irs Form 2106 Ez?

Completing the Irs Form 2106 Ez using airSlate SignNow offers several benefits, including time savings and ease of use. The platform enables you to fill out forms quickly and securely sign them digitally. Additionally, you can store your documents centrally, making them easily accessible when needed.

-

Is airSlate SignNow compliant with IRS regulations for Irs Form 2106 Ez?

Yes, airSlate SignNow is designed to comply with IRS regulations for forms like the Irs Form 2106 Ez. We ensure that electronic signatures meet all legal standards, providing you with peace of mind that your documents are secure and valid. Trust our platform for reliable tax-related documentation.

-

How do I get started with airSlate SignNow for the Irs Form 2106 Ez?

Getting started with airSlate SignNow for the Irs Form 2106 Ez is easy. Simply sign up for an account, choose your desired plan, and access our user-friendly interface to begin filling out your form. Our intuitive design ensures you can quickly learn how to manage your documents effectively.

Get more for Irs Form 2106 Ez

- Abc checklist form

- Ho chunk nation k 12 application form

- Thelma rae self music scholarship form

- Cput application closing date form

- Austin high school librarys reading challenge form

- Dance audition form template

- Chicago state university transcripts form

- Asip application form new england college of optometry neco

Find out other Irs Form 2106 Ez

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF