2106 Ez Form 2011

What is the 2106 Ez Form

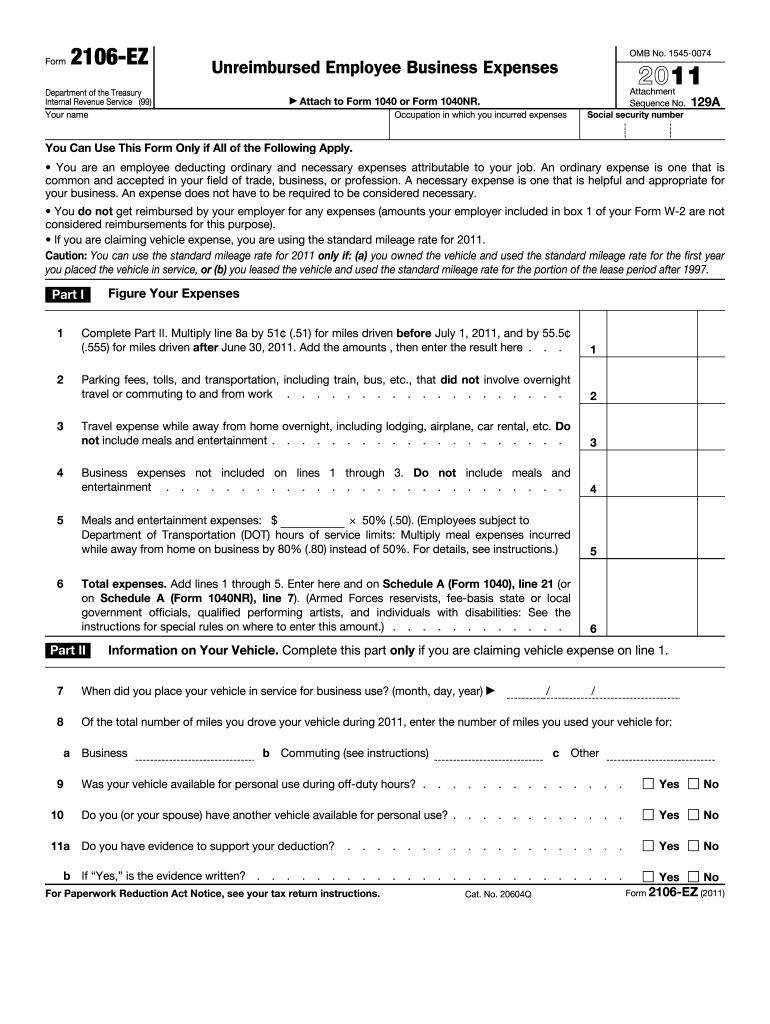

The 2106 Ez Form is a tax form used by employees to claim deductions for unreimbursed business expenses. This form is particularly relevant for individuals who incur costs related to their job that are not reimbursed by their employer. The 2106 Ez Form simplifies the process of reporting these expenses, allowing taxpayers to take advantage of potential deductions on their federal tax returns. It is essential for employees in specific job roles, such as those in sales or service industries, where out-of-pocket expenses can significantly impact their taxable income.

How to use the 2106 Ez Form

Using the 2106 Ez Form involves several straightforward steps. First, gather all relevant documentation regarding your business expenses, including receipts and invoices. Next, complete the form by entering your personal information, including your name, address, and Social Security number. You will then detail your expenses, which may include costs for travel, meals, and other job-related expenditures. After filling out the form, ensure that all information is accurate before submitting it with your tax return. This form can help reduce your taxable income, so it is important to utilize it correctly.

Steps to complete the 2106 Ez Form

Completing the 2106 Ez Form requires careful attention to detail. Follow these steps for accurate submission:

- Gather all necessary receipts and documentation for your business expenses.

- Fill in your personal information at the top of the form.

- List your unreimbursed expenses in the designated sections, ensuring to categorize them appropriately.

- Calculate the total amount of your deductions and enter this figure on the form.

- Review the completed form for accuracy and completeness.

- Attach the form to your tax return when filing.

Legal use of the 2106 Ez Form

The 2106 Ez Form is legally recognized for reporting business expenses under the Internal Revenue Code. To ensure compliance, taxpayers must adhere to IRS guidelines regarding what qualifies as a deductible expense. It is crucial to maintain accurate records and documentation to support the claims made on the form. Additionally, understanding the legal implications of misreporting expenses is vital, as it can lead to penalties or audits. By using the form correctly, taxpayers can benefit from legitimate deductions while remaining compliant with tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the 2106 Ez Form, which must be followed to ensure that the deductions claimed are valid. Taxpayers should refer to the IRS instructions for the form, which outline eligible expenses, record-keeping requirements, and submission procedures. It is important to stay updated on any changes to tax laws or IRS regulations that may affect the use of this form. Following these guidelines will help maximize deductions while minimizing the risk of errors or compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the 2106 Ez Form align with the overall tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these important dates to ensure timely submission of their forms. Additionally, extensions may be available, but it is crucial to file the 2106 Ez Form by the original deadline to avoid potential penalties.

Quick guide on how to complete 2011 2106 ez form

Effortlessly prepare 2106 Ez Form on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle 2106 Ez Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign 2106 Ez Form with ease

- Locate 2106 Ez Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and electronically sign 2106 Ez Form to ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 2106 ez form

Create this form in 5 minutes!

How to create an eSignature for the 2011 2106 ez form

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2106 Ez Form used for?

The 2106 Ez Form is designed for employees to report their business-related expenses. It simplifies the process of claiming deductions for unreimbursed employee expenses, making it easier to track and document these costs. Utilizing the 2106 Ez Form can help you maximize your tax deductions effectively.

-

How can airSlate SignNow help with the 2106 Ez Form?

airSlate SignNow streamlines the process of completing and eSigning the 2106 Ez Form. With our user-friendly platform, you can easily fill out the form, add your electronic signature, and send it securely to your employer or tax advisor. This not only saves time but also ensures accuracy and compliance.

-

Is there a cost associated with using the 2106 Ez Form through airSlate SignNow?

While the 2106 Ez Form itself is a standard IRS form and free to access, using airSlate SignNow comes with a subscription fee. Our pricing plans are designed to be cost-effective, offering various features that enhance your document management and eSigning experience, making it a worthwhile investment.

-

What features does airSlate SignNow offer for the 2106 Ez Form?

airSlate SignNow provides a range of features for the 2106 Ez Form, including customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that you can manage your expense reports efficiently and securely, giving you peace of mind during tax season.

-

Can I integrate airSlate SignNow with other apps for managing the 2106 Ez Form?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow when managing the 2106 Ez Form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems, allowing for a more streamlined document management process.

-

What benefits do I gain by using airSlate SignNow for the 2106 Ez Form?

Using airSlate SignNow for the 2106 Ez Form offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for your sensitive information. Our platform also provides an audit trail, ensuring that all your documents are tracked and stored securely.

-

Are there any tips for completing the 2106 Ez Form using airSlate SignNow?

To efficiently complete the 2106 Ez Form using airSlate SignNow, ensure you have all necessary receipts and documentation ready. Take advantage of the platform's template feature to pre-fill common information, and use the eSigning function to quickly finalize and send your form to the relevant parties.

Get more for 2106 Ez Form

- Medical consultation request form medical consultation form by berkeley lake dentists in norcross ga

- Patient information release form henry ford health system

- Fitness certificate by doctor form

- Yoga intake form

- Obstetric template form

- Aim specialty prior authorization form

- Home health aide skills checklist form

- Hipaa form pdf printable

Find out other 2106 Ez Form

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application