Form 2106 Ez 2015

What is the Form 2106 Ez

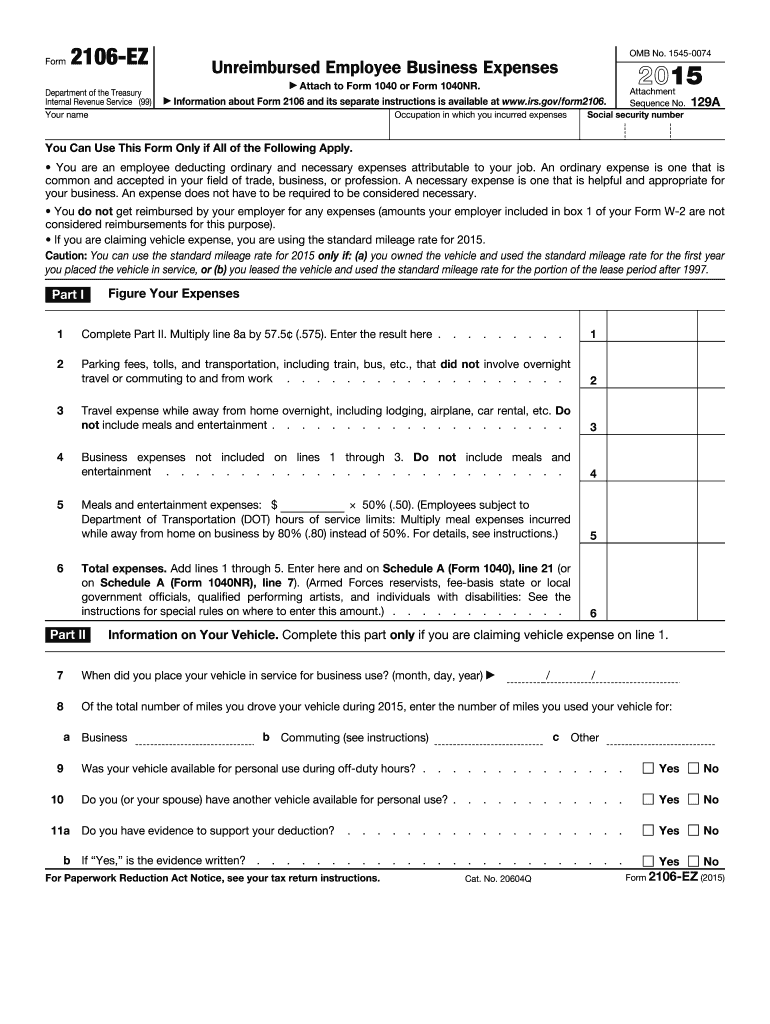

The Form 2106 Ez is a simplified version of the IRS Form 2106, used by employees to report unreimbursed business expenses. This form is particularly beneficial for employees who do not receive reimbursement from their employers for certain expenses incurred while performing their job duties. It allows taxpayers to deduct eligible expenses on their federal income tax returns, ultimately reducing their taxable income.

How to use the Form 2106 Ez

Using the Form 2106 Ez involves several straightforward steps. First, gather all necessary documents that support your business expenses, such as receipts and invoices. Next, accurately fill out the form by entering your personal information, including your name, Social Security number, and the details of your employment. The form requires you to list your unreimbursed expenses, which may include vehicle expenses, travel costs, and other job-related expenditures. After completing the form, ensure that you sign and date it before submitting it with your tax return.

Steps to complete the Form 2106 Ez

Completing the Form 2106 Ez involves a series of clear steps:

- Gather Documentation: Collect all relevant receipts and records of your business expenses.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Detail Your Expenses: List your unreimbursed business expenses in the designated sections, ensuring accuracy.

- Calculate Totals: Sum your expenses to determine the total deduction amount.

- Sign and Date: Ensure you sign and date the form, confirming the information is accurate.

Legal use of the Form 2106 Ez

The Form 2106 Ez is legally binding when completed accurately and submitted in compliance with IRS regulations. To ensure its validity, taxpayers must adhere to the guidelines set forth by the IRS regarding allowable deductions and documentation. Proper use of the form can lead to legitimate tax deductions, ultimately benefiting the taxpayer's financial situation.

IRS Guidelines

IRS guidelines for the Form 2106 Ez specify the types of expenses that are eligible for deduction. These may include costs related to travel, meals, and entertainment incurred while conducting business. It is essential to maintain thorough records and receipts to substantiate these expenses. Additionally, taxpayers should be aware of any changes to tax laws that may affect their eligibility to use this form or the deductions they can claim.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2106 Ez align with the general tax return deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be mindful of these dates to ensure timely submission of their forms and avoid potential penalties.

Required Documents

To complete the Form 2106 Ez, several documents are required to validate your claims. These include:

- Receipts for all unreimbursed business expenses.

- Records of mileage if claiming vehicle expenses.

- Documentation of travel expenses, including hotel and meal receipts.

- Any relevant employer documentation regarding reimbursement policies.

Quick guide on how to complete form 2106 ez 2015

Complete Form 2106 Ez seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Handle Form 2106 Ez on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 2106 Ez effortlessly

- Locate Form 2106 Ez and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Form 2106 Ez and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2106 ez 2015

Create this form in 5 minutes!

How to create an eSignature for the form 2106 ez 2015

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 2106 Ez?

Form 2106 Ez is a simplified expense report used by employees to claim unreimbursed business expenses. It's an important tool for maximizing your tax deductions for work-related costs. With airSlate SignNow, you can easily fill out and eSign your Form 2106 Ez remotely.

-

How can airSlate SignNow help with Form 2106 Ez?

airSlate SignNow provides a seamless platform to complete and eSign Form 2106 Ez, allowing you to streamline your expense reporting process. Our solution simplifies document management, making it easy to share and store your completed forms. This efficiency helps ensure you stay compliant while saving time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, whether you're a solo entrepreneur or part of a larger team. Each plan includes access to all features for managing documents, including Form 2106 Ez. Check our website for detailed pricing and choose the best fit for your requirements.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to test the platform before committing to a paid plan. During the trial, you can explore features like eSigning and document management for Form 2106 Ez. This way, you can experience the benefits firsthand and see how it suits your business needs.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with a variety of popular applications, enhancing your workflow. You can easily connect your existing tools to automate processes related to Form 2106 Ez and other documentation needs, ensuring a more cohesive business operation.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow provides a comprehensive set of features for document management, including templates, collaborative editing, and eSigning capabilities. These features are especially useful for preparing and submitting Form 2106 Ez. The platform's user-friendly interface ensures that you can efficiently manage your documents while staying organized.

-

Is airSlate SignNow secure for signing documents like Form 2106 Ez?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When signing documents like Form 2106 Ez, you can rest assured that your data is protected. Our platform helps you maintain privacy while ensuring that your eSignatures are legally binding and secure.

Get more for Form 2106 Ez

Find out other Form 2106 Ez

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast